Digging For Gold At LRT Stations

Publish date: Sat, 3 May 2014, 11:00 PM

(Gold, gold every where)

As mentioned in some of my earlier articles, one of my favorite investment theme is contractors which grew big by venturing into property development.

After covering Gadang, Ken, Encorp and Mitrajaya, I am now taking a closer look at Crest Builder Holdings Berhad ("Crest").

1. Background Information on Crest

Crest is principally involved in construction, concession holding and property development.

Based on 161 mil shares and market price of RM1.50, market cap is RM241 mil.

The group reported net profit of RM54 mil in FY2013. However, RM30 mil was attributable to exceptional items.

Excluding those items, group profit is only RM24 mil. This translates into historical PE multiple of 10 times.

Based on net assets of RM367 mil, loans of RM475 mil and cash of RM12 mil, net gearing is 1.26 times.

At first look, the figure looked alarming. However, upon closer examination, it seemed that a substantial amount of the borrowings is associated with its UiTM campus concession (please refer to item 6 below).

The company didn't provide detailed breakdown of borrowings in its accounts. However, based on information provided by TRIplc (another public listed company which owns UiTM concession with similar size and operating structure), it seemed that as high as 85% of such concession could be funded by debts (including junior debts).

In Crest's case, that would amount to at least RM240 mil.

Based on conservative assumption that RM200 mil (instead of RM240 mil) of the borrowings are concession related debts, the group's other borrowings could be RM275 mil.

This amount of debt is still not low. However, the group has two major investment properties : 3 Two Square office tower & car park and Tierra Crest at Kelana Jaya, which are almost fully tenanted and generates annual rental income of RM9 mil and RM6 mil respectively (please refer to sections below for further details).

Based on preliminary estimate, the group's 51% stake in UiTM concession could potentially generate net income of at least RM3 mil per annum.

The estimated total recurrent income of RM18 mi per annum could play a useful role in helping the group to service its debt obligation.

The two properties mentioned above have aggregate open market value of RM238 mil. As both are almost fully tenanted, the group has the option of disposing them as yield bearing assets in the event of contingencies.

(In the first place, it is very likely that the group's RM275 mil non concession related borrowings were drawn down in the past to fund the construction of these investment properties)

After taking into consideration the above factors, it seemed that we do not need to be unduly worried about the group's financial position. I would say that the group's debts are taken up with proper planning and well thought out strategy and are backed by recurrent income and productive assets.

(Crest share price over past 2 years)

(Crest WB share price ober past 6 months)

2. Historical Profitability

As can be seen from the table below, the group consistently reported net profit of approximately RM5 to 6 mil per quarter :-

| (RM mil) | Q1 FY13 | Q2 Fy13 | Q3 FY13 | Q4 FY13 | FY2013 | |

| revenue | 107.2 | 68.8 | 67.3 | 58.7 | 765.0 | |

| construction | 131.0 | 91.4 | 70.6 | 93.7 | 386.7 | |

| invetment holding | 3.4 | 3.5 | 3.7 | 15.8 | 26.4 | |

| property devpment | 5.9 | 7.7 | 18.6 | 13.7 | 45.9 | |

| elimination | (32.7) | (34.1) | (25.3) | (143.5) | (235.6) | |

| operating profit | 15.8 | 30.1 | 18.8 | 16.1 | 80.7 | |

| construction | 13.8 | 12.4 | 11.6 | 13.7 | 51.5 | |

| invetment holding | 2.2 | 15.3 | (0.1) | 18.9 | 36.3 | |

| property devpment | 1.5 | 2.9 | 5.7 | 5.0 | 15.1 | |

| elimination | (1.6) | (0.7) | 1.5 | (21.4) | (22.2) | |

| net profit | 6.5 | 20.3 | 5.7 | 21.7 | 54.2 | |

| net profit excludes EI | 6.5 | 5.7 | 5.7 | 6.2 | 24.1 | |

Construction division is the biggest earnings contributor, contributed more than RM50 mil operating profit, three times of property development division's RM15 mil.

However, this is set to change going forward. With the kicking off of several JV projects with government agencies, property division will outshine every other division to become the core earnings contributor.

Further details at sections below.

3. Construction Division

According to JF Apex Securities, the group's order book has depleted to RM110 mil.

The group secured RM63 mil contracts earlier this year and is reportedly closed to securing two building contracts amounting to RM500 mil in near future.

4. Landbanks

The group has only approximately 18 acres of land bank left, the bulk of which are located at Petaling Jaya. However, as will be explained in sections below, this is not really a big problem.

