Author: Icon8888 | Publish date: Mon, 20 Jun 2016, 02:28 PM

1. Introduction

Stockmanmy has a lively debate with KCChong recently.

http://klse.i3investor.com/blogs/stockman/98587.jsp

http://klse.i3investor.com/blogs/kcchongnz/98599.jsp

If you filter out the noises and emotion, the debate is actually valid, matured and intellectual.

I don't mean to put words in people's mouth. But in order to write this article, I need to first sum up the respective party's view, so as to allow the readers to know exactly what the debate is about.

Stockmanmy has made it very clear how he picks stocks. The following are some of the salient points :-

(i) Net cash is not a good predictor of future share price;

(ii) The best predictor of share price is the business segment it is in; and

(iii) To be specific, the best predictor of share price is earnings growth.

In a nutshell, Stockmanmy said that you should not pay too much attention to balance sheet (of course, it is understood that we should avoid companies with excessive gearing and high bankruptcy risk) but should instead focus more on earnings growth.

As for KC, most forum members would have been very familiar with this gentleman's view as he is an active blogger. Just like everybody else, KC's stockpicking strategy involves many little little details. I must be careful not to misquote him or paint a misleadsing picture that does not reflect his actual stance. However, for the purpose of this article, I seek his indulgence to allow me to claim that "historical data plays an important role in KC's stock picking strategy".

I am not exactly shoving things down KC's throat. KC's style involved studying the PLC's Return On Invested Capital, Earnings Yield, etc. In order to do that, inevitably you need to look back to the past.

Not only that. If I am not wrong, KC is usually not very comfortable trying to make prediction about the future. If you do a search of "KCChong + statistical significance + future" in i3, the following will show up (not exhaustive) :-

Before I proceed further, let me clarify that the above examples should not be contrued as stating that KC ignores the future when come to picking stocks. All we can say is that compared to Stockmanmy, KC does let the past plays a more important role.

So, Stockmanmy vs. KCChong, future vs. past. Who is right ? Who is wrong ?

2. Picking Stocks Based On The Future

I believe many people would have noticed that I am friendly towards KC. However, that is not relevant for this article. I am writing this article to discuss facts and truth, not to play politics.

With that in mind, I hereby declare that I am actually in similar school as Stockmanmy.

This is actually not surprising. Forum members who have been following my articles would have noticed that I rely heavily on future earnings to guide my investment decision.

My thought process and the way I operate is actually very similar to what Stockmanmy eloborated in his article. To deny that is simply lying.

Not only that, I have gone one step further to narrow down the timeframe for earnings forecast to the immediate next 12 months, as proposed by Uncle Koon in his now famous "Buy stocks that next year profit will be higher than this year".

The strategy has served me well. I achieved good return in 2015. In 2016, after an initial dip, my portfolio has rebounced and is doing reasonably well.

3. Picking Stocks Based On The Past

In the above section, I mentioned that the future is important for successful stock picking. How about the past ? Is referring to the past equivalent to "driving by looking at rearview window" as mentioned by forum member Fortunecheat ?

Is the past still relevant ? If the answer is Yes, how relevant ? And in what way it is relevant ?

To answer the above questions, I would like to refer you to the wisdom of one very famous investment Guru, Joel Greenblatt.

Joel Greenblatt is a very successful investor. Through his firm Gotham Capital, Greenblatt presided over an impressive annualised return of 40% during the period from 1985 to 2006.

How did he do it ? Greenblatt's investment strategy is explained in his book "The Little Book That Beats The Market". You can download it by clicking on the following link :

http://www.poslovni.hr/media/PostAttachments/1203672/Joel%20Greenblatt%20-%20The%20Little%20Book%20That%20Beats%20the%20Market.pdf

Bascially, Greenblatt picked stocks that fulfilled A COMBINATION OF the following :-

(a) High earnings yield (EY); and

(b) High Return On Invested Capital (ROIC).

whereby EY = EBIT / Enterprise Value; and

ROIC = EBIT / (Net fixed assets + working capital).

The above formulars looked very complicated. However, there are equivalents that can help you to immediately understand them.

EY is actually the cousin of our well know PE Ratio (in reverse, namely 1/PER).

ROIC is the cousin of our well known Return on Equity (ROE).

Basically, Greenblatt picks stocks that have a combination of Low PER and High ROE.

