Publish date: Wed, 6 Jan 2016, 07:27 AM

1. Introduction

"Clash of The Titans" is an article series written by me to talk about various style of investing based on my observation of Sifus in i3.

Part 1 was an introduction. I identified Value Traders as a disctinct group of market players that operate differently from Value Investors, even though both are guided by fundamentals.

In Part 2, I provided the theoretical background for Value Trading via the discussion of Shaughnessy's study of High Relative Strength Investing.

The title of that article was "Ooi Teik Bee Demystified". However, as many readers would have noticed, the objective was not to discuss OTB, it was to discuss Shaughnessy's findings. I slapped on the OTB tag as a marketing gimmick to attract your eyeballs.

In this article (Part 3), I will look into the investing strategy of another Sifu - our phoenix rising from the ash Uncle Koon.

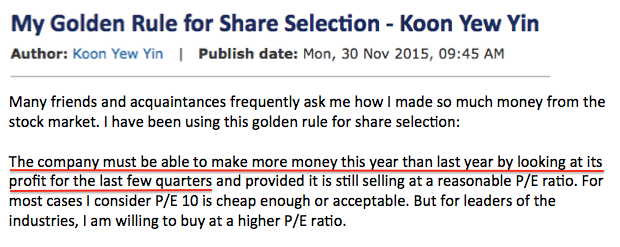

2. Emphasis On Earnings Growth

Uncle Koon's concept of investing is very simple - buy stocks that you think this year's earning will be higher than that of last year.

How do I feel about Uncle Koon's strategy ? Let's do a study before we jump into conclusion.

3. My 2015 Experience

The best way to determine whether Uncle Koon's method will work is to study the correlation between profit growth and share price gain.

In 2015, altogether I have written about 67 stocks. I did a quick check of their status. The complete list has been attached at the Appendix section for your reference.

Out of the 67 stocks, I only make use of the first 54 stocks for analysis purpose. The remaining 13 stocks were covered too late by me (from September 2015 onwards) to be useful as samples.

My first step is to identify those stocks with strong profit growth. I want to find out whether strong profit growth will drive share price.

Out of the 54 stocks, 22 stocks reported very strong profit growth during the relevant period. They are shown in table below.

Of the 22 strong profit growth stocks, 14 stocks exhibited strong price gain (orange highlighted).

Of the remaining 8 stocks that the price hasn't gone up proportionate to profit growth, 7 stocks can be explained away (blue highlighted), only 1 stock cannot (yellow highlighted).

The 7 that can be explained away (blue highlighted) are :-

(i) Rex Industry - Too low profile, illiquid, erratic quarterly performance.

(ii) WTK - Before profit growth, the stock traded at high PER (backed by high net assets per share). Strong profit growth only brought PER down to a more reasonable level. As such, investors did not chase the share price up substantially.

(iii) DKLS - Ipoh based construction company. Too low profile.

(iv) SYF Resources - Recent strong earnings growth driven by property division. Investors are not particularly keen about this sector at the moment.

(v) Jaycorp - Earlier profit marred by exceptional items. Investors knew that. So they tolerated a relatively high PER. The earnings growth played the role of bringing PER down to a more reasonable level.

Having said so, there is also an element of mispricing. With prospective EPS of 16 sen, forward PER is only 7.4 times. There is room for further price gain.

(vi) Media Prima - EPF selling pressure, market perception of conventional media as sunset industry.

(vii) Mmode - I don't speak for all investors. However, I never quite feel comfortable with the business they are in. They distribute digital content such as music, lifestyle, entertainment, etc through mobile devices. I always have this fear that they will be the first one to get hit in the event of economic downturn (better save your money for essential items). Maybe other investors have the same perception ?

The only stock that cannot be explained away is Hexza. Its latest quarter strong earning is sustainable. In my opinion, underperformance of its share price must be due to mispricing. Call your remisier now !!! (I don't own any Hexza share)

Summary Findings Out of 22 strong profit growth stocks, 21 stocks (being 14+7, representing 95%) behaved rationally with share price going up in accordance with their fundamentals. Only 1 did not behave as it should (representing 5%).

Pursuant to the above findings, YES, profit growth does cause share price to go higher

Has Uncle Koon found the key to King Solomon's treasures ? Can his formula forever lift all Malaysians out of poverty ?

Yes and No. Please read on.

4. The Devil Is In The Details

(Jayatiasa and Mudajaya's Painful Experience)

It is not my intention to open up old wound. However, our discussion about Uncle Koon's stock picking strategy will not be complete without looking back at the past.

If I am not wrong, Uncle Koon started blogging in early 2014. He has been very consistent. Since day one, he preached the same message that "you must buy stocks that the earning this year will be higher than last year".

In accordance with that principle, Uncle Koon recommended, among others, Jayatiasa and Mudajaya.

The Buy call for Jayatiasa was based on expectation that maturing estates will drive earnings growth, thereby resulting in capital gain. The Buy call for Mudajaya was based on expectation that the commissioning of India IPP will boast earnings, thereby resulting in capital gain.

As we all know, things didn't quite work out as planned. Due to multiple negative developments, Jayatiasa and Mudajaya's share price declined by more than 50% over the subsequent one year.

(Windfall Gain In 2015)

Just when everybody has more or less written off Uncle Koon, he made a stunning comeback in 2015. With the help of some advisers, Uncle Koon did extremely well in that year.

What has actually transpired ? With the same strategy, why did Uncle Koon fail in 2014 and succeed in 2015 ? What conclusion can we draw from these two starkly different episodes ?

Well, the conclusion is very simple :-

Uncle Koon's concept is valid, but its success is highly depedent upon execution. I think not many people will dispute the merit of buying stocks with strong earnings growth potential, the challenge is to correctly identify those stocks.

5. Concluding Remarks

(a) 2014 demonstrated the challenges faced by stock pickers trying to identify companies with strong earnings growth potential. Things do not always work as planned.

Despite extensive analysis and excellent market intelligence, negative events could happen to delay the process by a significant margin.

Worse, sometime the entire theme will get derailed and investors will face multi year set back.

(b) Not that I want to deny Uncle Koon the credit that he deserves, I believe his stockpicking strategy worked well in 2015 because there was a strong export theme for all of us to leverage on. Due to sharp depreciation of Ringgit, even the weakest exporters managed to chalk up some growth.

Before 2015, I very seldom invest in manufacturing companies. During that time, Malaysia was not cost competitve. We also did not posses any technological advantage. Most manufacturing companies were half dead. It was closed to impossible to predict earnings. Without that, how do you identify "companies that will have higher earnings than last year" ?

(c) Despite the challenges mentioned above, same as Uncle Koon, I believe that his method is an excellent way to pick stocks with potential for capital gain. There will always be something that exhibits earnings visibility. The challenge is to do it properly that you end up with the right candidates. For this purpose, riding the industry up cycle always help.

For example, lets' assume in 2017, oil price rallies and Ringgit strengthens back to RM3.50. We will lose earnings visbility for exporting companies. However, oil and gas industry will be able to step in to fill the void. That will be where we should zoom in to try to identify the next Heng Ong Huat stocks.

The game continues.

Appendix

No comments:

Post a Comment