Positive Momentum Despite Rising Raw Material Cost

Publish date: Thu, 24 Jul 2014, 03:41 PM

1. Introduction

Recently, strengthening of Aluminium prices generated a lot of interest in Aluminium related companies.

(Aluminium prices has been going up since May 2014)

Among the stocks that attracted investors' attention are Press Metal, ARank and LB Aluminium ("LB").

Based on preliminary analysis, I am of the opinion that not all companies will benefit equally from strong Aluminium prices.

Press Metal, being a smelter, is an obvious beneficiary.

In a previous article, I wrote about ARank, which produces aluminium billets by using,inter-alia, scraps and ingots.

ARank is considered an upstream player. However, its historical protifability does not seem to have strong correlation with Aluminium price movement.

In that article, I speculated that ARank's business model might be based on making "refiner margin". Namely, it makes a fixed profit margin independent of Aluminium price level.

One possible explanation is that ARank uses ingots and scraps as raw materials. The prices of these materials will go up and down with Aluminium prices, thereby offsetting any gain or loss resulting from the higher / lower selling price of the end products.

How about LB ? Will stronger Aluminium prices benefit or hurt the company ?

In order to answer that question, we need to have a better understanding of what LB does and where it is positioned in respect of the industry value chain.

2. LB's Business Activities

As mentioned in my previous article, ARank, an upstream player, produces Aluminium billets from scraps and ingots.

(Aluminium ingots)

(Aluminium billets)

The billets will be used by midstream producers to churn out interim products, which will then used by downstream players to transform into end products (industrial and household items).

(Note : midstream players can at the same time undertake downstream activities)

LB is a midstream player. It uses billets to produce "Aluminium profiles" through "extrusion process".

(Extrusion process - billets are fed from left hand side into a tunnel embedded in the machine. The machine then push the billet forward towards a die. As the billet has no where to go, it will come out from the die in the shapes the manufacturer wants it to be, called "Aluminium profiles")

(Die - billets are pushed against the die so that the desired profiles can emerge from the other side of the die as per specification)

(Aluminium profiles produced by extrusion process)

According to LB's website, the group has been in operation since 1985.

LB is one of the largest aluminium extrusion manufacturers in South-East Asia. Its production facilities boast 14 extrusion presses with annual production capacity of 90,000 metric tonnes.

(aluminium products for building construction)

(electronic components)

(furniture)

(transportation)

(sheets and coils)

(ceiling suspension system)

(fittings and accessories)

3. Basic Financial Information

Based on 248 mil shares outstanding and share price of RM0.75, the company has market cap of RM186 mil.

Based on historical profit of RM22 mil, PE multiple is 8.5 times.

Based on net assets of RM258 mil, cash of RM35 mil and loans of RM67 mil, the group's net gearing is 0.12 times only.

4. Historical Profitability

The first thing that comes to my mind is to find out what is the relationship between Aluminium prices and LB's profitability.

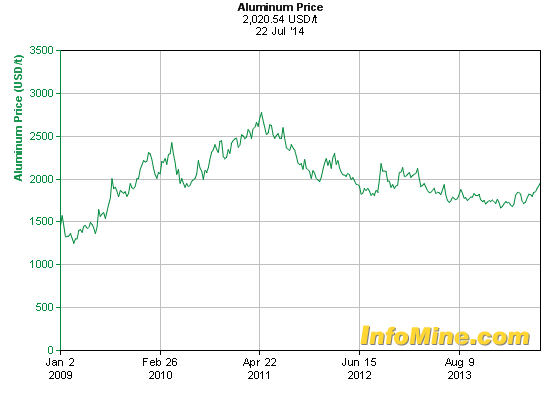

The following is the historical prices of Aluminium over the past five years.

(Aluminium prices over past 5 years. Based on visual inspection, estimated average price over past 5 years are USD / MT 1750, 2250, 2250, 2000 and 1750 respectively)

