Publish date: Wed, 20 Jan 2016, 08:13 AM

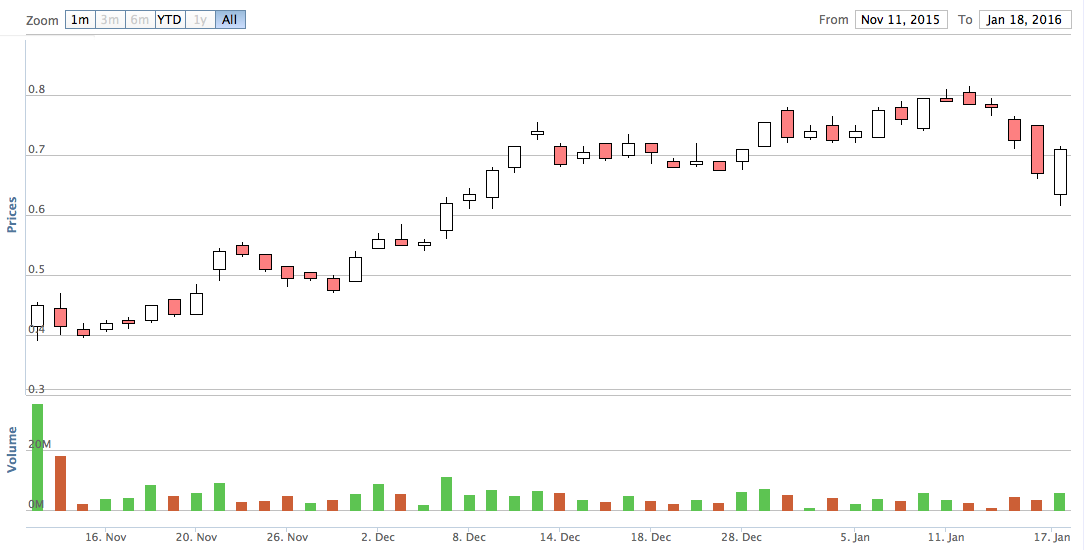

(EG share price)

(EG-WC price)

1. Introduction

EG is involved in electronic manufacturing services. To be specific, its business activities are :-

(a) Printed Circuit Board assembly; and

(b) Original Design Manufacturer (ODM) of complete Box Built products.

Based on 211 mil shares and share price of RM1.04, market cap is RM219 mil.

My friend alerted me about EG when it was trading at about 60 sen, but I didn't take any action. It subsequently released a strong set of results for September 2015 quarter and share price has been on an upward trend, reaching about RM1.20 last week.

These few days, due to negative sentiment, stock price came down to as low as 93 sen. I took the opportunity to pick up some EG-WC.

EG is already a famous stock, I don't expect this article to stir up a lot of buying interest. The main objective is to kick start coverage for this company so that I can continue to write about it in the future.

2. First of All, A Little Bit of History...

EG was not always this sexy. The group has always been involved in PCB assembly. However, under the previous owner (Tai Family), the group did not perform well and share price hovered around 40 sen.

(EG used to be a sleepy counter, but it woke up in July 2014....)

In July 2014, Jubilee Industries Holdings Ltd ("Jubilee"), a company listed on Singapore's Catalist (same as Malaysia's ACE) acquired 26% stake in EG from Mr. Tai. In January 2015, Jubilee further increased shareholding to 30%.

Jubilee did not make any major changes to EG's top people. Apart from Terence Tea Yeok Kian, a Singaporean who represents Jubilee, EG's Board of Directors remained more or less the same. Existing CEO, Alex Kang Pang Kiang has been with the group for a long time.

The company undertook a rights issue in 2015. Through a series of steps, Terence and Kang emerged with 5% and 4% direct stakes in the company respectively. As Jubilee did not subscribe for the rights, its stake was diluted to 13%.

(CEO Alex Kang Pang Kiang is also an Independent Director of Main Market listed Thong Guan Industries Bhd)

3. A Brilliant Strategy

We cannot fully understand EG without first understand Jubilee.

What you are going to read below did not come directly from EG or Jubilee. It was pieced together based on bits and pieces of information I gathered from public domain, including Singapore Stock Exchange. My understanding of the whole sitiuation is arrived at based on certain assumptions that I make, as well as my own reasonings and interpretation of events. It might not be 100% correct. So please read it with a pinch of salt.

