Author: Icon8888 | Publish date: Wed, 23 Mar 2016, 02:51 PM

(Hmmm....)

1. Investors Apprehension

Despite announcing an impressive set of results recently, investors seemed to be a bit apprehensive about AAX. Even though both Air Asia and AAX had gone up by more or less the same percentage, it is obvious that Air Asia attracted more interest. Very often, it is the strong buying in Air Asia that drags AAX price up with it.

Do a quick check of AAX's latest quarterly results and you will know why.

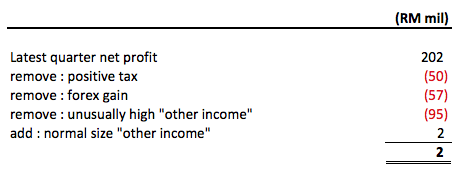

As shown above, the group reported net profit of RM202 mil in latest quarter. However, after making adjustments, core operating profit dropped to RM2 mil only.

One thing that upsets me is that all these were achieved with average fuel cost of USD 62 per barrel. Why is it that the group can only break even when fuel cost is so low ? What are the drivers and inhibitors ? Will things improve going forward ? It is with all these questions in mind that I decided to undertake a detailed study of the group.

2. Historical P&Ls

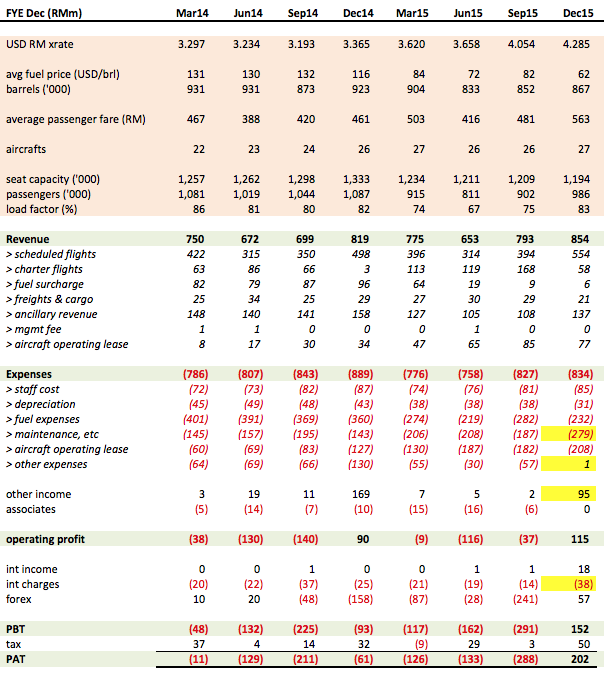

Key observations :-

(a) Fuel Cost

In Q4 of 2015, AAX Group's average fuel cost was USD 62 per barrel (note : Air Asia's cost was higher at USD 75 per barrel). I did a quick check to see whether my formula works.

Fuel cost = 866,453 barrels x USD62 x 4.285 (Q4 2015 average exchange rate) = RM230 mil.

This is very closed to the RM232 mil in the quarterly report. Great.

I understand that Air Asia has hedged some of its FY2016 fuel requirement at USD59. Lets use that to run a simulation for AAX.

By applying the same formula, adjusted fuel cost per quarter = 866,453 barrels x USD59 x 4.10 = RM210 mil.

(note : I use exchange rate of 4.10 to be consistent with my earlier Air Asia article. Anyway, no harm to be a bit conservative)

Fuel Saving per quarter = RM230 mil - RM210 mil = RM20 mil

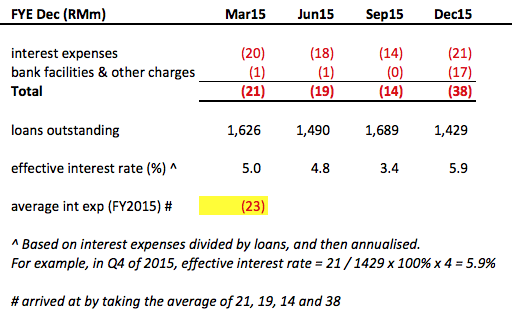

(b) Interest Expense

This is one of the major item that distorted latest quarter earnings.

As at 31 December 2015, the group has RM1,429 mil borrowings. However, Q4 interest expenses was RM38 mil. Interest rate works out to be 10.6%.

Closer examination showed that actual interest expense was only RM21 mil (translating into a more reasonable 5.9% per annum). Total financing cost was inflated by bank facilities fee and other charges amounting to RM17 mil.

Even though the RM17 mil figure inflated quarterly interest expense, I decided not to treat it as a one off item. According to quarterly reports, as part of its financing structure, AAX group repays and draws down loans regularly. There is a possibility that the RM17 mil constitutes arranger and facility fees payable by AAX to financial institutions for those financial transactions. If that is the case, it might be a regular feature that happens at least once per annum. To accomodate this item, I keep the RM17 mil but took the average of 4 quarters as the interest expense figure to be used in the financial model (please refer below).

(c) Maintenance Charges

I am highly suspicious of this item. In the previous quarters, its average was RM200 mil (being average of 206, 208 and 187). However, in Q4 of 2015, it increased by RM79 mil to RM279 mil.

The RM79 mil spike has a material effect on overall group earnings (RM316 mil, if you annualise it).

Is RM279 mil per quarter the new norm ? Or it contains certain one off items that will not re appear in subsequent quarters ? I don't have the answer for that.

However, I notice that in Q4 of 2015, AAX's aircrafts increased by only 4% (from 26 to 27 units). During the period, USD appreciated against the Ringgit by 5.7% (from 4.054 to 4.285).

After factoring in all these changes, by right maintenance charges should be RM220 mil instead of RM279 mil (a difference of RM59 mil).

(Note : RM200 mil x 1.04 x 1.057 = RM220 mil)

(d) Other expenses

During Q1, 2 and 3, average figure for this item is RM47 mil (being the average of 55, 30, 57). However, in Q4, it has become positive RM1 mil.

The company did not provide explanation. However, since it has always been there historically, I will add back RM47 mil to the financial model.

3. Financial Model

The model will now look like this :-

4. Concluding Remarks

(a) Not too long ago, I did a similar analysis for Air Asia. I have to say that compared to AAX, Air Asia's case gave me more comfort - it required me to make less assumptions and adjustments.

(b) Among the so many items in AAX P&L, the unusually high maintenance charges in latest quarter posed the biggest challenge for me to build a convincing financial model. Due to the sheer size of this number, it will have a huge impact on earnings should it swing either way. We can only find out more in next quarter results.

(c) As a result of the above, I don't think I am in a position to give a meaningful call for AAX. However, due to the following two factors, I am in general quite positive about the group's prospects :-

(i) low fuel price; and

(ii) strengthening of Ringgit, as closed to 70% of expenses are denominated in USD.

(d) Last but not least, I would like to point out that my financial model assumes zero deferred tax. However, in past 2 years, average deferred tax was positive RM20 mil per quarter. If you add the RM80 mil per annum back to P&L, that would provide buffer for achieving the RM184 mil net profit churned out by the model.

Different investors have different way of making assumptions. You have to decide what your expectation should be. Only time can tell whether you are right or wrong.

No comments:

Post a Comment