Publish date:

1. Introduction

On 24 November 2016, Bloomberg published an article called "Air Asia's New Lease of Life".

https://www.bloomberg.com/gadfly/articles/2016-11-24/airasia-s-new-lease-of-life

The article is basically a repitition of GMT's earlier wild talks about how Air Asia's profitability was artificially inflated by leasing income earned from associate companies.

First of all, I did not find the 2015 GMT allegations credible (will briefly explain in Section 4 below). In my opinion, it was a biased piece of work written by conspirators to enrich themselves at others expense. Its objective was to create panic in the market to cause Air Asia share price to tank, thereby benefiting their own short selling position.

Even though written by a different author, this latest Bloomberg article went along the same line. It paints a picture of how the bulk of Air Asia's profit is derived from aircraft leasing, and the ultimate disposal of it will leave behind an empty shell struggling to survive.

As a shareholder of Air Asia, it is my responsibility to examine the validity of the article and speak up against it if I find that it is trying to paint a false picture to mislead.

To nip the problem in the bud, that is the objective of this article.

2. Trying To Mislead Again

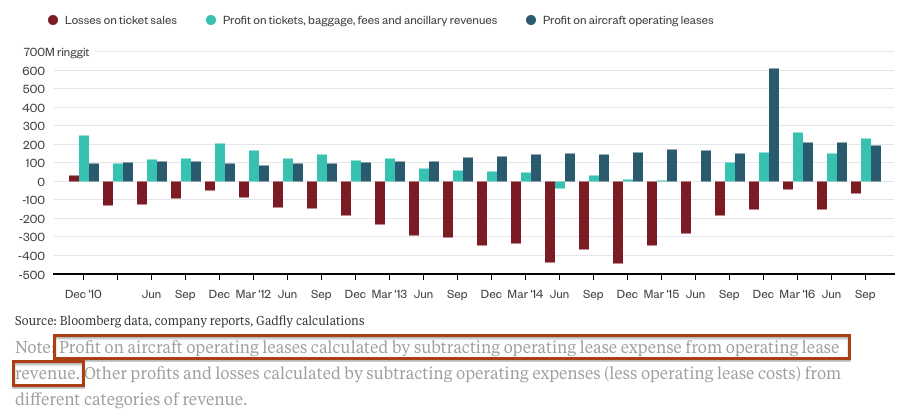

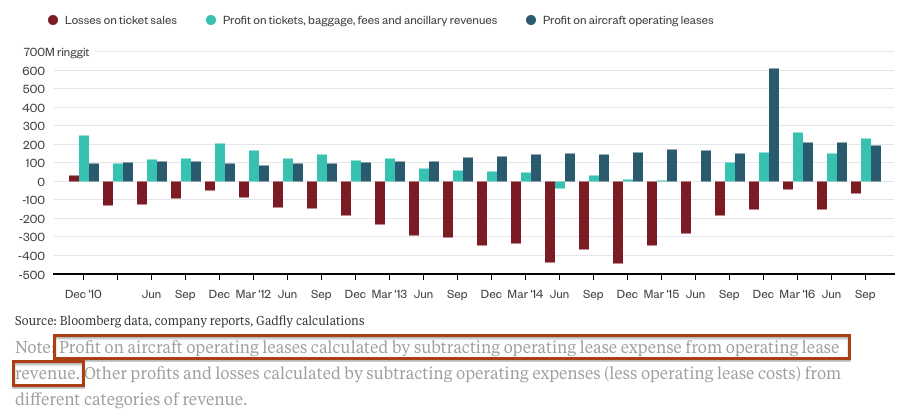

The gist of the Bloomberg article can be summed up in the following chart :-

Basically, the author claimed that Air Asia's profitability comprises mostly lease income, and that the actual passenger operation was not profitable at all (note how the deep blue bars of leasing income are higher than the light blue bars of passengers derived profit most of the time).

Why did I say that it is a bullshxt article ? Why did I say that it is trying to paint a false picture to mislead ? Can I justify my claim ?

