Author: Icon8888 | Publish date: Wed, 9 Mar 2016, 09:39 AM

1. Introduction

Recently, Air Asia released a strong set of results for the December 2015 quarter. Many investors jumped in to take position. How good was the result actually ? Did the December 2015 quarter contain any one off gain ? Can the good performance be repeated ? Is Air Asia still a good buy at current price ?

2. P&L Analysis

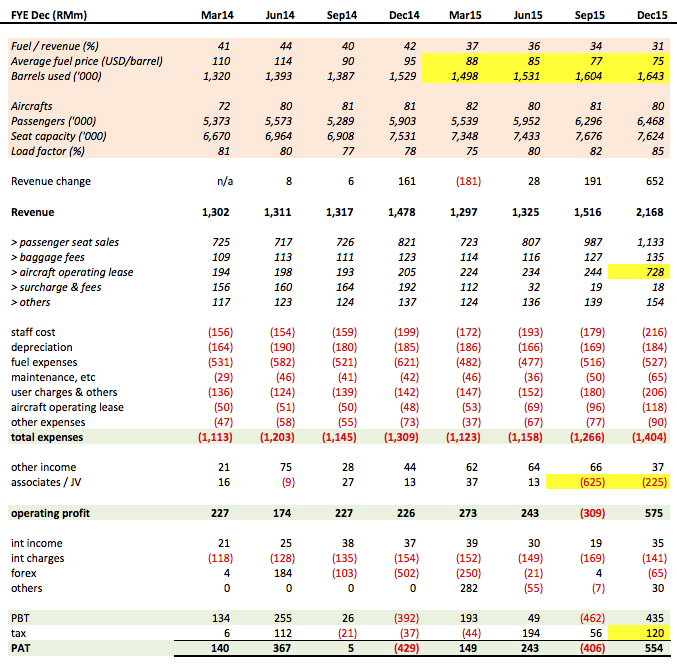

To answer the above questions, I put Air Asia's past few quarters' results in a spreadsheet and did a quick analysis.

Plenty of pleasant surprises.

Key observations :-

(a) Fuel Cost

According to quarterly reports, Air Asia used 6.28 mil barrels of oil in FY2015 and average fuel cost was USD81 per barrel (being average of 88, 85, 77, 75).

To test whether my understanding is correct, I did a back of envelope calculation.

2015 estimated fuel cost = 6.28 mil barrels x USD81 x 3.90 = RM1,984 mil.

According to quarterly reports, total fuel consumption was RM2,001 mil. It seemed that the formula works.

I understand that the group has hedged some of its FY2016 fuel requirement at USD59. Lets use that to run a simulation.

By applying the same formula, estimated fuel cost for FY2016 = 6.28 mil barrels x USD59 x 4.10 = RM1,519 mil.

Fuel Saving = RM2,001 mil - RM1,519 mil = RM482 mil

Based on 2,783 mil shares, fuel saving alone is 17.3 sen per share !!!

Now you know why I ask you to sell car sell house.

(b) Revenue

This item is very important. One of the main reasons Air Asia reported such strong December results was because its revenue jumped Q-o-Q from RM1.52 billion to RM2.17 billion. We need to examine the figures to find out whether it can be repeated going forward.

As shown in table above, there were two main things that caused December revenue to spike. The first one was aircraft operating lease of RM728 mil, an increase of RM484 mil compared to previous quarter's RM244 mil. The company explained that it was revenue previously not recognised due to uncertainty of recoverability. If that is the case, it will be a one off item.

The second reason was higher passenger seat sales of RM1,133 mil compared to previous quarter's RM987 mil, an increase of 15%. In my opinion, this item is indication of genuine improvement in operational performance.

(c) Operating Expenses

Apart from fuel cost, other expenses such as staff cost, maintenance, etc remain stable and in line with historical performance.

(d) Associates

This item is also very important. In September and December 2015 quarter, associate losses was RM625 mil and RM225 mil respectively. We need to understand how those losses arise and whether they will occur again in the future.

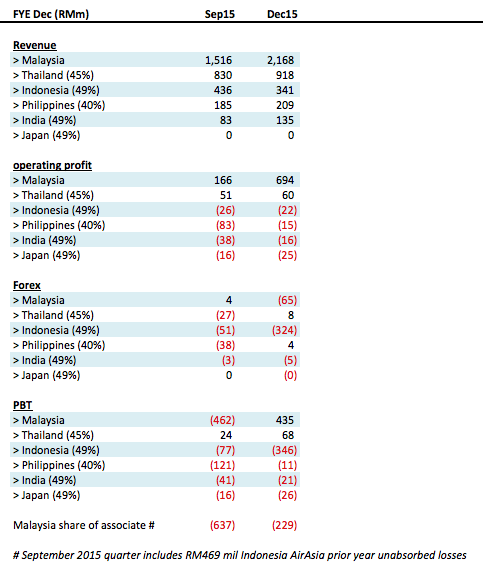

For comparison purpose, the table below shows both Malaysia operation as well as those of associates :-

As shown above, 45% owned Thai Air Asia is quite sizeable. Its revenue was almost half of Malaysia operation. It is also profitable, with PBT of RM68 mil in latest quarter.

Indonesia Air Asia is 49% owned. Its revenue was about 1/4 of Malaysia operation. This associate incurred forex loss of RM324 mil in December 2015 quarter, and was the main reason behind Air Asia's massive associate losses of RM225 mil.

Philippines, India and Japan's operation is quite small.

I am relieved to find out that the huge associate losses seen in December 2015 quarter was due to Indonesia Air Asia's forex loss (and hence one off). This means that operationally, even though the associates are loss making, they are not bleeding the group in a big way.

