A Miniature Crescendo ?

Publish date: Mon, 28 Apr 2014, 10:58 AM

Gromutual is a property development company listed on Bursa. It assumed the listing status of Medas, a second board company, in 2005 via a restructuring scheme.

All of the group's land bank are located in Johor and Melaka. In this regard, it is an Iskander play.

As a portfolio investor, I am not particularly keen on Iskander theme.

After investing for so many years, I have developed an instinct to shy away from places with big crowds.

That is why inside my portfolio are stocks like PJDev, Ivory, GOB, Symlife, all do not have exposure in Iskander (with the exception of Gadang, which was involved in Iskander via Capital 21).

However, after I studied Gromutual, I notice that there is something that differentiate the company from other Iskander based developers - its residential projects are mostly single storey, which I presume will be more affordable, thereby making it less vulnerable to risk of oversupply in a crowded property scene.

On top of that, Gromutual is involved in development of industrial properties.

I have to admit that all these years of neglect on Iskander has taken a toll on me - I don't actually have a good feel for Johor industrial property sector, apart from the fact that Johor (together with Penang) has sort of become a favorite destination for FDI, attracting certain Singapore based manufacturers and MNCs to relocate their operations there.

However, as usual, I don't insist on investing in a stock only after knowing fully about the company. As long as the company's fundamentals are reasonably sound, I will park my money there first and carry out further research.

1. Background Information on Gromutual

Based on 375 mil shares outstanding and share price of RM0.54, the company's market cap is approximately RM202 mil.

The group has net assets of RM287 mil, loans of RM50 mil and cash of RM39 mil. As such, net gearing is only 0.04 times (4%). Very healthy balance sheets.

Based on FY2013 net profit of RM26.8 mil, PER is 7.5 times. (FY2012 net profit was RM22.2 mil).

2. Landbanks

The bulk of the group's land banks are in Johor. Most of them are industrial land.

There are also some land bank in Melaka, which in my opinion is not exactly prime area.

| Location | Description | Area | NBV | date of |

| (acres) | (RM mil) | valuation | ||

| Mukim of Senai-Kulai, Johor | ind land with factory | 10.9 | 22.3 | 2011 |

| Mukim of Plentong, Johor | industrial land | 27.8 | 25.7 | 2003 |

| Mukim Bandar JB, Johor | Residential land | 1.1 | 3.3 | 2012 |

| Kota Tinggi, Johor | Agriculture land | 366.0 | 43.6 | 2010 |

| Daerah Kluang, Johor | industrial land | 9.9 | 2.3 | 2011 |

| Daerah Kluang, Johor | industrial land | 19.2 | 9.2 | 2003 |

| Batu Pahat, Johor | agriculture land | 5.4 | 0.5 | 2011 |

| Mukim Kluang, Johor | industrial | 1.2 | 0.4 | 2011 |

| Mukim Kluang, Johor | industrial | 3.0 | 0.3 | 2011 |

| Mukim Tebrau, Johor | industrial | 1.7 | 2.1 | 2011 |

| Mukim Tebrau, Johor | agriculture | 4.7 | 8.4 | 2012 |

| Mukim Tebrau, Johor | agriculture | 2.0 | 3.3 | 2012 |

| Mukim Tebrau, Johor | agriculture | 1.9 | 2.9 | 2012 |

| Subtotal (Johor) | 454.7 | 124.3 | ||

| Alor Gajah, Melaka | residential | 14.3 | 1.4 | 2011 |

| Alor Gajah, Melaka | residential | 10.6 | 3.5 | 2006 |

| Sungai Udang, Melaka | agriculture | 27.2 | 4.1 | 2008 |

| Alor Gajah, Melaka | agriculture | 9.9 | 2.2 | 2011 |

| Sungai Udang, Melaka | commercial | 2.2 | 0.8 | 2011 |

| Sungai Udang, Melaka | commercial | 1.5 | 1.1 | 2011 |

| Alor Gajah, Melaka | agriculture | 29.4 | 5.9 | 2012 |

| Mukim Cheng, Melaka | commercial | 1.6 | 2.0 | 2012 |

| Tangga Batu, Melaka | mixed development | 17.6 | 14.6 | 2010 |

| Subtotal (Melaka) | 114.3 | 35.6 | ||

| GRAND TOTAL | 569.1 | 159.9 |

3. Development Projects

In 2013, management told the press that they have GDV of approximately RM200 mil and they target to launch RM700 mil projects over next few years. To put into proper perspective, the group's revenue in FY2013 was RM134 mil.

