Author: Icon8888 | Publish date: Tue, 29 Mar 2016, 11:58 AM

According to Alliance DBS Research, more than 75% of Air Asia X's expenses are denominated in USD.

As Air Asia has same business model as AAX, I wonder whether it has a similar cost structure ? To find out how the strengthening of Ringgit will affect Air Asia, let's take a closer look at its historical P&Ls.

If I am not wrong, the yellow highlighted items should be mostly denominated in USD.

For revenue, the final quarter of aircraft operating lease was unusually high. I normalised the figure by annualising January to September 2015 figures to arrive at USD248 mil as full year estimate.

For expenses, the FY2015 fuel figure was based on USD82 per barrel. In FY2016, the likely price per barrel should be USD59 (Air Asia has hedged 50% of its requirement at that price). Based on 6.28 million barrels, fuel expense should be USD371 mil.

Based on the adjusted fuel cost, total expense would be approximately USD1.25 billion, out of which USD631 mil will be denominated in USD. This represents approximately 50% of total expenses.

However, after being offset against USD248 mil operating lease revenue, net Dollar denominated expenses is only USD383 mil, representing 30% of expenses.

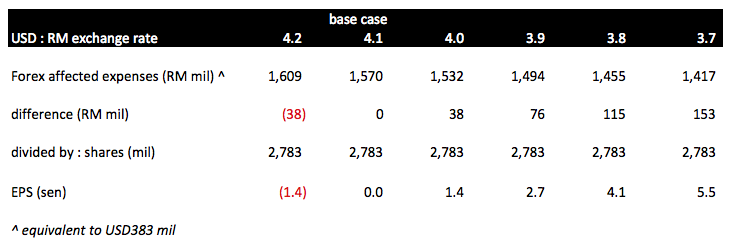

To determine the impact of USD movement, I did a quick sensitivity analysis based on base case of 4.1 and USD383 mil :-

According to table above, every RM0.10 movement in RM vs USD will result in RM38 mil changes. Based on 2.783 billion shares, approximately 1.4 sen impact on EPS.

No comments:

Post a Comment