First of all, Jubilee is not doing well. Based on 340 mil shares and share price of 3 cents (!!!), Jubilee's market cap is only SGD10.2 mil (RM31 mil). The group has been loss making. However, its balance sheet is quite clean, with little bit of gearing.

The following information is extracted from Jubilee's website.

Three points I would like to highlight from the above :-

(a) The group is a specialist in plastic injection moulding (note : absolutely no electronics manufacturing experience).

(b) It has manufacturing operation in Singapore (commenced operation in 1993), Suzhou, China (commenced operation in 2003) and Johore (commenced operation in 2007).

(c) Its customers include famous names such as Apple, Dyson, Hewlett-Packard, Mazda, Honda, etc.

Based on the above information, my impression is that the group must have done not too badly in the past (China footprint, branded customers, etc). However, in recent years, their business have been going downhill. I haven't studied the group in detail, but my guess is that it must have been due to intense competition, which drove down profit margin (quite common nowadays).

Across the straits in Malaysia, EG faced the same problem. However, EG is in PCB assembly, not plastic injection moulding.

One thing that Jubilee and EG have in common is that both are companies with mono expertise. With so many other players around, it is not easy to differentiate, no matter how hard they tried.

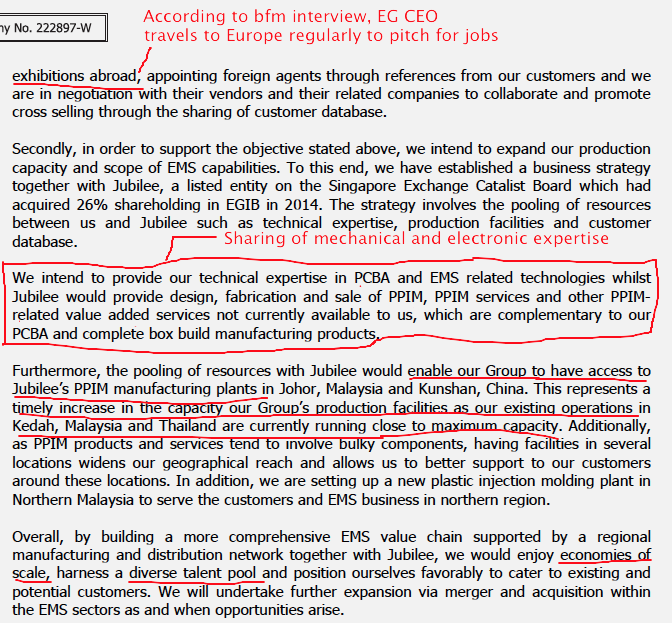

Jubilee's latest annual report sheds light on how the company intends to break away from its competitors. It feels that the best way to do it is through verticle integration. By combining mechanical and electronic expertise, it hopes to reposition itself in a field with smaller number of players and less intense competition.

EG is a good candidate. According to Jubilee's annual report, EG is the largest electronic contract manufacturer in Malaysia. Its operation is sizable, but years of low profit has depressed its equity value. This provides Jubilee with golden opportuity to enter at attractive price.

In July 2014, Jubilee acquired 19.5 mil shares (26% equity interest) from EG's controlling shareholder for RM21 mil. This worked out to be approximately RM1.08 per share.

The subsequent Ringgit devaluation was a bonus (EG's previous controlling shareholder must have regretted selling 6 months too early). Jubilee must have liked the new operating environment so much that it decided to further increase its shareholding by 4% in January 2015. As mentioned above, EG subsequently undertook a rights issue that resulted in Terence Tea and Alex Kang holding 5% and 4% direct stake in EG respectively.

So far, things seemed to have been working well for Jubilee and EG. In August 2015 (one year after Jubilee assumed control), EG secured USD50 mil (RM215 mil) contract from Finland's Tramigo Ltd to produce vehicle tracking device (box build services). The contract will last for 2 years.

On 30 November 2015, EG announced that it has secured another box build contract worth RM150 mil. The contract will last until FYE 30 June 2016.

On 22 December 2015, in an interview with bfm, EG's CEO mentioned that the company has secured another contract from a European customer. The contract has yet to be announced and details are not available.