Over the past two years, the group has successfully secured three separate joint ventures with government bodies. Those JV projects has effective GDV of approximately RM2 billion (51% of RM1 billion + 51% of RM1.3 billion + 100% of RM1 billion), sufficient to keep the group busy for many years (note : FY2013 property development revenue was only RM45.9 mil).

| Location | Description | Area | NBV | Year |

| (acres) | (RM mil) | |||

| Mukim Damansara, PJ | residential land | 7.1 | 7.6 | 2005 |

| Mukim Petalking, PJ | commercial land | 1.8 | 7.4 | 2006 |

| Mukim Batu, KL | cultivation land | 2.9 | 6.2 | 2004 |

| Mukim Damansara, PJ | commercial land | 3.8 | 2.9 | 2005 |

| Mukim Damansara, PJ | commercial land | 2.0 | 2.1 | 2005 |

| Subtotal | 17.7 | 26.2 | ||

| The Crest, 3 Two Square | 16 storey office & parking bays | 151k sq ft | 108.0 | 2012 |

| Tierra Crest, Kelana Jaya | 16 storey office & 3 storey retail podium | 130.0 | 2013 | |

| Taman Megah, PJ | office building | 13k sq ft | 3.5 | 2002 |

| Subtotal | 241.5 | |||

| Grand Total | 267.7 |

The group has two major investment properties, The Crest at 3 Two Square and Tierra Crest at Kelana Jaya. These two properties are expected to generate rental income of closed to RM15 mil per annum going forward.

5. Development Projects

3 Two Square, PJ (Completed project)

(Crest's maiden project 3 Two Square at Seksyen 19, PJ)

Crest has sold off all the retail / shop units of 3 Two Square but retained The Crest, the 13 storey office block and car park, which contributes approximately RM9 mil rental income per annum.

Tierra Crest, Kelana Jaya (Completed project)

(Tierra Crest, leased out to Unitar International University)

In 2012, Crest secured a nine year tenancy agreement with Unitar International University whereby the university will occupy the two office towers, contributing annual rental income of RM6 mil. Crest will also lease out the three level retail podium.

Alam Idaman, Shah Alam (Completed project)

(Alam Idaman, Batu Tiga, Shah Alam)

Avenue Crest, Shah Alam (ongoing project)

(Avenue Crest, Shah Alam. 24 storey building with 495 units of boutique office suites and SOFO suites)

Alam Sanjung, Shah Alam (ongoing project)

(Alam Sanjung, Shah Alam. The group's major ongoing project with GDV of RM300 mil. Due to its affordable pricing, the project has been well received)

The Bank, Dang Wangi LRT Station (future project)

(The Bank, on top of Dang Wangi LRT Station at Jalan Ampang, KL)

In March 2012, Crest announced that together with another partner, it has entered into JV with Prasarana for a mixed development project at Dang Wangi LRT station. Crest will own 51% of the JV.

GDV is estimated to be RM1 billion. Prasarana will be entiled to RM220 mil (21.2%).

The Dang Wangi project, subsequently named "The Bank", is set for an international preview in the second quarter of 2014, with markets like Japan, China, Singapore, South Korea and Taiwan on the list.

The company targets to start work by Q4 2014. Construction time line is 5 years.

The Bank will comprise a retail mall, serviced residential suites, hotels and offices. The company mentioned that they might set selling price as high as RM1,600 per sq ft.

When Dang Wangi LRT station was built in the 1990s, there was originally a commercial component. However, that was abandoned when 1997 crisis hit. According to the company, piling work is already in place. In other works, they will not be starting from scratch.

Galleria, Jalan Ampang (future project)

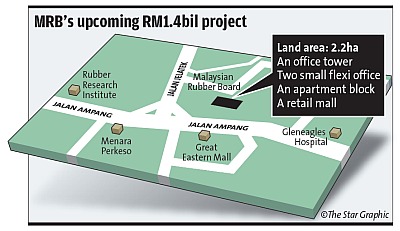

(Galleria, Jalan Ampang. Crest JV with Malaysia Rubber Board)

(Galleria location)

On 28 June 2012, Crest announced that its 51% subsidiary has entered into JV agreement with Malaysia Rubber Board ("MRB") to develop 5 acres of land at Jalan Ampang, opposite Great Eastern Mall and next to Gleneagles hospital.

The proposed development will comprise three 28 storey Apartments and SOHO Towers, a 33 storey Corporate Tower and a 6 storey retail mall.

GDV is estimated to be RM1.3 billion. MRB will be entitled to RM300 mil (22.5%), in cash and completed property.

Based on latest update, the Galleria is scheduled for a launch sometime in the fourth quarter of 2014.

The company sais it could be integrated with the Gleneagles MRT station on the circle line, although the exact alignment has yet to be determined.

MRB is likely to take up the office block, while Crest plans to sell the residences and manage the mall below it.

The company envisions a Bangsar Shopping Centre-type mall for The Galleria, catering to the expatriate community.

