1. Introduction

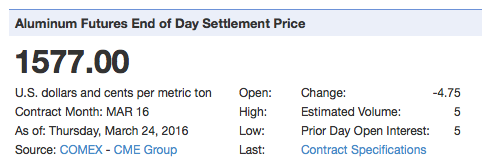

MACD (pronounced as MAC D) is a popular tool many traders use. The calculation behind the MACD is fairly simple. Essentially, it calculates the difference between 12-day and 26-day Exponential Moving Averages (EMA).

MACD = 12 Day EMA - 26 Day EMA

The calculation of both EMAs uses the closing prices of whatever period is measured.

On the MACD chart, a nine-day EMA of MACD itself (Signal Line) is plotted as well.

2. Buying and Selling Based On MACD

Three ways to read MACD :

(i) Cross Over of Zero Line - When MACD is positive (above Zero Line), the stock's price is in bullish territory. The opposite is true when MACD is negative. As such, a cross over from positive to negative signals a trend reversal.

In other words, MACD crosses above and below Zero Line is a Buy and Sell signal respectively.

(ii) Cross Over of Signal Line - MACD crosses above and below Signal Line is also a Buy and Sell signal respectively.

This can also be done through reading the Histogram. Histogram is the difference between MACD and Signal Line. When MACD crosses Signal Line, the value of histogram will be zero.

When come to Histogram, it is good if the value is huge. A huge distance between MACD and Signal Line means that momentum is continuing in the desirable direction. Based on the same principle, a shrinking Histogram is something to be monitored closely - always remember that a zero histogram is equivalent to MACD crossing over of Signal Line, a trend reversal.

What is the relationship between Zero Line crossover and Signal Line crossover ? You can rely on either one to detect Buy and Sell signals. However, Signal Line crossover is more sensitive than Zero Line. It gives earlier signal. Usually only after Signal Line crossover, Zero Line crossover will happen.

As shown in chart above, MACD (Blue Line) always crosses Signal Line (Red Line) before it finally crosses Zero Line (Black Line). As such, if you rely on Signal Line cross over, you will always Buy / Sell earlier than the person who relies on Zero Line cross over.

The weakness of method (i) and (ii) above is that when market moves sideway, you will have problem of Whipsawing (frequent signals of Buy and Sell). Method (iii) below faces less such problem.

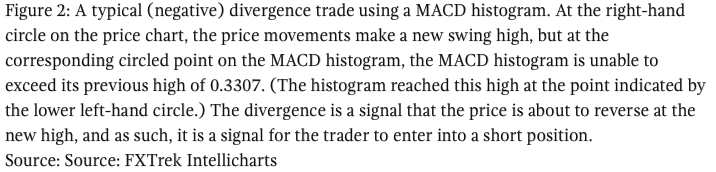

(iii) Divergence - Divergence happens when price chart is trending down while MACD trending up (Buy signal).

On the other hand, price chart trending high while MACD trending low is a Sell signal.

Alternatively, you can use MACD Histogram vs. price instead of MACD vs. price to detect Divergence.

Alternatively, instead of comparing price chart with MACD, Divergence can be detected by comparing Histogram with MACD.

(3) Last But Not Least

Just like any other technical tools, MACD will serve you well when there is a clear trend. When price sideways, you will be whipsawed to death.