(a) Development Projects in Johor

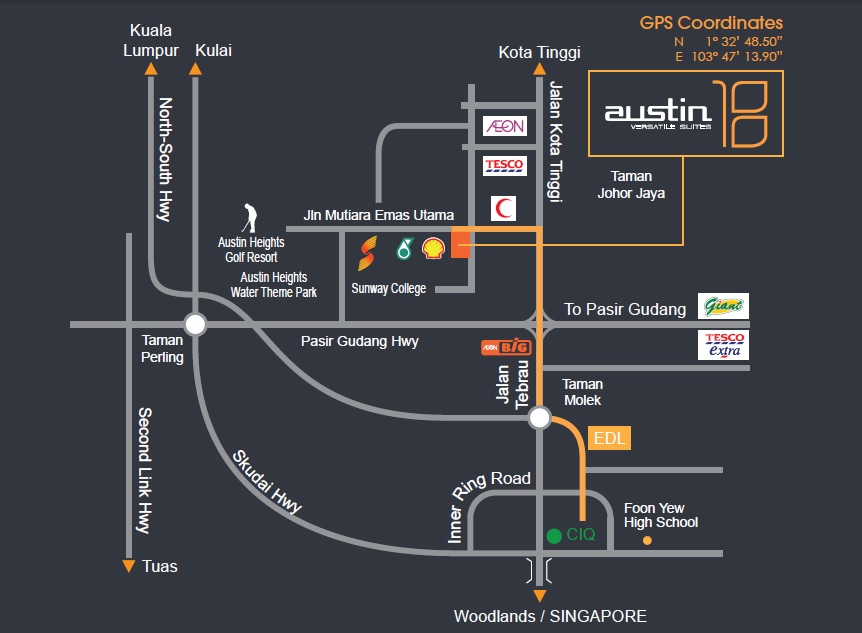

Austin 18 (picture below) is the group's only commercial project. It has GDV of RM150 mil, comprises offices / executive suites.

(Austin 18 Small Office Versatile Office Executive Suites)

(Location of Austin 18)

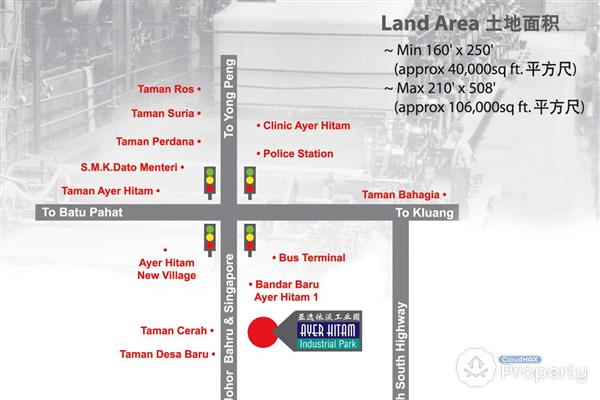

Ayer Hitam Industrial Park is one of the group's industrial property projects in Johor.

(Ayer Hitam Industrial Park)

(Location of Ayer Hitam Industrial Park)

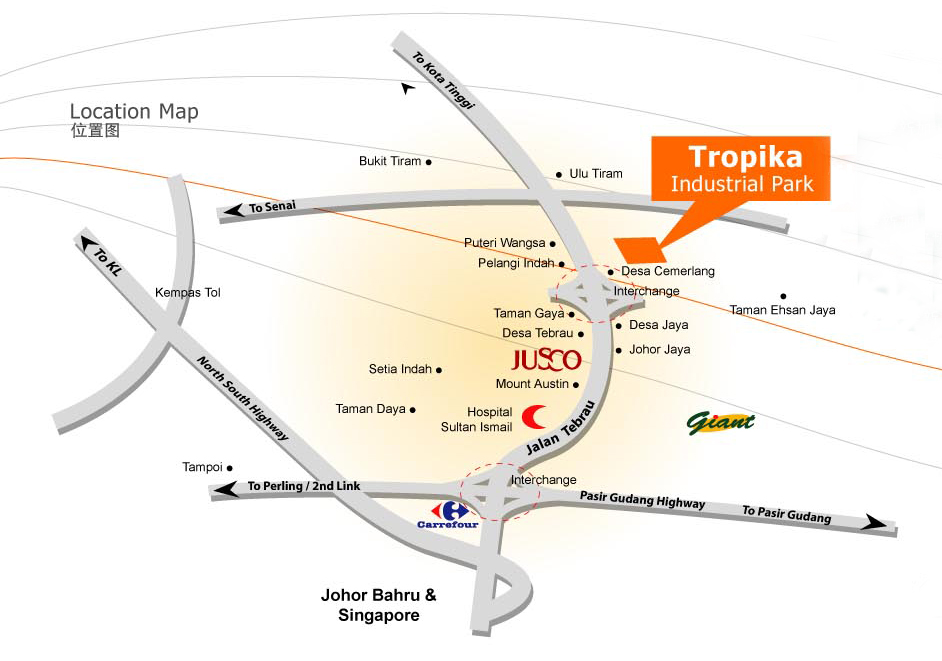

Tropika Industrial Park is another of the group's industrial property project in Johor.