Kelana Jaya LRT Station mixed development (future project)

(Yet to be named Kelana LRT station mixed development project)

On 30 December 2013, Crest announced that it is entering into JV with Prasarana for a mixed development project at Kelana LRT station with GDV of RM1 billion.

Unlike the Dang Wangi and MRB projects which are 51% owned, this JV project is to be undertaken entirely by Crest.

Crest has proposed two 30-storey blocks of residences and an office block linked by a podium, all of them on top of a live LRT station and using the surrounding land that currently serves as a carpark.

The plan for now involved 70% residences, 20% offices and 10% retail. The group hopes to secure a plot ratio of six times the land area of 4.95 acres.

The project has earmarked 1,000 out of its total 2,500 carparks as part of a park-and-ride facility for the LRT station.

And instead of a full-fledged mall, the company says the retail component will feature transit-based retail, affording commuters grab-and-go style offerings.

The condominium units are tentatively priced at RM1,000 per sq ft. The residences at the Kelana Jaya LRT station will see average sizes of 700 sq ft with 2 + 1 rooms. The 100,000 sq ft of office space, however, is likely to be ceded to Prasarana as their entitlement.

Construction is slated to begin no earlier than mid 2015, with launches in the later part of the year. Crest doesn’t intend to keep anything in the Kelana Jaya LRT station for investment except the carparks.

6. Unitapah Concession

In 2010, Crest secured a 23 year concession to build and maintain Universiti Tecknologi Mara at Tapah, Perak. Crest owns 51% of the concession. The project was completed in January 2014.

According to FY2012 annual report, "The project at construction cost of RM285 mil, will generate average annual cashflow of RM45 mil until 2034. " However, please don't get too excited about the average annual cashflow as mentioned above. The RM45 mil figure is the gross amount. After factoring in operating expenses and service of debt obligations, the net amount is significantly lower.

There isn't sufficient information in public domain to fully understand Crest's concession. However, TRIplc (another public listed company) has a similar concession and can provide a useful frame of reference.

(TRIplc's Concession)

TRIplc's UiTM campus concession is located at Puncak Alam, Selangor (another one was won by Menang Corp).

It has similar size as Crest at RM266 mil. Concession period is also 23 years.

The following are the cash flow projections for the concession project prepared by TRIplc :-

| Cashflow projections for TRIplc UiTM concession | ||||||||||

| (RM mil) | 2015 | 2016 | 2017 | 2018 | 2020 | 2022 | 2024 | 2026 | 2028 | |

| Year | 4 | 5 | 6 | 7 | 9 | 11 | 13 | 15 | 17 | |

| availability charge | 43 | 43 | 43 | 43 | 43 | 43 | 43 | 43 | 43 | |

| maintenance charges | 14 | 14 | 14 | 14 | 16 | 16 | 16 | 19 | 19 | |

| others | 5 | |||||||||

| Total inflow | 61 | 56 | 56 | 56 | 59 | 59 | 59 | 62 | 62 | |

| maintenance cost | (10) | (10) | (10) | (10) | (12) | (12) | (12) | (15) | (15) | |

| admin cost | (3) | (1) | (1) | (2) | (2) | (2) | (2) | (2) | (2) | |

| taxes | (2) | (4) | (5) | (5) | (6) | (7) | ||||

| finance fee | (3) | (3) | (3) | (3) | (2) | (2) | (1) | (0) | ||

| senior debt interest | (10) | (14) | (13) | (12) | (10) | (7) | (5) | (2) | ||

| senior debt redemption | (20) | (20) | (20) | (20) | (25) | (25) | ||||

| junior debt interest | (1) | (1) | (1) | (1) | (1) | (1) | (1) | (42) | ||

| junior debt redemption | (35) | |||||||||

| others | (21) | (5) | ||||||||

| Total outflow | (47) | (28) | (52) | (49) | (51) | (48) | (51) | (51) | (102) | |

| Free cash flow | 15 | 28 | 4 | 8 | 8 | 10 | 8 | 10 | (40) | |

| 51% entitlement | 7 | 14 | 2 | 4 | 4 | 5 | 4 | 5 | 39 | |

(Key Observations)

(a) the RM45 mil mentioned in Crest annual report could be refering to the "Availability Charges" (RM43 mil for TRIplc)

(b) on top of that, the concessionaire will receive maintenance charges every year (RM14 mil for TRIplc)

(c) these cash inflow won't directly benefit the concessionaire. The bulk of them will be used to pay for maintenance and admin cost, taxes, and to service debt obligations.

(d) in TRIplc's case, for the first 16 years, there is minimum residual income (few millions per annum). Only by year 17 will the concessionaire see big dividend coming in. The concession will then end in another 6 years time.

(How the Concession Is Reflected in Crest's Balance Sheet)

The concession is reflected as Operating Financial Asset in Crest's balance sheet with book value of RM350 mil.

