Author: Icon8888 | Publish date: Fri, 1 Jan 2016, 05:59 PM

(Don't worry, be happy)

1. Introduction

As we all know, Comintel Corp ("Comcorp") released a strong set of results recently and share price has a good run.

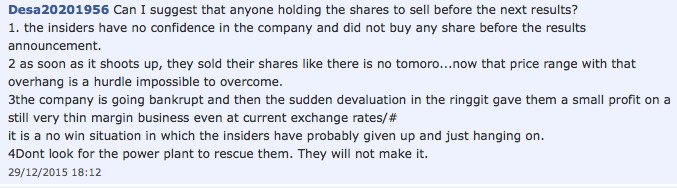

However, in the past few days, I noticed certain unfavorable remarks by forum members regarding the group.

The first two points sound like baseless speculation, I brushed them aside.

But the third point caught my attention. Bankruptcy is a very strong word, not something to be taken lightly. I sat up and took notice.

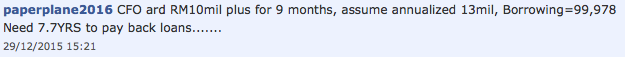

Another forum member brought up the issue of whether the group's operating cash flow is sufficient to fully pare down borrowings.

To be fair, Comcorp's balance sheet is not really that pristine. As at 30 September 2015, it has net assets of RM105 mil, borrowings of RM96 mil and cash of RM42 mil. Net gearing is approximately 0.5 times.

Maybe we shouldn't simply brush aside paperplane's comment ? We need to have a better understanding of how Comcorp service its debt obligations. Is it really going to take the company 7.7 years to fully pay back loans ?

It is with all these in mind that I decided to undertake a more detailed study of the group.

2. Balance Sheet Anatomy

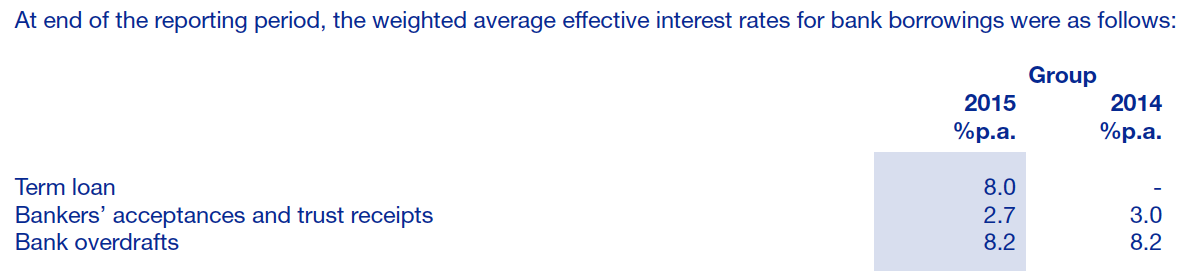

Comcorp's quarterly report does not provide much details about borrowings, so I have to rely on the annual report for the financial year ended 31 January 2015.

Key observations :-

(a) Out of RM94 mil borrowings, RM82 mil are Bankers' Acceptance ("BA"). The remaining RM11 mil and RM1 mil are term loans and overdrafts respectively.

(b) The BA are payable within one year. Term loan repayment is spread over 5 years. The BA are denominated in USD.

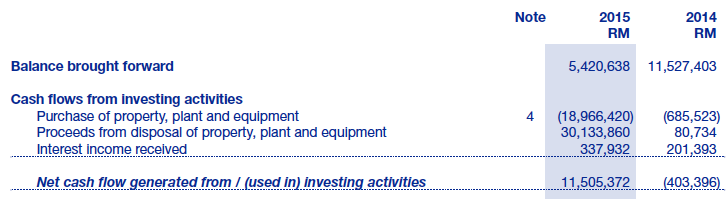

(c) The term loan of RM11 mil is new facility, it was non existent in FY2014.

As shown above, the term loan is secured against the assets of the group's green energy project. In this regard, it is very likely that it was drawn down to fund the project, which is pending completion and is backed by Tenaga offtake.

The group spent RM19 mil on capex in FY2015. Comcorp's contract manufacturing business traditionally did not spend much on capex. The FY2015 capex must be for the energy project.

(d) The BA bears very low interest rate of 2.7%. No wonder the group's FY2015 effective interest rate was only 3.9% (being RM3.7 mil / RM94 mil).

We now know that the bulk of the borrowings are BA, and they bear low interest rate. But what exactly is BA ? How does it work ?

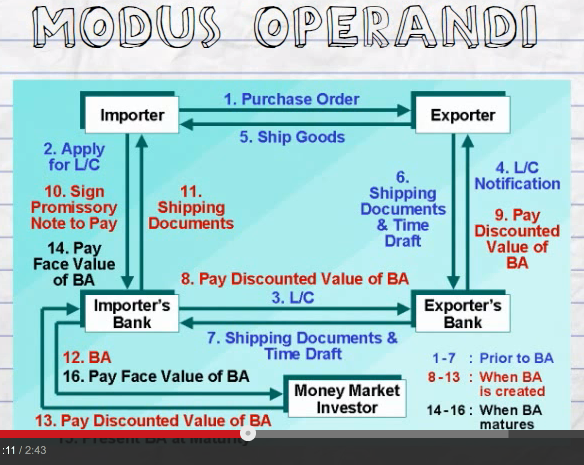

BA is banking facility used by companies to import goods from overseas. Please refer to diagram below.

(source : YouTube)

The diagram looked very complicated, but it is not difficult to understand. Let me try to summarise for you :-

(a) Comcorp wants to buy some chips. It places order with Intel's US factory.

(b) At the same time, Comcorp approaches Maybank to help out.

(c) Maybank liaises with Citibank's US office.