Yes, I can.

The major flaw of the article is the way it tries to overstate the leasing division's profitability. According to the author, Leasing Division's Profitability = Operating Lease Revenue - Operating Lease Expense.

This is absoluately not true. It shows either how mischievous the author is or how little he knows about aircraft leasing.

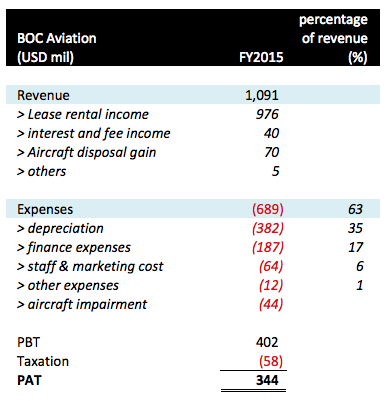

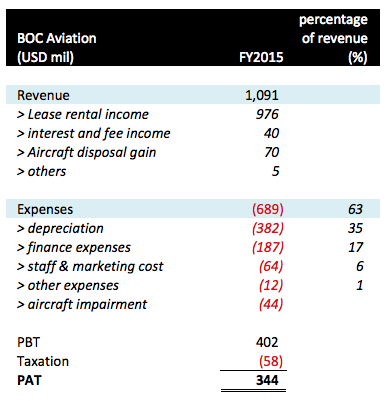

Let's take a look at BOC Aviation's P&L, which I discussed in my earlier article dated 21 September 2016 ("Asia Aviation Capital : Sale or No Sale, Air Asia Is The Winner") :-

If you use the author's method, Asia Aviation Capital's profit will be USD66 mil - USD26 mil = USD40 mil. Based on exchange rate of 4.05, its profitability will be RM162 mil, consituting a staggering 46% of Air Asia's latest quarter net profit of RM354 mil.

However, we all know that this is not true. Asia Aviation's latest quarter PAT was only USD13.1 mil, or RM53 mil, as presented in the account based on internationally accepted accounting principles. The difference is RM109 mil, folks.

In a nutshell, the Bloomberg article deliberately excludes depreciation, interest expenses, etc from the P&L of Air Asia's leasing division. The end result is that leasing division's profitability was inflated, while all those cost items are kicked over to the passenger division, making its profitability lower than the actual figure. This helps the author to achieve his objective of painting an alarming picture.

3. The Real Picture

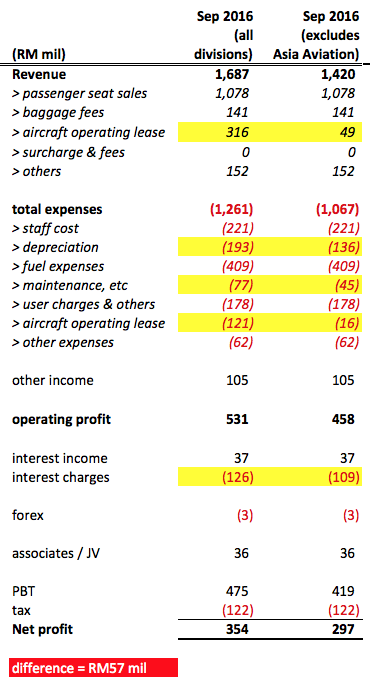

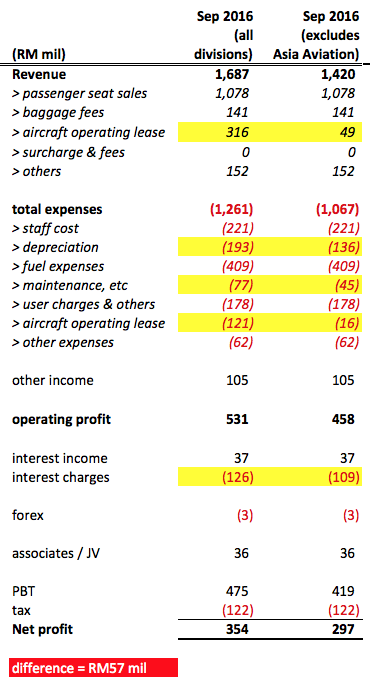

So, how much did the passenger divsion actually make in September 2016 quarter ? To answer the question, I made adjustments to Air Asia's P&L by excluding Asia Aviation's contribution :-

As shown in table above, it will cause Air Asia Group's net profit to delcine by 17%. Not a small amount, but hardly the end of the world scenario as per the Bloomberg article.