The following table sets out LB's historical P&L from FY2010 until FY2014 :-

| FYE April | 2010 | 2011 | 2012 | 2013 | 2014 |

| Aluminium price | 1,750 | 2,250 | 2,250 | 2,000 | 1,750 |

| (USD /MT) | |||||

| Revenue | 347 | 355 | 365 | 391 | 416.4 |

| EBITDA | 37.7 | 30.2 | 28.2 | 44.2 | 46.8 |

| > depreciation | (15.1) | (15.7) | (18.1) | (19.2) | (16.5) |

| > int expenses | (2.5) | (2.9) | (3.8) | (3.8) | (3.3) |

| > int income | 0.5 | 0.2 | 0.1 | 0.2 | 0.6 |

| > associate | 0.2 | 1.4 | 1.3 | 0.8 | 0.0 |

| > Excp Items | (6.2) | (1.7) | 2.1 | (4.0) | (2.7) |

| PBT | 14.5 | 11.5 | 9.9 | 18.2 | 25.0 |

| Tax | (2.0) | (2.7) | (1.4) | (1.2) | (2.9) |

| Net profit | 12.6 | 8.8 | 8.7 | 17.0 | 22.1 |

| EBITDA margin (%) | 10.9 | 8.5 | 7.7 | 11.3 | 11.2 |

| tax rate (%) | 13.7 | 23.7 | 13.8 | 6.6 | 11.5 |

| Net margin (%) | 3.6 | 2.5 | 2.4 | 4.3 | 5.3 |

| EPS (Sen) | 5.1 | 3.5 | 3.4 | 6.8 | 8.9 |

Key observations :-

(a) The group's EBITDA margin declined during the two years when Aluminium prices are particularly strong (FY2011 and 2012).

In normal years, EBITDA margin is consistently approximately 11%. However, in FY2011 and FY2012, EBITDA margin declined to approximately 8%.

Based on simplistic calculation, EBITDA declined by approximately RM10 mil when Aluminium prices moved up by USD500 (from USD1750 per MT to USD2250 per MT). This roughly translated into decline of RM2 mil EBITDA for every USD100 per MT increase in Aluminium prices.

The impact is midler than expected (which is a good thing).

(b) During FY2011 and FY2012 when Aluminium prices is high, there is no corresponding increase in LB's revenue. This implies that the group was not able to pass through the higher production cost to its end users.

This is different from the cases of plastic packaging industry (Thong Guan, BP Plastic, etc) which will report higher selling price (and hence revenue) when raw material cost is high.

(c) The group has low average tax rate of approximately 10%, probably due to tax incentives arising from its capex programme.

(d) The group has been growing nicely over the past two financial years. Revenue increased from RM365 mil to RM416 mil during the period, more than doubling its earnings from RM8.7 mil to RM22 mil.

This positive momentum is very delighting. Hopefully it can continue going forward.

5. Expansion Plan

On 31 May 2014, The Star conducted an interview with the CEO of LB. The following are some of the salient points :-

(a) The group is contemplating major expansion this year, in line with the gorwing Aluminium extrusion industry in Malaysia. Target to finalise details by end of July.

(b) three years ago, the group underwent an expansion of capacity which cost about RM40 mil. The group has more or less digested the new capaciy and is ready to move on for more.

(c) The expansion, if any, will be internally funded.

(d) The group's factory is located at 30 acres of land at Semenyih. There is another factory in Sarawak. Both factories operating at 70% capacity, which accoding to CEO, is an ideal level for the group (spare capacity needed to cater for surge in demand).

(e) lately, more and more developers are moving towards green index buildings. Typically such buildings will use more Aluminium, which augurs well for the group.

(f) LB currently holds 25% local market share. It exports 30% of its products.

(g) Expect steady growth of demand over next few years, in line with the country's economic growth.

6. Concluding Remarks

(a) Recent strengthening of Aluminium prices has generated a lot of interest among investors. As a result, stocks related to Aluminium industry has been actively traded.

In my opinion, Press Metal would be a clear winner. However, based on common sense, I have doubt that the LB group, which uses Aluminium as raw material, would benefit from the higher commodity prices. If anything, higher Aluminium prices should have an adverse impact on its profitability.

(b) It is against this backdrop that I conducted a study of LB. Pursuant to my analysis of LB's business activities and its historical P&L, I am more or less convinced that LB is a wrong play for high Aluminium prices.

Having said so, I am pleasantly surprised by the relatively muted impact the high Aluminium prices inflicted on LB in FY2011 and FY2012. This gave me an impression that the group is very well run and have certain level of sophistication and resilience.

Subject to further information and analysis, I am wondering maybe we shouldn't be too over concerned about higher Aluminium prices will adversely affect the group's profitability (unless there is a drastic spike, which I might need to revisit the whole scenario).

(c) I am beginning to like this group. It has been in business for a long time. Managment seemed very competent. Balance sheet is strong. There seemed to be a lot of positive momentum in the recent two years (beneficiary of Government's Economic Transformation Programme, in particular the buoyant construction and property industries ?).

(d) As mentioned in Section 5 above, the group is positive over its immediate prospects and is planning to expand its production facilities. I think this is positive signal that the group is doing well.

(e) At PE multiple of only slightly more than 8 times, the stock is reasonably priced (undervalued, if you really want to hear me saying it).

No harm taking position. But please do it for the right reason - don't buy the stock because Press Metal is going up. These two companies are completely different stories.

Have a nice day.

We Offer Loan At A Very Low Rate Of 3%. If Interested, Kindly Contact Us. email us at (fastloanoffer34@gmail.com) /whats-App Contact Number +918929509036

ReplyDelete