Author: Icon8888 | Publish date: Thu, 25 Feb 2016, 07:52 AM

1. Strong Results

Yesterday, Fajarbaru announced a sterling set of results with EPS of 2.5 sen per quarter. Timber division is the biggest profit contributor. The strong results was purely operational and not caused by any one off gain.

Fajarbaru group has three major divisions - construction, property development and timber extraction.

Key observations :

(a) Property division has yet to generate revenue. Start up costs resulted in losses.

(b) Timber division is the main contributor to PBT since June 2015 quarter. In the latest quarter, it has doubled to RM23.3 mi.

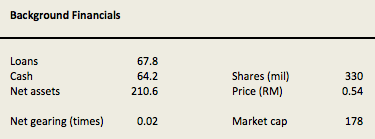

The group has strong balance sheets. With net assets of RM211 mil, loans of RM68 mil and cash of RM64 mil, net borrowing is only RM4 mil.

2. Timber Extraction

On 18 February 2014, Fajarbaru acquired 51% equity interest in Billion Valley Sdn Bhd (BVSB) for cash consideration of RM0.41 mil.

On 14 April 2014, BVSB acquired 100% equity interest in Smooth Accomplishment Sdn Bhd (SASB) for cash consideration of RM1 mil.

Following the acquisitions, Fajabaru owns effective interest of 51% in both BVSB and SASB.

BVSB has been appointed by a third party to act as contractor with the rights to extract and sell timber from a 1,000 acres forest area in Jerantut, Pahang for a period of 12 months.

SASB has been appointed by a third party to act as contractor with the rights to extract and sell timber from a 28,645 acres forest area in Jerantut, Pahang for a period of 4 years (until November 2018).

The group commenced timber extraction in December 2014. By December 2015 quarter, the timber division has become the LARGEST profit contributor to the group.

On 9 October 2015, SASB was appointed by a third party to act as contractor with rights to extract and sell timber from 500 acres of forest area in Jerantut, Pahang.

Altogether, BVSB group has 30,145 acres (12,2000 hectares) of extraction rights. According to the 2014 circular to shareholders, the group is allowed to extract up to 68 cubic meter of timber per hectare. This works out to be 830,000 cubic meter in total.

So far, the group has extracted 224,055 cubic meter. As such, there is still 605,945 cubic meter to be extracted over next 3 years. This works out to be 202,000 cubic meter per annum.

As shown in table above, PBT per cubic meter ranges from RM244 to RM317. Based on the average of RM280 per cubic meter and 202,000 cubic meter per annum, annual PBT would be RM56.6 mil.

Based on 25% tax rate, annual PAT would be RM42.5 mil. As Fajarbaru owns 51% equity interest in BVSB group, its share of net profit would be RM21.6 mil.

Based on 330 mil shares, the timber division alone will contribute EPS of 6.6 sen per annum.

(Of course, the above is a simplistic calculation arrived at based on various assumptions such as timber price remains strong, harvesting schedule, etc etc. Please refer to the company's 2014 circular to shareholders if you want to find out more about the various risk factors affecting timber operation)

3. Property Development

The group owns 51% of an apartment project in Doncaster, Melbourne called "Gardenhill". So far, 80% of the units had been sold. Construction started in September 2015 and will take 18 months to complete (mid 2017). GDV is approximately RM213 mil.

Apart from the above, the group has the following development projects in pipeline :-

(a) condominium project in Puchong (GDV RM400 mil);

(b) Sevice apartment project in Sentul (GDV RM250 mil); and

(c) project in Malacca (GDV RM78 mil).

According to FY2015 annual report, the Puchong project is targeted to be launched by end 2015 while the Sentul and Malacca projects in 2016.

4. Construction

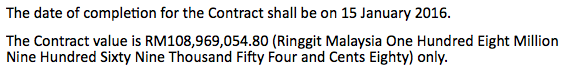

The group secured RM250 mil plus new contracts in past 12 months.

I don't have full details of the group's order book. But in the FY2015 annual report, management is comfortable with the prospects of the division :-

The next big potential catalyst for re-rating would be the Gemas JB Rail Lik project (if successful).

On 4 November 2015, the Malaysian government issued letter of intent to a Chinese consortium for the project. It is estimated to cost RM7 billion.

On 3 December 2015, Fajarbaru confirmed that it is in joint bid for the project.

5. Private Placement

The company proposes to undertake a placement involving issuance of up to 33 mil new shares to investors to be identified. The private placement is still in progress.

No comments:

Post a Comment