1. A More Balanced Portfolio

In stock market, many things can happen in just a few days. Ringgit traded at approximately 4.40 last week, but yesterday it closed at 4.14.

Together with many other forum members, I started playing the export theme since December 2014. Common sense tells us that the party will end one day.

I didn't really have a feel of when it will happen, but decided to diversify my portfolio at beginning of 2016 by taking position in some non export stocks :-

(a) JHM Consolidation Bhd - Manufacturer of High Brightness LED. The group derives 94% of its revenue from Malaysia. It has done well in past few quarters due to strong demand of its products. Completion of new factory this year should provide further boost to earnings.

(b) Mercury Industries Bhd - Principally involved in manufacturing and trading of car paints. The group derives 80% of its sales from Malaysia. It is a beneficiary of low oil price. The strengthening of Ringgit should allow it to lower import cost.

(c) Mieco Chipboard Bhd - Manufacturer of particleboard. It derives 75% of its sales from Malaysia. It is a beneficiary of low oil price as the glue it uses in the manufacturing process is a petroleum derivative. The strengthening of Ringgit should allow it to lower import cost.

(d) Luxchem Bhd - Manufactures and trades Unsaturated Polyester Resin and gloves related chemicals. It derives 75% of its sales from Malaysia. It is a beneficiary of low oil price. I bought it at around RM1.10 in July 2015 but took profit end 2015 at RM1.65. Recently I bought it back at RM1.70. I am hoping that low oil price will turn in quarter after quarter of super profit for the group. The strengthening of Ringgit should allow it to lower import cost.

2. Keeping My Export Stocks

Despite recent strengthening of Ringgit, I am of the view that USD will remain strong going forward (even though might not be as high as 4.40). This is consistent with my July 2015 article :-

My abovementioned view was backed by historical precedence. In the past two rounds USD bull run, strong Dollars lasted for 7 years in both cases. Please go through the article for more details.

I still have 40% of my money in export stocks (40% in non export cum low oil price beneficiary, 20% in others). The major exporters in my portfolio are as follows :-

(a) Thong Guan Industries Bhd - My exposure is through the Warrants. It was the star performer in my 2015 portoflio, went up from 90 sen (my cost) to as high as RM2.50 within one year.

I haven't sold a single unit. Recently it has gone down to RM1.74.

I have no regret for not selling at recent peak. For me, Thong Guan is a very rare opportunity, I would like to let it unleash its full potential (whether achievable or not is a different thing).

Thong Guan benefited a lot from weak Ringgit. However, it has other strengths that make it resilient and defensive :-

(i) Capacity expansion still ongoing and hence yet to be fully priced in;

(ii) Low oil price stimulates demand for more plastic packaging material, creating new market that previously did not exist;

(iii) Investment in new technology and machineries allows it to differentiate from competitors, thereby commanding better profit margin; and

(iv) Turning net cash soon. If it starts paying out strong dividend (can be as quick as this year), valuation will be propelled to an entirely new level.

The only black spot is recent Yen weakness, which should have an adverse impact on demand.

(b) EG Industries Bhd - I am a late comer to this stock, only started buying EG-WC recently at 64 sen. The group should benefit from weak Ringgit. However, same as Thong Guan, it has a beautiful growth story that I hope could shield it from a strengthening Ringgit. Will buy more if it comes down further.

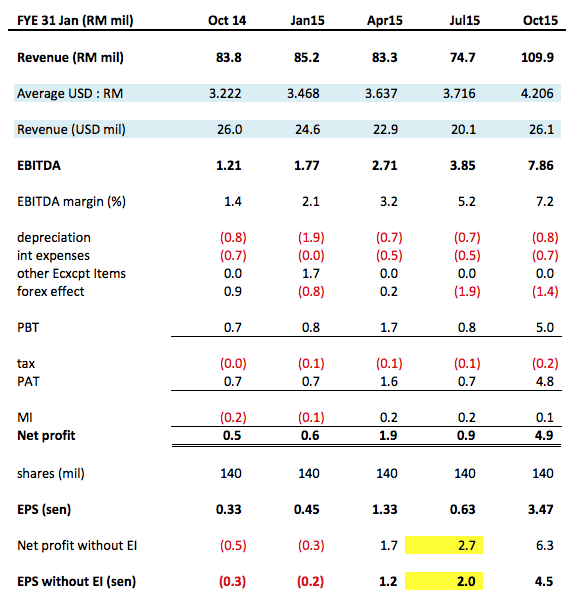

(c) Comintel Corporation Bhd - I am keeping Comcorp in my portfolio. According to analysis in my previous article, the group reported EPS of 2 sen in July 2015 quarter (yellow highlighted at table below) when USD was 3.72 per Ringgit.

Based on annualised EPS of 8 sen and current price of 64 sen, prospective PER would be 8 times. If USD is > 3.72, maybe EPS will be even stronger ?

Please refer to my previous article for further details.

Apart from the above, I still hold some Dufu, Jaycorp, etc. But their weightage is not as high as the above few stocks.

3. Construction Stocks

Recently, George Kent declined to as low as RM1.50. I took the opportunity to add more to my portfolio.

I am still holding Gadang and Mudajaya.

I have exposure to the abovementioned stocks not because I am bullish about the construction sector. In fact, with current low oil price, I am cautious about that industry.

Push come to shove, the government might need to postpone some of the future projects. But so far, Malaysian government has a tradition of respecting sanctity of contracts. It won't simply cancel contracts that have already been awarded unless it is absolutely necessary. We are far from that kind of situation.

I keep GKent, Gadang and Mudajaya in my portfolio because of their good earnings visibility (of course, things don't always work out as expected, especially for Mudajaya). My experience over the years is that as long as earning is strong, share price will be resilient.

That is how I kicked start 2016. Let's see how things work out going forward.

After a turbulent 2015, another exciting year is ahead of us.

No comments:

Post a Comment