"I just came back from Europe. We have a done deal on another agreement, which will be announced soon"

(Alex Kang, EG CEO)

http://www.bfm.my/bg-alex-kang-eg-industries-same-world-more-wired.html

The above contract wins are exactly what Jubilee has been hoping to achieve when they entered EG. It seemed that the strategy is beginning to bear fruits.

On 30 November 2015, EG announced a strong set of quarterly result. Based on net profit of RM5 mil and 211 mil shares, EPS was approximately 2.4 sen.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) # |

|---|---|---|---|---|---|

| 2016-06-30 | 2015-09-30 | 190,877 | 5,338 | 5,039 | 6.56 |

| 2015-06-30 | 2015-06-30 | 199,344 | 3,581 | 6,572 | 8.79 |

| 2015-06-30 | 2015-03-31 | 179,884 | 1,493 | 1,342 | 1.79 |

| 2015-06-30 | 2014-12-31 | 219,076 | 10,286 | 10,286 | 13.74 |

| 2015-06-30 | 2014-09-30 | 243,636 | 7,759 | 7,560 | 10.09 |

# based on pre rights issue shares

If annualised, full year EPS would be approximately 10 sen, which explained why EG's share price currently trades at approximately RM1.00 plus (PER of 10 times plus).

Unlike the June 2015 quarter, the latest quarter result was purely operational and does not contain any exceptional items.

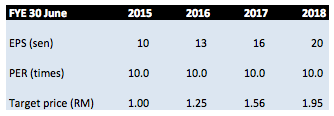

The group has set a target of doubling net profit within 3 years. This translates into compounded annual growth rate of 25% per annum.

The following would be how the company will look like if the way I interprete the information is correct :-

On hind sight, what Jubilee has done makes a lot of business sense.

If I am not wrong, all this while EG has a domestic focus. It mostly supplied to MNCs based in Malaysia (Western Digital is one of the major customer). The group managed to survive over the years but could not really thrive. Not only that, with operating cost escalating in Malaysia, EG is increasingly facing an existential threat. As much as it wants to transform, it lacks the expertise to do so.

Jubilee is different. It has relatively sophisticated expertise, a dynamic management team, international exposure and ready access to branded customers. However, it faced the same problem that plagued EG - as a mono expertise company, it is hard to pull away from competitors, no matter how hard they tried.

By taking over EG, Jubilee can leverage on its unique expertise as well as the synergies arising from the merger to make EG's assets sweat. Previously one square feet of EG's factory floor can produce RM100 profit. But with multiple expertise, Jubilee can now squeeze additional RM900 profit out of it.

No wonder share price has been running lately.

A brilliant strategy indeed.

4. Balance Sheets

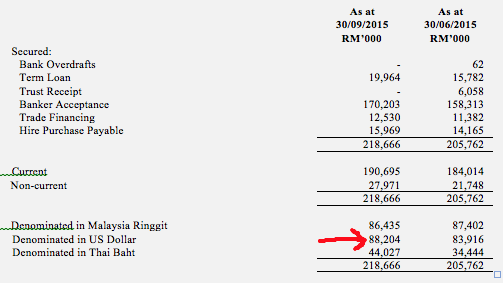

According to September 2015 quarterly account, the group has net assets of RM157 mil, cash of RM51 mil and loans of RM218 mil. After factoring in recently completed rights issue and private placement, estimated net assets should be about RM220 mil. As the bulk of the cash raised will be for business expansion, the exercise will not have much impact on loans and borrowings. in this regard, net gearing post proposals is estimated to be approximately 0.77 times.

The net gearing is not low. However, the bulk of the borrowings are Bankers' Acceptance (BA). This is nothing new for i3 members who have been following my articles. The case is exactly the same as Comcorp.

The general concept is as follows :-

(a) the BA allows the company to import intermediate goods;

(b) source of repayment will be future payment by customers; and

(c) this draw down and repayment of BA can happen forever as long as EG does not encounter huge bad debts that can disrupt its cash flow.

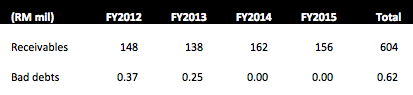

With regard to item (c) above, a quick analysis showed that over the past 4 years, only 0.1% of EG's receivables turned bad. As long as the company can manage this part of the operation well, BA financing should be sustainable. Please refer to Appendix for further details.

