Publish date: Mon, 4 Jan 2016, 07:39 AM

(Friendly match among the Sifus. We all can learn something from it)

1. Introduction

In "Clash of the Titans (Part 1) - Traders vs. Investors", I mentioned that Value Investors are guided by Classical Investment Theories (Warren Buffett, etc). However, Value Traders such as Ooi Teik Bee are not well understood, even though they are quite common nowadays.

The following is extracted from that article :-

I undertook further study and discovered an article written by James P. O' Shaughnessy which is in my opinion, relevant to the topic.

I am happy to share the information here. Hopefully, it can move us one step closer towards better understanding of Value Trading.

(Shaughnessy was previously the Top Management of Bear Stearns Asset Management)

2. Shaughnessy's Study

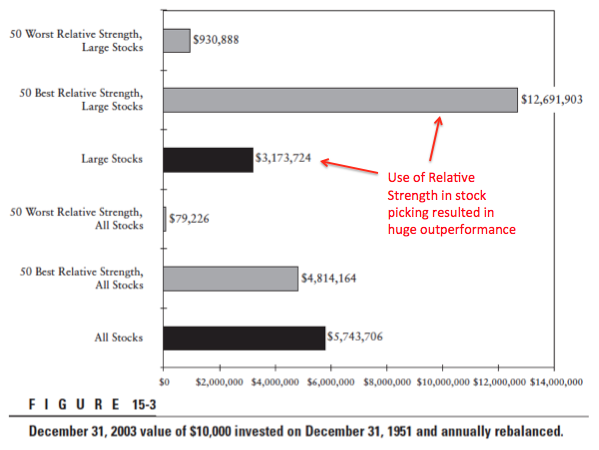

In the article, Shaughnessy studied the stock picking strategy of focusing on buying previous year's biggest winners (with good fundamentals and reasonable valuation).

According to Shaughnessy's definition, stocks with strong previous year price performance are called "High Relative Strength Stocks" while those that underperformed are called "Low Relative Strength Stocks", apparently drawing inspiration from Technical Analysis concept of Relative Strength Index (RSI), which measures Overbought and Oversold.

What have that got to do with the topic of "Value Traders vs. Value Investors" ?

It is related to the topic because Chasing Winners is exactly what Value Traders do.

As discussed in Part 1 (my previous article), Value Investors pick stocks based on their long term prospects (via the concept of moat).

Value Traders are different, they try to benefit from stocks that are flavour of the month / year.

At one end of the spectrum are Drift Woods, who wait passively. At the other end are the Surf Riders, who try to profit from as fast as the next quarter's result. Anglers are in the middle. They all share one thing in common - they don't crave for moat.

Our forum member Ooi Teik Bee is a good example. His famous slogan is "TA first, FA second". He only goes for (good) stocks that have "broken out" (in Shaughnessy's words, "High Relative Strength Stocks").

I hope at this point, my readers are convinced by my argument that Value Traders such as OTB are the same animal that Shaugnessy studied and discussed in his article.

Shaugnessy's article cannot be reproduced here as it was part of a book, which is not friendly for a blog article with limited space. The following is an internet article written by another author, Michael Carr, discussing Shaughnessy's findings. To fully digest the essence, it is advisable for you to go though the article line by line, instead of just focusing on the underlined parts.

Before I proceed further, I would like to apologize to my readers for "finetuning" Shaughnessy's study to suit my "Traders vs. Investors" analysis. Shaughnessy have not done any direct study on Traders vs. Investors. His Relative Strength FA Investing study is the closest I can get. I hope I havn't given you the impression that I am shoving something down your throat.

Let's assume that Shaughnessy's observation of Value Trader outperforming Value Investor is true. But what is the underlying reason for that phenomenon ?

It is actually not difficult to explain. Value Traders jump into a stock only when it shines, both in terms of share price as well as fundamentals.

Velocity is higher when momentum is strong. It is only natural that they reap the benefit faster than Value Investors.

3. Hold On To Your Champagne ...

If you are a seasoned investor or a businessman, at this point, you would be on high alert instead of pulling out your champagne. This is because moneymen always know that there is no free lunch in this world. Everything comes with a catch.

So what is the catch ? It happens that there are two major ones.

First of all, higher and faster return also comes with higher volatility (price fluctuation). Come to think about it, it is as natural as breathing. The reason Value Trading beats Value Investing (according to that study) is because you decided not to wait, but jump in to join the crowd. You enjoy fast return but at the same time, there are many ahead of you, and many are also rushing in right behind you. This is a recipe for chaos and disorder.

Compared to a Value Investor, a Value Trader needs to endure more stomach churning moments.

Secondly, Shaugnessy's study showed that over a longer period of time (about 5 years), Value Investor outperformed Value Trader.

This outcome is actually not difficult to verify. The most successful investor in the world is Warren Buffett. He is a VALUE INVESTOR, not Value Trader.

It is not difficult to explain either. Value Trader chalked up faster and higher return in the initial years because they bother to ride the indutry upcycle (while Value Investor doze off, indifferent of the opprtunities prersented to them, as they only want to play the moat game).

As Value Traders are not protected by moat, their performance will not last forever. It turned out that according to Shaugnessy's study, 5 years are the time when industry upcycle tapers off, moat flexes its muscle and Value Investors catch up.

A classical case of Hare vs. Tortoise.

4. Concluding Remarks

(a) For Value Traders, there is no more need to feel guilty or suspicious about the fast money. Shaughnessy's study explains your (temporary) outperformance.

And you didn't get it for free - you pay the price of higher volatility.

(b) As for Value Investors, Shaughnessy's study confirmed the continued relevance of your method. You have chosen to forego fast money and be patient. Warren Buffett practises the same craft, and he becomes the richest person in the world. The concept is valid, the challenge is to figure out how to do it.

Have a nice day.

Appendix - Cut And Pastes From Shaughnessy's Book "What Works In Wall Street"

No comments:

Post a Comment