Author: Icon8888 | Publish date: Mon, 1 Feb 2016, 10:24 PM

1. Introduction

I first wrote about LB Aluminium in July 2014.

http://klse.i3investor.com/blogs/icon8888/56467.jsp

Many people don't understand what LB does. I have cut and pasted the relevant section from that article to give the readers a feel :-

2. Recent Performance

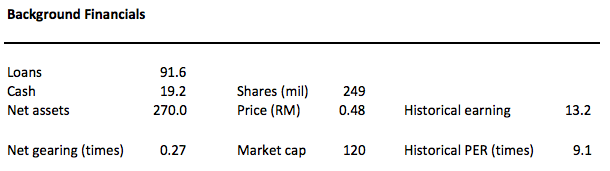

LB did well in FYE 30 April 2014. As a result, share price went up to as high as 90 sen in August 2014. However, in the subsequent financial year, it was adversely affected by the weak Ringgit which pushed up raw material cost (aluminium billets are imported). As a result, share price went on a downward trend (48 sen as at the date of this article).

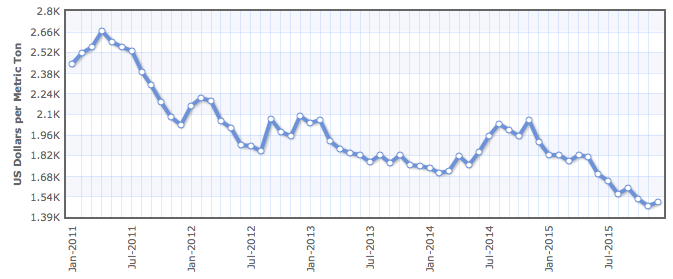

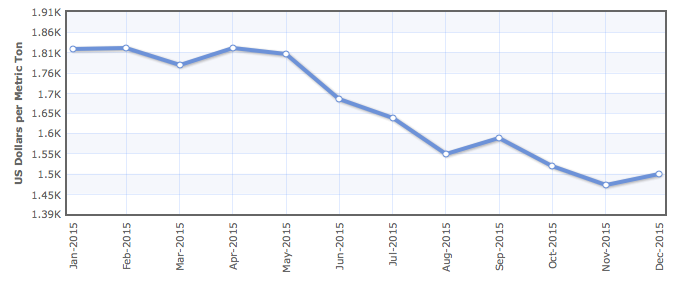

3. Aluminium Price

Together with other commodities, aluminium price declined from approximately USD2,200 per MT in 2014 to USD1,500 per MT in December 2015.

(Past 5 years)

(Past 1 year)

4. P&L

To better understand LB, I studied the group's P&L from FY2009 until 1H of FY2016 :-

Key observations :-

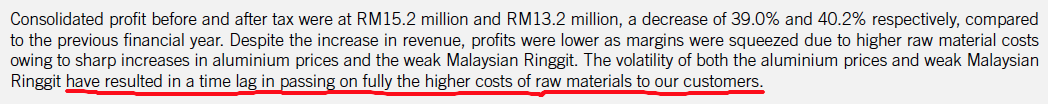

(a) According to annual reports, the effect of higher or lower cost of aluminium will be passed on to customers. However, I believe this is only partial as in years of low aluminium price, the group's profit will increase, and vice versa.

For example : in FY2010, with aluminium price at USD5,645 per MT, EBITDA increased from RM31.2 mil to RM38.8 mil. The same happened to FY2013, FY2014 and Q1 of FY2015.

(b) It seemed that the group will do exceptionally well when aluminium price was lower than RM6,000 per MT (yellow highlighted).

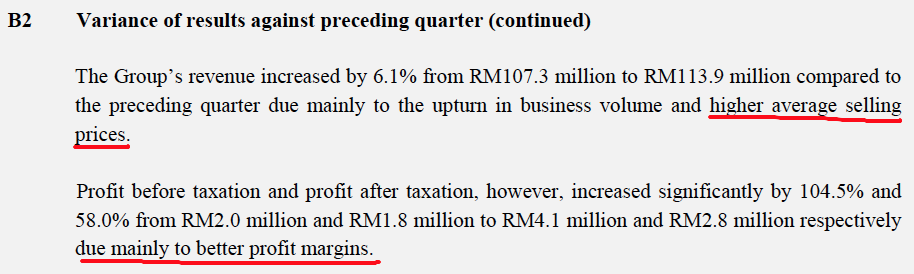

(c) According to the company, there will be a time lag before higher / lower cost can be passed on to customers. The following is extracted from FY2015 annual report :-

(d) It is difficult to determine how much revenue has grown in a particular year. This is because revenue is a function of both volume and selling price, which is influenced by aluminium price.

(e) Despite the drop in international aluminium price, the significantly weakened Ringgit caused import price to remain high. For example, in July 2015 quarter, aluminium price has declined to USD1,522 per MT. However, with Ringgit at 4.22, import cost was RM6,531 per MT, closed to the recent peak of RM6,683 in January 2015 when aluminium was trading at USD1,926 per MT.