Even though the above analysis leads me to conclude that repayment is not a problem, I do have a little complain - it would be nice if the cost of financing can be lowered. Comcorp's BA cost is approximately 2.7% while EG's average interest rate is approximately 4.2% (being RM9.2 mil / RM218 mil).

5. Forex Exposure

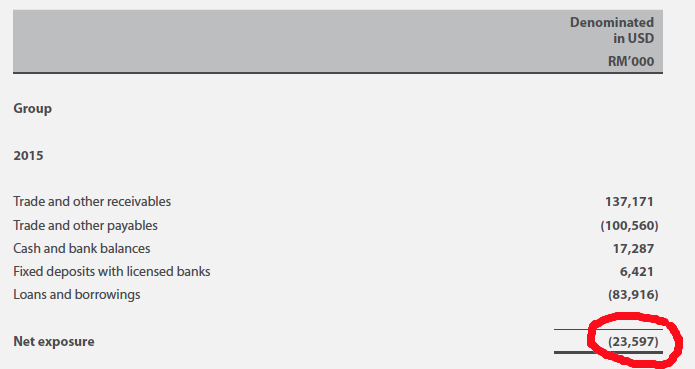

Out of the RM218 mil borrowings as at 30 September 2015, approximately RM88 mil are denominated in USD.

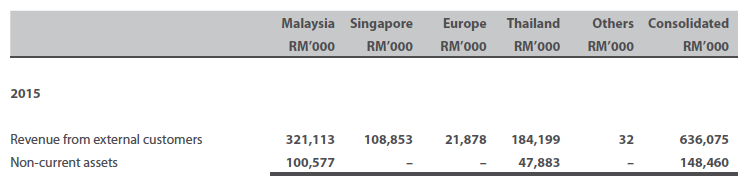

This is not a major issue as the loans are mostly hedged by USD receivables and cash. During FY2015, approximately 50% of the group's revenue was derived from overseas.

As at 30 June 2015, net exposure to USD liabilities was approximately RM23.6 mil :-

The latest exposure must have been lower as in the September 2015 quarter, forex loss was only RM0.4 mil despite Ringit depreciated by closed to 15%.

6. Rights Issue

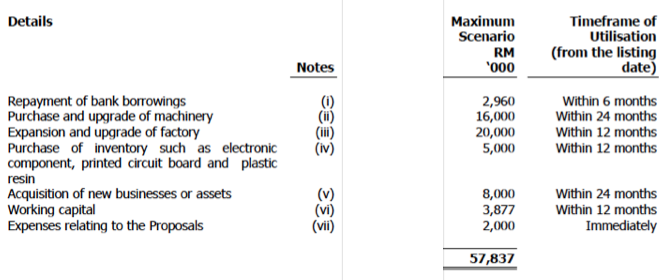

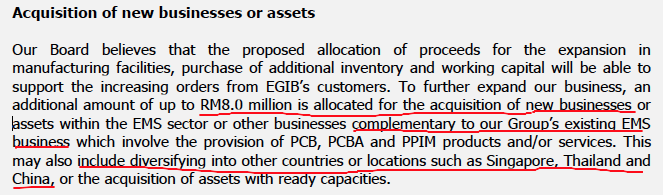

In 2015, EG untook a rights issue involving the issuance of 116 mil shares at RM0.50 per share to raise approximately RM58 mil, which will be utilised as follows :-