4. Concluding Remarks

Since buying into Air Asia, I have studied the group in details. I don't claim to be an expert, but I think I do know a thing or two about the company.

In my opinion, there is some truth that Air Asia makes money by leasing aircrafts to associate companies. However, I don't subscribe to the view that the group survives and thrives because of that :-

(a) Firstly, as much as Air Asia wants to exploit its associate companies / JV entities, will its partners allow it to do so ? Will they allow Air Asia to charge them exorbitant fees for the aircrafts they lease ? NO, THEY WILL NOT. Everything will be done based on commercial rates. They have their own interest to take care of as well.

(b) Secondly, whenever Air Asia squeezes exorbitant profit from its associate companies through leasing (assuming it can do so), the negative impact will flow down to those associate companies' bottomline, out of which 50% of it (roughly) will flow back to Air Asia by virtue of its equity interest. How can you convince me that this is an effective way to boast profit artificially ?

As per my analysis in Section 3 above, on pro forma basis, divestment of Asia Aviation Capital will lead to 17% decline in Air Asia's profitability. Different people might have different view, but I don't find that to be too alarming.

On top of that, there is another mitigating factor - it is unlikely that the entire RM4.6 billion will be distributed to shareholders. If some of the proceeds are used to pare down borrowings, there could be reduction in interest expenses. So, the actual earning decline might not be as much as 17%.

Based on preliminary calculation, the divestment will deconsolidate closed to RM2 billion Asia Aviation Capital debts from Group balance sheets. Plus the RM1 billion to be received from private placement, the improvement in gearing ratio and dividend payment capacity will enhance Air Asia Group's risk profile. There is room for re-rating through PE Multiple expansion.

To sum it all up, there is no need to unduly worry about earning dilution pursuant to Asia Aviation Capital divestment. Always bear in mind that Tony Fernandes is in same boat as you. There are still many things that can be done to unlock value (for example : dual listing in HK). Afterall, current PER of approximately 8 times is not demanding.

On 24 November 2016, Bloomberg published an article called "Air Asia's New Lease of Life".

https://www.bloomberg.com/gadfly/articles/2016-11-24/airasia-s-new-lease-of-life

The article is basically a repitition of GMT's earlier wild talks about how Air Asia's profitability was artificially inflated by leasing income earned from associate companies.

First of all, I did not find the 2015 GMT allegations credible (will briefly explain in Section 4 below). In my opinion, it was a biased piece of work written by conspirators to enrich themselves at others expense. Its objective was to create panic in the market to cause Air Asia share price to tank, thereby benefiting their own short selling position.

Even though written by a different author, this latest Bloomberg article went along the same line. It paints a picture of how the bulk of Air Asia's profit is derived from aircraft leasing, and the ultimate disposal of it will leave behind an empty shell struggling to survive.

As a shareholder of Air Asia, it is my responsibility to examine the validity of the article and speak up against it if I find that it is trying to paint a false picture to mislead.

To nip the problem in the bud, that is the objective of this article.

2. Trying To Mislead Again

The gist of the Bloomberg article can be summed up in the following chart :-

Basically, the author claimed that Air Asia's profitability comprises mostly lease income, and that the actual passenger operation was not profitable at all (note how the deep blue bars of leasing income are higher than the light blue bars of passengers derived profit most of the time).

Why did I say that it is a bullshxt article ? Why did I say that it is trying to paint a false picture to mislead ? Can I justify my claim ?

Yes, I can.