(d) Citibank USA approaches Intel USA.

(e) With Citibank USA in the picture, Intel USA is assured of payment. So it immediately ships the goods to Comcorp.

(f) Once Comcorp receives the goods, Maybank pays US Dollars to Citibank USA.

(g) Citibank USA pays US Dollars to Intel USA.

(h) As Maybank has made payment on behalf of Comcorp, there is an amount owing by Comcorp to Maybank. The amount owing is called BA.

(i) Maybank does not want to carry the BA in its book. It sells it to fixed income investors. The BA is guaranteed by Maybank. Investors like Maybank credit, so they happily mop them up.

(j) After a short period (let's say 3 months), Comcorp receives US Dollar payment from customers. It uses the cash to pay Maybank. Maybank pays the fixed income investors. BA extinguished.

(k) The cycle is complete. The next cycle will start when Comcorp wants to buy more chips from Intel USA.

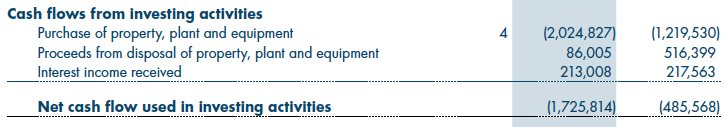

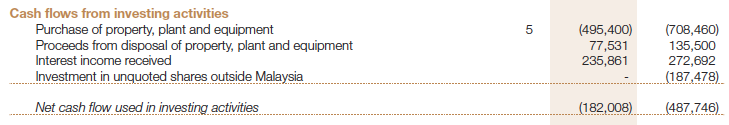

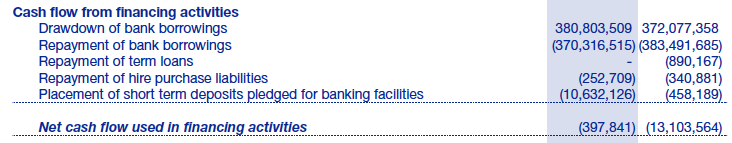

This is how the process will look like in the cash flow statement :-

As shown above, in FY2015, Comcorp drew down RM380 mil borrowings, out of which RM370 mil was likely BA. It used the RM370 mil to import intermediate goods, processed into finished products and sold to customers. Upon receipt of payment from customers, it FULLY repays the RM370 mil BA.

(The RM82 mil BA outstanding as at 31 January 2015 represents a half cycle. The amount will be settled once Comcorp receives payment from its customers. They must have repeated this cycle 4 times a year, thereby resulting in total amount of RM370 mil. This means roughly every 3 months, they will place order with their suppliers)

So this more or less addressed forum member paperplane's concern. The issue of "paring down RM99.98 mil debts over 7 years" does not exist. The credit cycle will keep repeating as long as Comcorp is in business.

The next question to be asked is "what can go wrong ?".

As discussed above, the draw down and repayment process is an eternal cycle that keeps on repeating. Problem will only happen when Comcorp is unable to repay the BA. This in turn will only happen when Comcorp's customers fails to pay it.

In an ideal situation, Comcorp can require its customers to buy goods from it by BA. That would eliminate the default risk. Unfortunately, this does not seem to be the case. I arrive at this preliminary conclusion as the group has receivables of RM102 mil. Settlement by BA should lead to very limited receivables in the book.

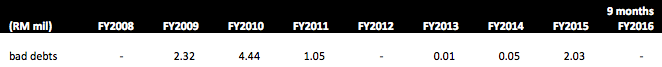

What is the risk of customer default dragging the group into financial distress (the dreaded bankruptcy case promoted by Desa2020) ? We can answer that question by looking at its history of bad debts.

To make my argument convincing, I deliberately roped in 2007 and 2008 figures to stress test the case. That two years was a period of great financial turmoil. Many companies fell into financial distress.

The finding is surprisingly robust. The maximum amount of bad debt was incurred in calender year 2009 and it was only RM4.44 mil. It will adversely affect P&L, but definitely not lead to bankruptcy.

Look like brankruptcy risk is nothing but a hearsay.

How about interest rate risk ? The group was able to make extensive use of USD BA because of the low interest rate environment in the past few years. Wouldn't rising interest rate inflict financial pains on the group ?

Of course the rise of USD interst rate will have negative impact. However, I don't think interest rate is about to increase so drastically. It will easily take two to three years before the impact can be felt by the real economy.

Hey !! Nobody is talking about long term investment here, we Traders are all waiting for another one or two more quarters of good earnings to lift the price so that we can flip the stocks, aren't we ? (At this point, I can almost imagine our KC Chong shifting uncomfortably in his seat).

Jokes aside, my point is that let's take thing one step at a time. Let's not scare ourselves to dealth by every little thing that pop up in our radar.

3. Summary Conclusion

(a) Most of the Group's loans are BA. Only RM12 mil are "genuine" borrowings in the form of term loans. The BA are self liquidating, the term loans are backed by TNB offtake. Nothing to worry.

(b) The BA are viable debt instruments as they are extremely low cost. Barring a major hike in interest rate, the funding structure is sustainable.

(c) Customer bad debts could cause the group difficulty in servicing BA repayment. However, historical data indicated that the group has a robust credit management system to mitigate that risk. Furthermore, the group has RM42 mil unencumbered cash to meet any potential shortfall.

Going into bankruptcy soon ? You must be smoking kerosene.

Saw on i3investor.

ReplyDeleteNo worries, keep blogging. I do blog, but lost interest after a while, because nothing new on method.

I dont spend too much time to study a counter, because i dont know how, just like the general public.

But as long as i keep buying fundamental good stocks, will keep making money, same as past 6 or 7 years.

Is like eating durian or food, if i know is nice, i'm very exciting to tell the whole world.