Author: Icon8888 | Publish date: Tue, 29 Mar 2016, 03:31 PM

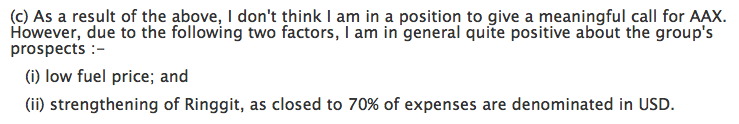

I first wrote about AAX on 23 March 2016. In the concluding remarks, I mentioned that I am positive about the group's prospects :-

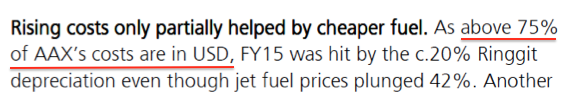

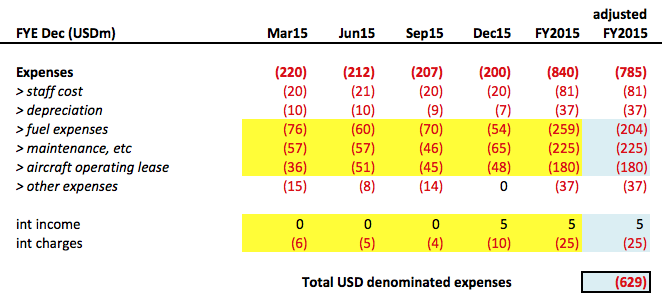

My view on AAX's USD exposure is similar to that of Alliance DBS Research. According to the research house, more than 75% of Air Asia X's expenses are denominated in USD.

Is it true that more than 75% of AAX's expenses are denominated in USD ? How big is the impact of Ringgit appreciation on AAX ? Let's run some numbers to find out.

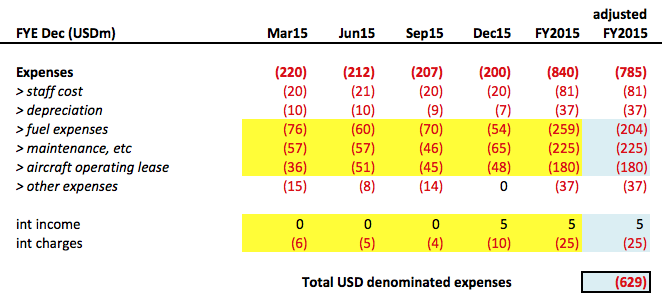

The finding is startling. According to table below, as much as 80% of AAX's expenses are denominated in USD (being 629 divided by 785).

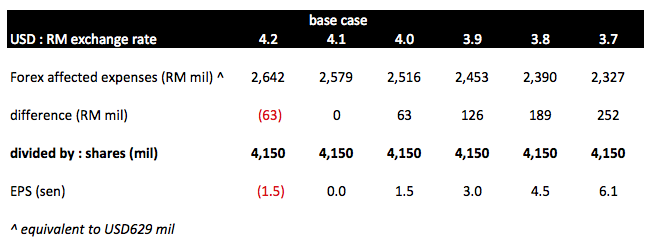

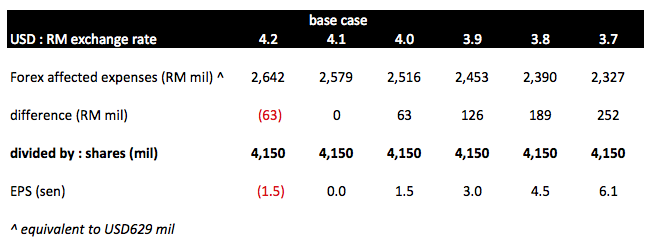

According to sensitivity analysis below, every 10 sen strengthening of Ringgit will result in cost saving of RM63 mil per annum for AAX. Based on 4,150 mil shares, EPS enhancement of 1.5 sen.

In the previous quarter ended 31 December 2015, the average exchange rate was 4.285. We are now closed to end of March. The average exchange rate for the first three months of 2016 was approximately 4.20. By applying the analytical tool above, strengthening of Ringgit by 0.085 should result in cost saving of RM53 mil per annum, or RM13 mil per quarter.

In the recent few weeks, the Ringgit has been hovering at around 4.00. For discussion purpose, if the quarterly average exchange rate is 4.00, cost saving will be USD629 mil x 0.285 = RM179 mil per annum, or 4.3 sen EPS.

Concluding Remarks

CIMB recently released a pessimistic research report on AAX. If that analyst is reading this article, I would like to let him know that it is ridiculous to ascribe a fair value of 15 sen to AAX.

No doubt AAX's past performance was less than satisfactory, but its operating environment has improved substantially over past few months. In the face of favorable risk reward balance, it is time to take a more positive view on the group.

The figures shown above might sound far fetched, but they were arrived at based on objective analysis without undue manipulation. If you managed to identify any flaw in my assumptions or calculations, please don't hesitate to share your thoughts with me. I am keen to listen to your view.

Having said so, even if I am only 50% correct, the implication is still very substantial - due to AAX's huge USD denominated operating and financing expenses, strengthening of Ringgit will have very huge positive impact on its profitability.

I maintain positive view on AAX.

My view on AAX's USD exposure is similar to that of Alliance DBS Research. According to the research house, more than 75% of Air Asia X's expenses are denominated in USD.

Is it true that more than 75% of AAX's expenses are denominated in USD ? How big is the impact of Ringgit appreciation on AAX ? Let's run some numbers to find out.

The finding is startling. According to table below, as much as 80% of AAX's expenses are denominated in USD (being 629 divided by 785).

According to sensitivity analysis below, every 10 sen strengthening of Ringgit will result in cost saving of RM63 mil per annum for AAX. Based on 4,150 mil shares, EPS enhancement of 1.5 sen.

In the previous quarter ended 31 December 2015, the average exchange rate was 4.285. We are now closed to end of March. The average exchange rate for the first three months of 2016 was approximately 4.20. By applying the analytical tool above, strengthening of Ringgit by 0.085 should result in cost saving of RM53 mil per annum, or RM13 mil per quarter.

In the recent few weeks, the Ringgit has been hovering at around 4.00. For discussion purpose, if the quarterly average exchange rate is 4.00, cost saving will be USD629 mil x 0.285 = RM179 mil per annum, or 4.3 sen EPS.

Concluding Remarks

CIMB recently released a pessimistic research report on AAX. If that analyst is reading this article, I would like to let him know that it is ridiculous to ascribe a fair value of 15 sen to AAX.

No doubt AAX's past performance was less than satisfactory, but its operating environment has improved substantially over past few months. In the face of favorable risk reward balance, it is time to take a more positive view on the group.

The figures shown above might sound far fetched, but they were arrived at based on objective analysis without undue manipulation. If you managed to identify any flaw in my assumptions or calculations, please don't hesitate to share your thoughts with me. I am keen to listen to your view.

Having said so, even if I am only 50% correct, the implication is still very substantial - due to AAX's huge USD denominated operating and financing expenses, strengthening of Ringgit will have very huge positive impact on its profitability.

I maintain positive view on AAX.

No comments:

Post a Comment