The major flaw of the article is the way it tries to overstate the leasing division's profitability. According to the author, Leasing Division's Profitability = Operating Lease Revenue - Operating Lease Expense.

This is absoluately not true. It shows either how mischievous the author is or how little he knows about aircraft leasing.

Let's take a look at BOC Aviation's P&L, which I discussed in my earlier article dated 21 September 2016 ("Asia Aviation Capital : Sale or No Sale, Air Asia Is The Winner") :-

As you can see in table above, apart from Operating Lease, an aircraft leasing company also incurred costs such as depreciation charges, interest expenses, etc.

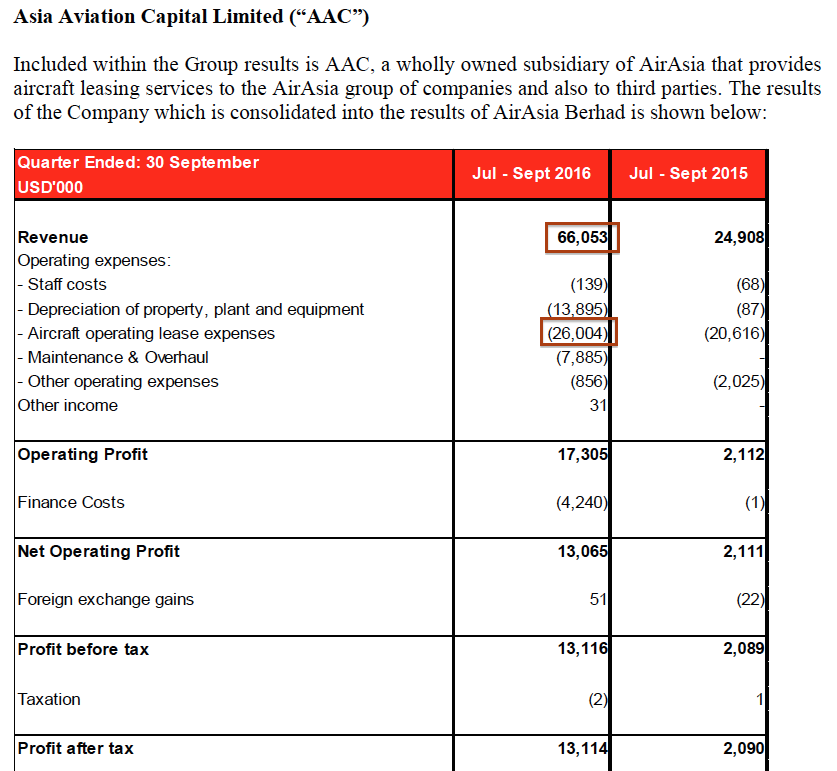

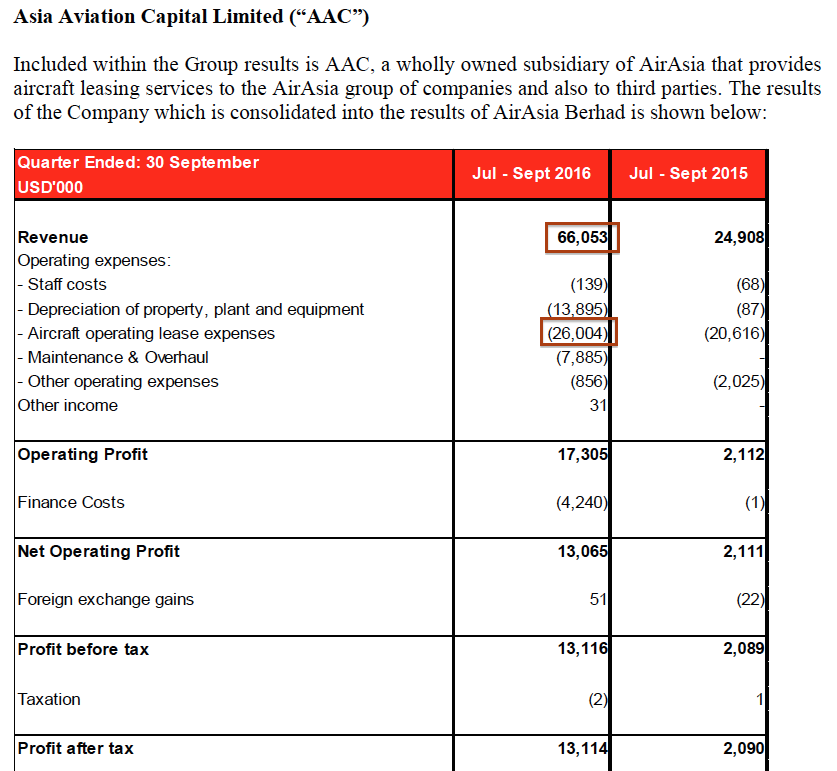

The same also applies to Asia Aviation Capital :-

If you use the author's method, Asia Aviation Capital's profit will be USD66 mil - USD26 mil = USD40 mil. Based on exchange rate of 4.05, its profitability will be RM162 mil, consituting a staggering 46% of Air Asia's latest quarter net profit of RM354 mil.

However, we all know that this is not true. Asia Aviation's latest quarter PAT was only USD13.1 mil, or RM53 mil, as presented in the account based on internationally accepted accounting principles. The difference is RM109 mil, folks.

In a nutshell, the Bloomberg article deliberately excludes depreciation, interest expenses, etc from the P&L of Air Asia's leasing division. The end result is that leasing division's profitability was inflated, while all those cost items are kicked over to the passenger division, making its profitability lower than the actual figure. This helps the author to achieve his objective of painting an alarming picture.

3. The Real Picture

So, how much did the passenger divsion actually make in September 2016 quarter ? To answer the question, I made adjustments to Air Asia's P&L by excluding Asia Aviation's contribution :-

As shown in table above, it will cause Air Asia Group's net profit to delcine by 17%. Not a small amount, but hardly the end of the world scenario as per the Bloomberg article.

4. Concluding Remarks

Since buying into Air Asia, I have studied the group in details. I don't claim to be an expert, but I think I do know a thing or two about the company.