In TRIplc's case, debt funding for UiTM Puncak Alam is approximately RM200 mil. As Crest's concession is almost the same size and same concept as TRIplc, it is possible that they adopted the same funding structure.

If that is the case, there is a possibility that maybe RM200 mil plus of Crest's borrowings of RM475 mil are actually related to the concession business, which is backed by govrnment payment and is self liquidating.

As such, Crest's balance sheet might be stonger then it looked (please refer to item 1 for further details).

7. Warrants B

Crest's WB expires in October 2015 (17 months to go) and have exercise price of RM1.00.

Based on latest mother share price of RM1.50 and WB price of RM0.70, conversion premium is 13%, which is reasonable.

If you have sufficient resources to exercise the WB comes October 2015, WB is actually a better choice than mother share for exposure to the group.

8. Concluding Remarks

(a) Crest is one of the many success stories in Bursa for construction firms.

They started as general contractor and over the years, gradually gained experience in property development, which has the potential to one day replace construction as main earnings driver.

As their shareholders' fund increases over the years via profit accumulation, they have more and more resources to venture into increasingly sophisticated business and property development concepts.

(b) Despite share price going up by closed to 100% over the past one year, the group's market cap at RM240 mil is still small.

With earnings at RM24 mil, the group is still at early stage of growth, especially if take into consideration the LRT related development projects, which could potentially deliver hundreds of million of profit to the group over next four to five years.

(c) At first look, the group's gearing is a bit high. However, the bulk of the borrowings are related to its UiTM concession, which is backed by future government payment and is self liquidating. The other borrowings are backed by yield bearing investment properties / assets which generate closed to RM19 mil recurrent income per annum. As such, there is no need to be unduly worried about the group's financial position.

(d) The construction division contributed to the bulk of the group's earnings in the past. However, going forward, this division is expected to become less important as property development takes over to become the major earnings contributor.

(e) The concession division is unlikely to generate huge net profit or free cash flow. Maybe RM5 mil to RM7 mil net profit per annum until debts are pared down by end of year 16. However, it is still a good investment as the bulk of it is debt funded with low equity input from Crest, implying high IRR or ROE.

(f) The Dang Wangi project has been slow to take off even though the award was announced in March 2012.

The company explained that it is actually common for projects of this nature to take some time to sort out the details. Once the letter of award is signed, the parties have two to four months to formalise the joint development agreement, after which the landowner, in this case the government agency, will proceed to procure the land title, because the land was probably leased to them from the government.

That and Cabinet approval could take six months or longer. When this is done, the title can be used for development planning.

(Latest update is that the company targets to start works on Dang Wangi project by Q4 2014. As mentioned above, piling work has already been completed back in 1990s. So Crest can ram up construction pretty fast, if they want)

The land cost for such JVs also tend to be higher. The Kelana Jaya LRT deal, for example, was agreed at almost 25% of GDV, exceeding the usual 15% to 20% paid to a landowner in Malaysia.

According to the company, despite the higher land cost, the payment method is more cashflow friendly, as no cash is needed upfront. In addition, the landowners typically agree to payment in kind and minimal cash, putting less strain on the developer’s balance sheet.

(g) Going forward, property development will become the core earnings contributor, potentially propelling the groups' sustainable net profit to closed to RM60 mil, twice its existing earnings.

(RM2 billion effective GDV divided by 5 years will be RM400 mil per annum. Based on 10% net margin, property net profit could be at least RM40 mil per annum. Add net profit of RM20 mil from contruction and other divisions, total will be at least RM60 mil. Please note that I am being conservative here by assuming 10% net margin for such projects with high selling price per sq ft)

The higher earnings would potentially cause share price to double. However, this will not happen over short term. Need at least 2 to 3 years for it to materialize.

(h) The group's property development projects are unique due to their proximity to the LRT systems. This kind of properties will usually be very well received, which sets it apart from other developers. In other words, earnings visibility will be better than average, making the group less susceptible to any property market downturn.

High take up rates also good for balance sheets. I was told by an industry veteran that if take up rate is high, the project will require very little bridging finance from banks, as the company will be paid progressively by buyers as works continue.

(i) Timing wise, it is difficult to recommend when is the best time to buy. The stock has gone up by closed to 100% since early 2013. Due to the slow progress of Dang Wangi project, the gorup might not see major earnings enhancement until probably in 2015, meaning there could be a lack of catalyst to drive share price over the short term.

Different investors have different style. Certain investors (for example, me) don't mind being a bit early while others prefer to enter when the durians are about to drop.

I will leave it to each individual investor who like this company to decide when is the best time to invest.

Have a nice evening.

We Offer Loan At A Very Low Rate Of 3%. If Interested, Kindly Contact Us. email us at (fastloanoffer34@gmail.com) /whats-App Contact Number +918929509036

ReplyDelete