(Tropika Industrial Park)

(Location of Tropika Industrial Park)

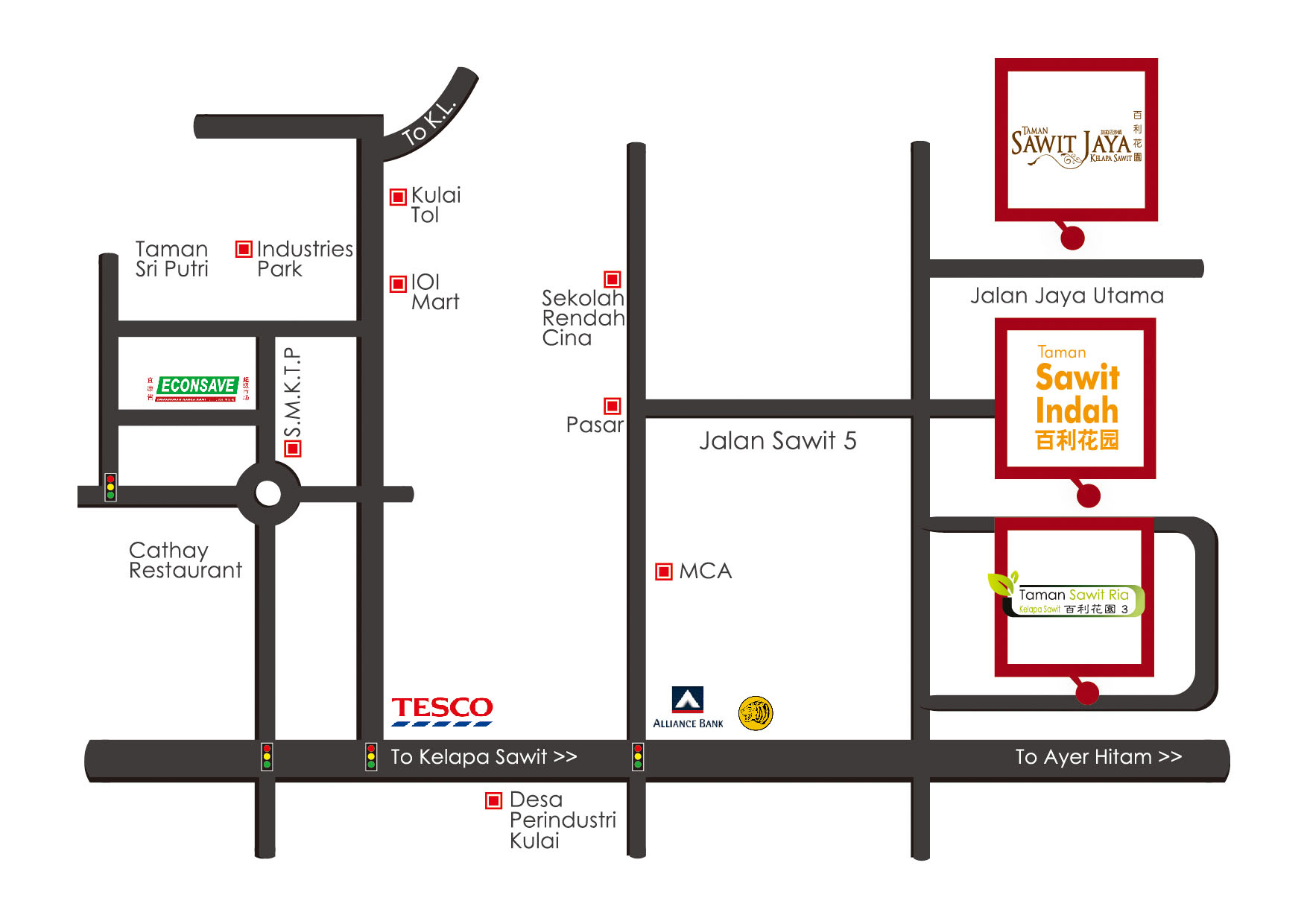

Taman Mesra, Taman Persona, Taman Sawit Indah and Taman Sawit Ria are residential projects in Johor. Please note there are mostly single storey, which should be more affordable.

(Taman Mesra Indah)

(Location of Taman Mesra Indah, Johor)

(Taman Persona, Johor)

(Taman Persona, Johor)

(Taman Sawit Indah, Johor)

(Taman Sawit Ria site plan, Johor)

(Location of Taman Sawit Indah and Taman Sawit Ria, Johor)

(b) Development Projects in Melaka

(Taman Keris Satria shop office. 37 units. Under construction)

(Taman Lesung Batu Jaya, Alor Gajah, Melaka. Single and double storey shop offices)

(Taman Tangga Batu Perdana, Melaka. SIngle and double storey shop office)

(Terendak Heights, Sungai Udang, Melaka. Double storey shop office)

(Taman Lesung Batu Jaya, Alor Gajah, Melaka. Single storey residential)

(Taman Tangga Batu, Melaka. Single storey residential)

4. Concluding Remarks

Gromutual has strong balance sheets. It has reasonable profit track record. Valuation based on PE multiple is also reasonable.

However, it is principally an Iskander based developer.

Iskander is a region with huge potential and yet facing potential supply demand imbalance.

Further research is needed to better understand the group's operation and its prospects.

Have a nice day.

We Offer Loan At A Very Low Rate Of 3%. If Interested, Kindly Contact Us. email us at (fastloanoffer34@gmail.com) /whats-App Contact Number +918929509036

ReplyDelete