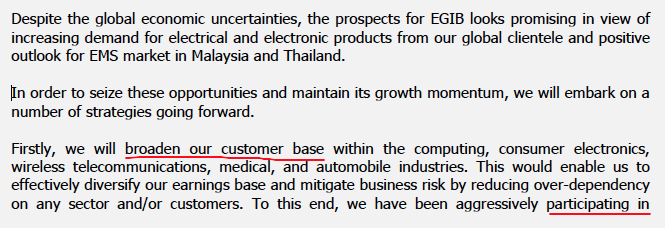

7. Prospects of The EG Group

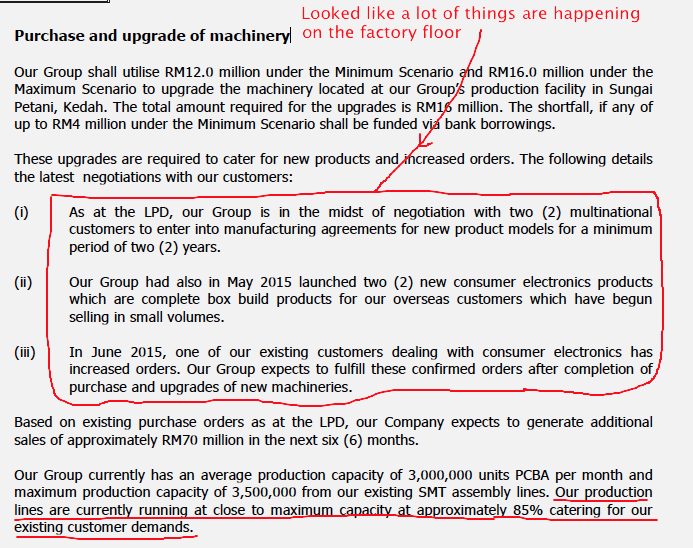

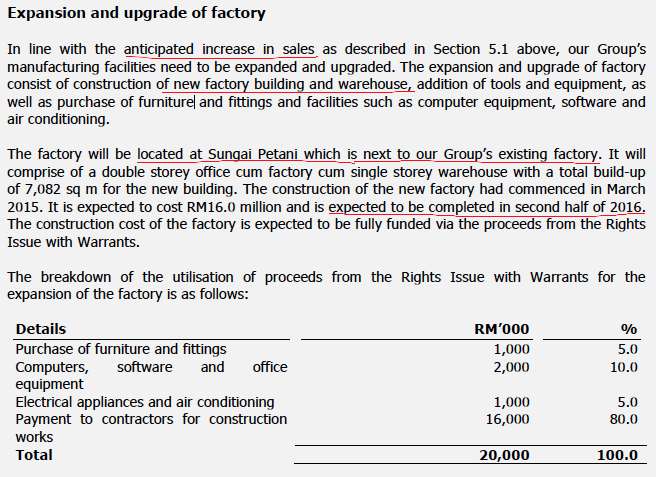

The following information is extracted from EG's Abridged Prospectus for the rights issue.

Appendix

Bankers' Accpetance (BA) is banking facility used by companies to import goods from overseas. Please refer to diagram below.

(source : YouTube)

The diagram looked very complicated, but it is not difficult to understand. Let me try to summarise for you :-

(a) EG wants to buy some chips. It places order with Intel's US factory.

(b) At the same time, EG approaches Maybank to help out.

(c) Maybank liaises with Citibank's US office.

(d) Citibank USA approaches Intel USA.

(e) With Citibank USA in the picture, Intel USA is assured of payment. So it immediately ships the goods to EG.

(f) Once EG receives the goods, Maybank pays US Dollars to Citibank USA.

(g) Citibank USA pays US Dollars to Intel USA.

(h) As Maybank has made payment on behalf of EG, there is an amount owing by EG to Maybank. The amount owing is called BA.

(i) Maybank does not want to carry the BA in its book. It sells it to fixed income investors. The BA is guaranteed by Maybank. Investors like Maybank credit, so they happily mop them up.

(j) After a short period (let's say 3 months), EG receives US Dollar payment from customers. It uses the cash to pay Maybank. Maybank pays the fixed income investors. BA extinguished.

(k) The cycle is complete. The next cycle will start when EG wants to buy more chips from Intel USA.

The next question to be asked is "what can go wrong ?".

As discussed above, the draw down and repayment process is an eternal cycle that keeps on repeating. Problem will only happen when EG is unable to repay the BA. This in turn will only happen when EG's customers fails to pay it.

In an ideal situation, EG can require its customers to buy goods from it by BA. That would eliminate the default risk. Unfortunately, this does not seem to be the case. I arrive at this preliminary conclusion as the group has receivables of RM156 mil. Settlement by BA should lead to very limited receivables in the book.

What is the risk of customer default dragging the group into financial distress ? We can answer that question by looking at its history of bad debts.

The table below sets out EG's receivables impairment over past 4 years.

As shown in table above, out of RM604 mil receivables over a period of four years, RM0.62 mil turned bad. The probability is 0.1%. It looked like we don't need to worry too much about this item.

Appendix - Sin Chew Write Up

Thanks for sharing this valuable info! PCB Assembly Singapore seems highly advanced and reliable.

ReplyDelete