(f) In the latest quarter ended 30 October 2015, the group's EBITDA margin has almost returned to previous high (10.8% vs. 6.5% in July 2015 quarter).

According to commentaries, the group benefited from higher selling price. Cost pass through ? Is the recovery sustainable ?

(g) Low tax rate is due to the group's regular capex programme. Further details in next section.

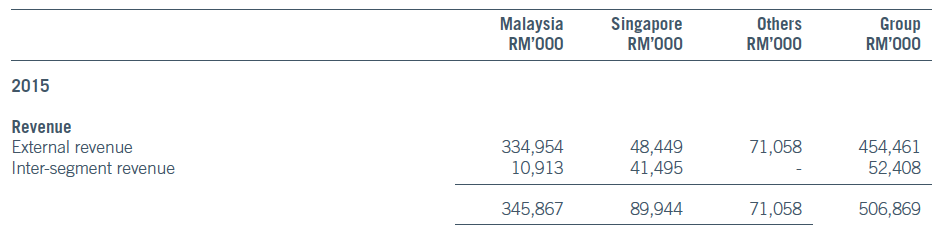

(h) The group derives approximately 74% and 26% of its revenue from domestic and exports sales respectively.

5. Cashflow

Key observations :-

(a) During the period from FY2009 until FY2014, the group channelled an average of RM2.6 mil per annum to finance increase in working capital.

This amount is not high, which is a plus point. Too much cash tied down in working capital will reduce free cash flow and depress Return On Invested Capital.

The group saw a huge negative change in working capital in FY2015 due to increase in inventories. Exact reason unknown. One possibility is that the group stocked up on billets in anticipation of Ringgit depreciation.

This seemed to have benefited the subsequent quarters. In 1H of FY2016, draw down of inventories allowed the group to save RM17.6 mil in cash flow.

(b) In normal years, the group spent around RM13 to 14 mil per annum for replacement of wear and tear. This is closed to the depreciation charges of approximately RM18 mil per annum.

(c) Every few years, the group will spend on capex to increase capacity as well as improve efficiency. It seemed that the money has not gone to waste. I arrived at this tentative conclusion after comparing the group's performance before and after capex.

In FY2010 (before capex), with aluminium price of RM5,645 per MT, the group reported EBITDA of approximately RM38.8 mil.

In FY2013 (after capex), with aluminium price of RM5,682 per MT, the group reported EBITDA of RM44.8 mil.

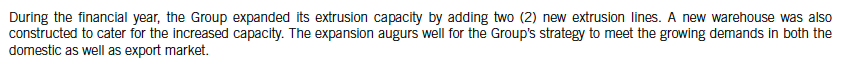

(d) The most recent capacity expansion was in FY2015 and is estimated to have cost RM27 mil (being RM41 mil less estimated annual wear and tear replacement of RM14 mil). According to annual report, the programme was completed in April 2015. However, due to weak Ringgit and softer demand (due to slow down in economy), looked like the positive effect has yet to show up. The following is extracted from FY2015 anual report :-

(e) The company paid out dividend consistently. Before FY2015, DPS is 1.75 sen per annum. In FY2015 and 2016, the company paid DPS of 2 sen (readers please double check). Based on current price of 48 sen, dividend yield is 4.2%.

6. Balance Sheets

Key observations :-

(a) Despite 2 rounds of capex and annual dividend payment, balance sheets remained strong. Net borrowings increased from RM62.3 mil in FY2010 to RM72.4 mil in FY2016, an increase of merely RM10 mil over seven years. I don't have any reason to complain.

(b) Latest net gearing is low at 0.27 times only.

7. Concluding Remarks

(a) I don't think LB is a company with moat. It is not the kind of companies that can just sit there and the cash register will ring non stop.

However, it is also not the type of weak companies that get pushed around haplessly by forces of competition. Past experience showed that as long as they keep reinventing themselves (for example, by investing in new machineries and technology), they will be able to chalk up reasonable growth.

The growth process will not be smooth though. It will be full of ups and downs, with raw material cost being the biggest determining factor.

For example, the group did not do well immediately after capex in FY2011. However, in FY2013 and 2014, when good time returned, its profitability was elevated to a new height.

(b) With the bulk of the group's raw material imported, it should benefit from the recent strengthening of Ringgit. However, the jury is still out on how the Ringgit will fare going forward.

As mentioned above, the group can pass on some of the cost to its customers. The latest quarter result showed signs of margin improvement. We will have to wait for next quarter result to find out whether the recovery can be sustained.

(c) In my opinion, the stock is currently trading at trough level. However, it is not a very sexy stock. I will be very happy if it can give me 20% to 30% return in one to two years time.

Just nice for a risk adverse old man like me.

No comments:

Post a Comment