In (a) above, I showed how the group will benefit from low fuel cost. The same should happen to all these associate companies as well. As such, in coming quarters, it is not inconceivable that associates contribution will turn positive.

3. Projection and Valuation

As usual, to determine whether Air Asia is overvalued at current price, I rely on PE multiple.

Based on 2,783 mil shares and RM1.66, Air Asia's existing market cap is RM4.6 billion. Based on 10 times PE multiple (plucked from the air), I will only feel comfortable if Air Asia can generate at least RM460 mil net profit per annum.

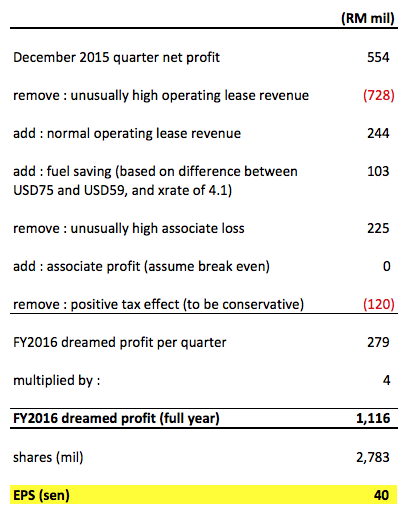

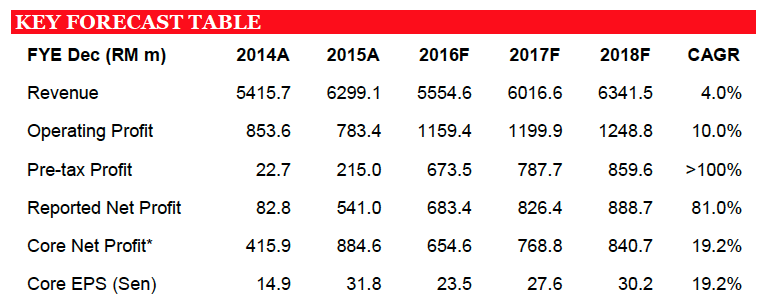

Is Air Asia in a position to deliver ? I constructed a simple financial model to try to gain further insight :-

To be objective, I chose not to manipulate any figures and instead let them flow naturally. Without any interference from me, the financial model churns out potential net profit of RM1.1 billion, or EPS of 40 sen for FY2016.

The figure looked staggering. Is it far fetched ? Is Icon8888 the only one that came up with such bullish projection ?

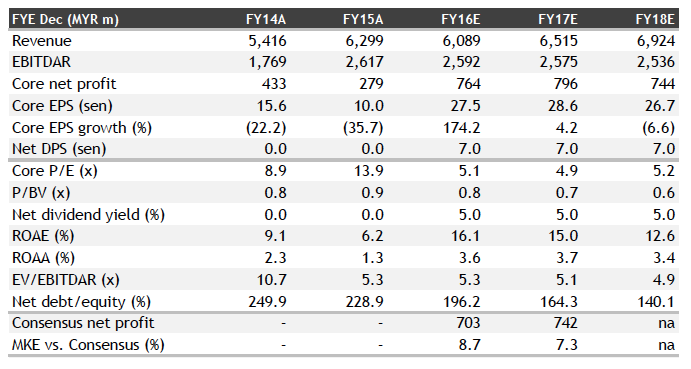

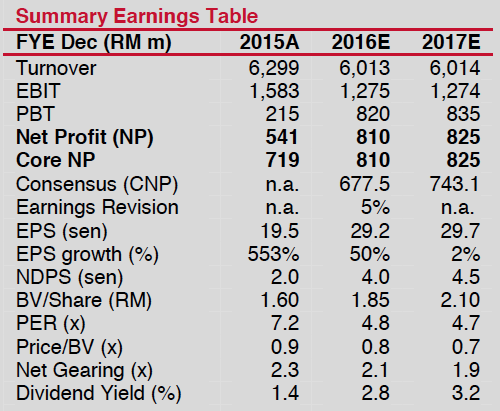

Not really, the following are recent analysts' forecast for Air Asia. Their figures are not as high as mine (probably due to more conservative assumptions regarding fuel cost). However, the projections are still way above market expectation (as reflected by latest market price) :-

(Maybank IB analyst report dated 29 February 2016, expects RM796 mil net profit this year. EPS of 28.6 sen)

(Hong Leong IB analyst report dated 29 February 2016, expects RM822 mil net profit this year, RM1.06 billion net profit next year)

(Kenanga IB analyst report dated 29 February 2016, expects RM810 mil net profit this year)

(Public IB is the most conservative. However, it is still as high as RM683 mil, or EPS of 27.6 sen)

4. Concluding Remarks

I believe the market has not fully understood the implication of Air Asia's latest turn around. Having said so, I would like to point out that RM1.1 billion net profit is aggressive and is NOT what I am targeting for in FY2016. Same as every other stock, I am only targeting 30% return for Air Asia by end 2016 (Target Price roughly RM2.20). Anything above that is bonus.

In view of the favorable balance of reward vs risk, I hereby stick my neck out to scream for Buy. Air Asia's tagline is "Now Everyone Can Fly". Mine is "Now Everyone Can Buy".

However, I am just joking when I said sell car sell house. Please buy within your means.

Last but not least, it is pointless to blame others when your investment is down. That won't help you to become a successful investor. My article should be treated as a source of information to help you to understand a stock, not a fixed deposit slip that guarantees your return.

Your money your risk your reward. Have fun.

No comments:

Post a Comment