This Smallish Food Company Exports 60% of its Products

Publish date: Mon, 26 Jan 2015, 02:36 PM

Exexutive Summary

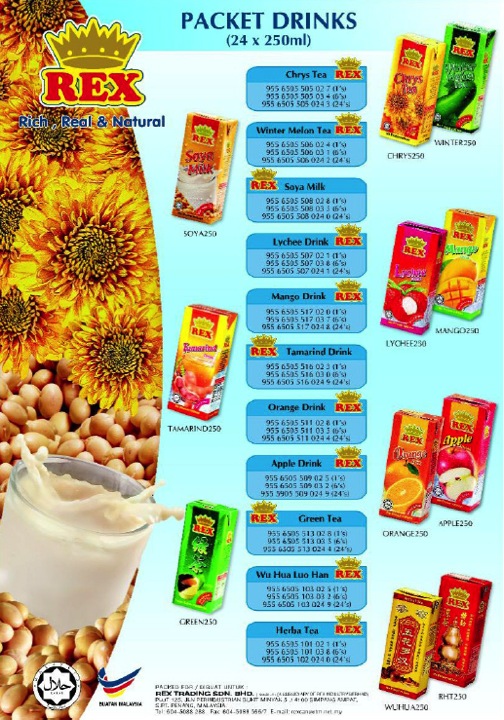

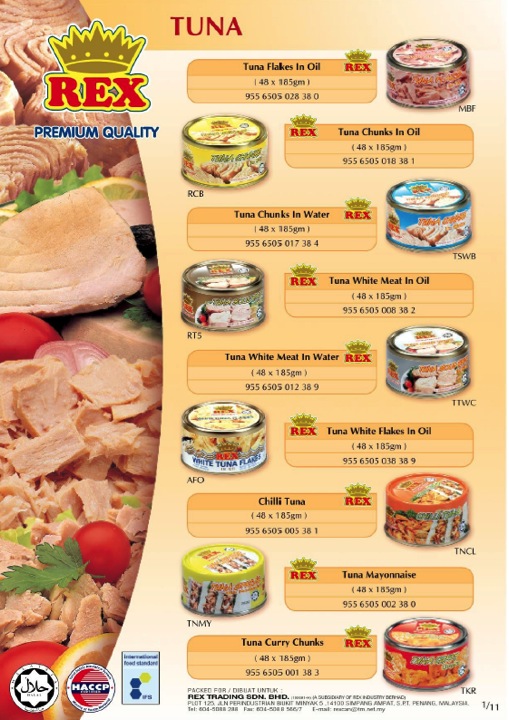

(1) Rex has been in operation since 1978. It manufactures canned and packaged foods and drinks

(2) The company exports 60% of its products, making it an interesting play at current weak Ringgit environment.

(3) However, the stock is extremely illiquid.

Next time you go to supermarket, please remember to check out the Rex and Cinta brands.

1. Basic Financial Information

The company has market cap of RM62 mil (based on 56.1 mil shares and RM1.10).

Based on FY2014 estimated net profit of RM5.5 mil, PER is 11.3 times (please refer to section 2 below for details of FY2014 estimated net profit).

The group has strong balance sheets. Based on net assets of RM131 mil, loans of RM28 mil and cash of RM17.5 mil, net gearing works out to be approximately 8%.

Based on net assets per share of RM2.19, the stock is trading at PBR of 0.5 times. The high net assets per share is due to the high retained earnings of RM62 mil, equivalent to RM1.10 per share.

The high retained earnings was a result of its long operating history and relatively consistent profitability (except for 3 bad years from 2010 to 2012, the group reported earnings of RM4 to 5 mil per annum in the past). This is a company that has been around for a long time and been through many economic cycles.

(Rex historical share price)

2. Historical Profitability

| 9 months | FY2014E | ||||||

| (RM mil) | FY2012 | FY2013 | Mac14 | Jun14 | Sep14 | FY2014 | (annualised) |

| Revenue | 138.9 | 157.2 | 33.5 | 32.2 | 39.7 | 105.4 | 140.5 |

| forex losses | (1.4) | (1.0) | (1.2) | 0.0 | (0.3) | (1.5) | (2.0) |

| goodwill impairment | (2.1) | (1.5) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| PBT | 1.9 | 3.3 | 1.3 | 1.4 | 0.8 | 3.5 | 4.7 |

| Tax | (1.7) | (1.4) | (0.3) | (0.4) | (0.2) | (0.9) | (1.2) |

| Net profit | 0.2 | 1.9 | 1.0 | 1.0 | 0.6 | 2.6 | 3.5 |

| profit excludes EI | 3.7 | 4.4 | 2.2 | 1.0 | 0.9 | 4.1 | 5.5 |

In FY2012 and FY2013, the group reported weak earnings. It seemed that one of the main reasons was impairment of goodwill.

According to the company's annual reports :-

"For the purpose of impairment testing, goodwill is allocated to the group's various businesses. Management assesed the recoverable amount of goodwill by discounting future cash flows to be generated by the respective units based on financial budget prepared in the relevant financial year and projected revenue covering a period of five years. A pre tax discount rate of 10% was then applied."

I am not against impairment testing. I beileve that it is a valid concept to ensure that a business entity's financial statements are properly reflecting the intrinsic value of its assets.

However, I found the way Rex made provision for impairment based on next five year projections is meaningless. In an ever changing world, projections is at best a guide and a goal to be achieved. Using it to come up with a short term fair value for its assets is akin to plucking a figure from thin air. The incorporation of these minor adjustments to operational P&L is annoying as it distorts the financial figures and unnecessarily complicates things.

To ascertain the sustainable earnings of the group, I chose to ignore the goodwill impairment (and also the forex losses, which is exceptional item). After making the relevant adjustments, it seemed that Rex's three year average earnings is aproximately RM4.5 mil per annum (RM3.7mil + RM4.4mil + RM5.5mil / 3). This translates into historical PER of approximately 13.7 times.

3. Sales According To Geographical Locations

According to latest quarterly report, the group's products are sold to customers in the following geographical locations :-

| 9 months revenue | ||

| (RM mil) | (%) | |

| Malaysia | 42.3 | 40.1 |

| US | 28.6 | 27.1 |

| Europe | 15.2 | 14.4 |

| Asia (excludes Malaysia) | 19.3 | 18.3 |

| TOTAL | 105.4 | 100.0 |

As can be seen from the table above, 60% sales are from overseas customers.

4. Concluding Remarks

(a) Rex has been in operation for a long time. By virtue of its business (food industry), it is relatively insulated from domestic economic downturn.

(b) In addition, with the bulk of its products exported, it should benefit from the strong US dollars and report improved earnings in the coming quarters.

(c) Having said so, the stock is already trading at more than 10 times PE mutiple. Due to its small cap, it is also very illiquid and difficult to accumulate.

There are better alternatives for export play.

Maybe a HOLD.

We Offer Loan At A Very Low Rate Of 3%. If Interested, Kindly Contact Us. email us at (fastloanoffer34@gmail.com) /whats-App Contact Number +918929509036

ReplyDelete