Author: Icon8888 | Publish date: Fri, 26 Feb 2016, 09:29 PM

Today, EG announced December 2015 quarterly results. For me, the result is satisfactory and above expectation.

Key observations :-

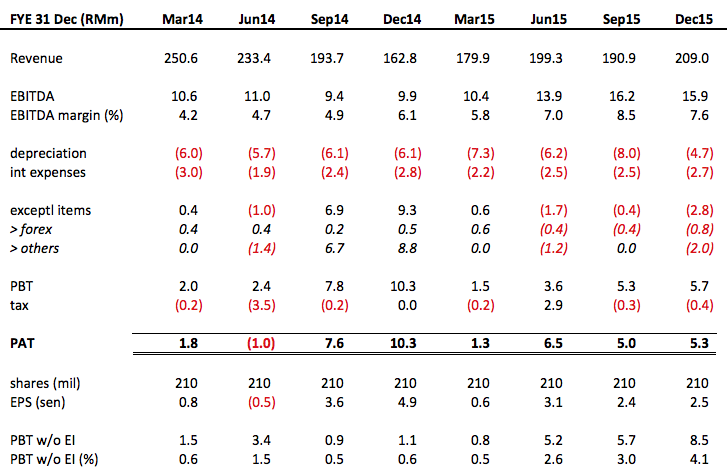

(a) The group's turnaround actually started in June 2015 quarter with PBT of RM5.2 mil (without exceptional items).

(b) In this latest quarter (December 2015), revenue increased by 9.4% Q-o-Q.

Despite higher revenue, EBITDA declined slightly from RM16.2 mil to RM15.9 mil, driven by lower margin.

What saved the day was the lower depreciation charges of RM4.7 mil (RM3.3 mil lower than previous quarter's RM8 mil). The company did not provide explanation for the sharp drop and it is not clear whether can be repeated.

As a result of lower depreciation charges, operating PBT increased by RM2.8 mil from RM5.7 mil to RM8.5 mil.

However, the group incurred RM2 mil expenses for the rights issue and private placement exercise completed in Q4 of 2015. As a result, the final PBT was only RM5.7 mil, slightly higher than previous quarter's RM5.3 mil.

The company used weighted average number of shares to calculate the EPS. However, I prefer to cut through all the confusions and use the 211 mil shares outstanding. As a result, latest quarter EPS is 2.5 sen, more or less the same as previous quarter's 2.4 sen.

Based on annualised EPS of 10 sen and latest closing price of RM0.89, PER is about 9 times.

This level of PER is not exactly very exciting. However, investors are buying the stock for its future. EG is at early stage of a beautiful growth story. With targeted completion of new plastic injection factory by second half of 2016, group performance is expected to further improve.

Exciting times ahead.

No comments:

Post a Comment