In my opinion, there is some truth that Air Asia makes money by leasing aircrafts to associate companies. However, I don't subscribe to the view that the group survives and thrives because of that :-

(a) Firstly, as much as Air Asia wants to exploit its associate companies / JV entities, will its partners allow it to do so ? Will they allow Air Asia to charge them exorbitant fees for the aircrafts they lease ? NO, THEY WILL NOT. Everything will be done based on commercial rates. They have their own interest to take care of as well.

(b) Secondly, whenever Air Asia squeezes exorbitant profit from its associate companies through leasing (assuming it can do so), the negative impact will flow down to those associate companies' bottomline, out of which 50% of it (roughly) will flow back to Air Asia by virtue of its equity interest. How can you convince me that this is an effective way to boast profit artificially ?

As per my analysis in Section 3 above, on pro forma basis, divestment of Asia Aviation Capital will lead to 17% decline in Air Asia's profitability. Different people might have different view, but I don't find that to be too alarming.

On top of that, there is another mitigating factor - it is unlikely that the entire RM4.6 billion will be distributed to shareholders. If some of the proceeds are used to pare down borrowings, there could be reduction in interest expenses. So, the actual earning decline might not be as much as 17%.

Based on preliminary calculation, the divestment will deconsolidate closed to RM2 billion Asia Aviation Capital debts from Group balance sheets. Plus the RM1 billion to be received from private placement, the improvement in gearing ratio and dividend payment capacity will enhance Air Asia Group's risk profile. There is room for re-rating through PE Multiple expansion.

To sum it all up, there is no need to unduly worry about earning dilution pursuant to Asia Aviation Capital divestment. Always bear in mind that Tony Fernandes is in same boat as you. There are still many things that can be done to unlock value (for example : dual listing in HK). Afterall, current PER of approximately 8 times is not demanding.

No comments:

Post a Comment