Another Hevea In The Making ?

Publish date: Fri, 23 Jan 2015, 07:03 PM

1. Introduction

HH Group is a relatively new comer. It was listed on ACE Market in July 2014.

The group is principally involved in manufacturing and trading of the follwoing products :-

(a) coconut biomass material;

(b) oil palm biomass materials; and

(c) natural fibre made matresses and other related products.

(coconut fibre)

(palm fibre)

(palm fibre mat)

(palm briquette)

(HH Group was listed in July 2014)

2. Background Financial Information

Despite being listed on ACE, the group has profit track record that can match a Main Market company :-

| 9 months | FY2014 | |||||||

| (RM mil) | FY2011 | FY2012 | FY2013 | Mac14 | Jun14 | Sep14 | aggregate | annualised |

| Revenue | 31.7 | 63.0 | 73.7 | 21.3 | 24.1 | 23.1 | 68.4 | 91.3 |

| Net profit | 10.5 | 12.2 | 9.7 | 3.0 | 2.7 | 3.1 ^ | 8.9 | 11.8 |

^ according to latest financial report, net profit for September 2014 quarter was only RM1.25 mil. However, this included RM1.87 mil expenses incurred for the IPO. Excluding this item, net profit would be RM3.1 mil

The company has market cap of RM93 mil (based on 205.8 mil shares and RM0.45) (note : IPO price is RM0.45 as well).

Based on prospective earnings of RM11.8 mil (arrived at based on latest 9 months net profit annualised), PER is 7.9 times.

The group has strong balance sheet. Based on net assets of RM64.8 mil, loans of RM31 mil and cash of RM21 mil, net gearing is 0.15 times only.

3. Beneficiary of Weak Ringgit

In FY2013, approximately 55% of the group's products are exported to China. In the IPO prospectus, the company mentioned that their customers pay them in Chinese Yuan (exporters usually insist on receiving US Dollar). The remaining 45% sale are to local customers.

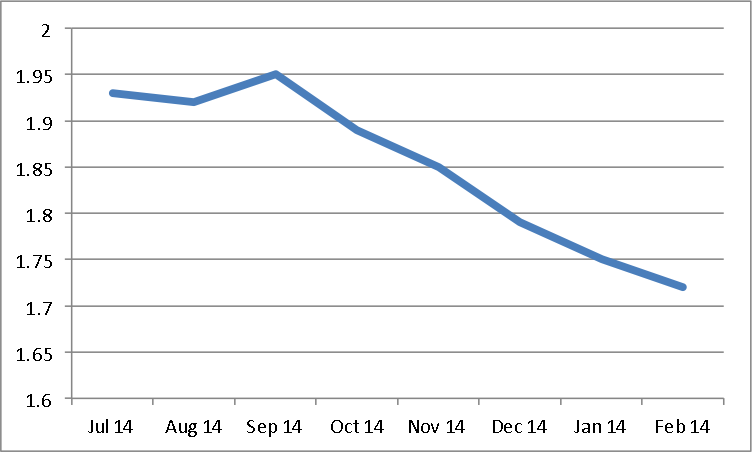

Since July 2014, Ringgit has depreciated by closed to 12% (from 1.93 to 1.72) against the Renminbi :-

As the group exported a significant amount of its products to China, it should benefit from the stregnthening of the Chinese Yuan.

4. Potential Growth Driver

Recently, the Chinese government has banned new coal fired power plant in Beijing, Shanghai and Guangzhou. This is expected to create demand for green fuel such as palm briquette.

This division has potential to propel the group to a new level.

5. Concluding Remarks

(a) Most of the export oriented stoks (furnitures, electronics, textile) has gone up by quite a lot since the beginning of this year. I am thrilled to discover this undervalued export counter which should benefit from the recent weakening of Ringgit.

(b) The group sourced almost all its raw materials from Malaysia, which produces abundant quantity. The absence of such raw material in China creates a natural barrier for Chinese manufacturers to duplicate the group's business model.

(c) In addition, as China prospers, more and more consumers will choose to use natural fibre made products (matresses, furnitures, etc) which provide better ventilation and supposed health benefits.

The banning of new coal power plants in big cities in China creates demand for green fuel which is expected to drive demand for the group's palm briquette.

(d) At PER of 8 times, the stock is reasonably priced, especially after taking into consideration its growth potential through increases in exports not only to China but to developed countries such as US and Europe.

As far as business is concerned, the company seemed to be in the right place at the right time.

We Offer Loan At A Very Low Rate Of 3%. If Interested, Kindly Contact Us. email us at (fastloanoffer34@gmail.com) /whats-App Contact Number +918929509036

ReplyDelete