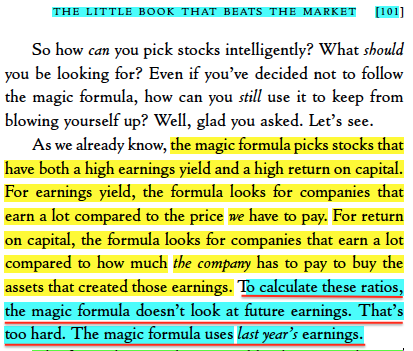

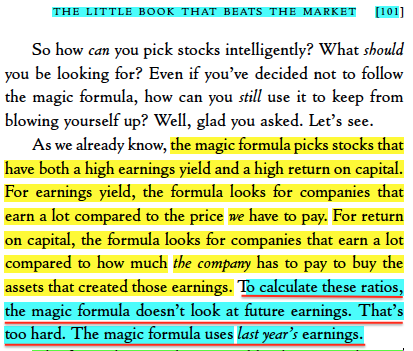

However, the above criterias is not important for this article (actually, what Greenblatt proposed is nothing groundbreaking. Most investors nowadays know that low PER and high ROE is good). What is important for this article is that Greenblatt relies heavily on the pastwhen come to calculating EY and ROIC.

I did not cook this up. Greenblatt explicitly mentioned this in Chapter Eleven of the Book.

I have cut and paste quite a lot of information up there. What is the key lesson learned ?

4. Fallen Angels

What I am trying to highlight is not that you should use EY and ROIC to pick stokcs. They are useful tools, but not the purpose of this article.

I am also not trying to convince you that you should rely on past earnings to forecast future profit. Forecasting of profit is best done based on assumptions of the future, not the past. The past is over, many things that was previously there might have changed beyond recognition. It is risky to drive by looking at rearview window, just like what forum member Fortunecheat mentioned (actually Peter Lynch was the one that said it).

What I am trying to highlight is that while making fast money in the market based on Earnings Growth method, please don't forget to also pay attention to beaten down stocks that used to do well in the past but are now suffering due to unfavorable economic conditions.

One good example is MBM Resources. It used to generate EPS ranging from 40 sen to 50 sen. However, due to difficulty of securing car financing, weak consumer sentiment, weak Ringgit, etc, the group's EPS declined to approximately 20 sen. Its share price also declined from as high as RM4.00 to the current RM2.02 (down by 50%).

Annual Result:

Companies like these are called "Fallen Angels". Their performance weakened substantially recently due to unfavorable market condition, but the business infrastructure (manufacturing capacity, distribution network, brand, etc) is very much intact. It is a matter of time (according to academic study, usually 5 years is the max) the operating environment will revert to the norm. When that happens, the stock will regain its mojo and deliver above average return to investors.

Please note that this is not the same as making a forecast of an untested company. I am not suggesting that we should forecast that for example, Asia Poly can make 10 sen EPS next year just because it reported 9 sen EPS in previous year. A Fallen Angel must be a company that has a strong track record in the past and has likelihood to recover when things normalised. Joel Greenblatt proved that for that kind of companies, if you invest BASED ON PAST DATA and with a bit of patience, it is possible to generate fantastic return over an extended period of time.

5. Concludng Remarks

(a) Based on real life experience, I advocate buying stocks based on future earnings. It is proven that most investors in Bursa love strong corporate profit. Stocks that display this characteristic will attract massive following and immediate outperformance.

(b) However, do not dismiss the useful role that historical earnings can play. It can be useful for picking Fallen Angels that have potential to shine again once things normalised. Those stocks usually trade at depressed valuation and hence offer good bargain. With some patience, they can generate impressive return at later stage.

(c) There is no need to dispute which method is more superior. One can give you fast money, the other gives you opportunity to bottom fish.

(d) In real life, I suggest putting the bulk of your money (let's say, 70%) in stocks that have strong earnings visibility while also nibble on beaten down stocks that have PROVEN HISTORICAL PERFORMANCE (let's say, 30% of your portoflio).

For beaten down stocks, you can build up your position more aggressively when there is indication of genuine turning around (be it based on FA or TA). By doing so, you can gain exposure at trough valuation while avoiding huge amout of capital being tied down in slow moving stocks.

Stockmanmy has a lively debate with KCChong recently.

http://klse.i3investor.com/blogs/stockman/98587.jsp

http://klse.i3investor.com/blogs/kcchongnz/98599.jsp

If you filter out the noises and emotion, the debate is actually valid, matured and intellectual.

I don't mean to put words in people's mouth. But in order to write this article, I need to first sum up the respective party's view, so as to allow the readers to know exactly what the debate is about.

Stockmanmy has made it very clear how he picks stocks. The following are some of the salient points :-

(i) Net cash is not a good predictor of future share price;

(ii) The best predictor of share price is the business segment it is in; and

(iii) To be specific, the best predictor of share price is earnings growth.

In a nutshell, Stockmanmy said that you should not pay too much attention to balance sheet (of course, it is understood that we should avoid companies with excessive gearing and high bankruptcy risk) but should instead focus more on earnings growth.

As for KC, most forum members would have been very familiar with this gentleman's view as he is an active blogger. Just like everybody else, KC's stockpicking strategy involves many little little details. I must be careful not to misquote him or paint a misleadsing picture that does not reflect his actual stance. However, for the purpose of this article, I seek his indulgence to allow me to claim that "historical data plays an important role in KC's stock picking strategy".

I am not exactly shoving things down KC's throat. KC's style involved studying the PLC's Return On Invested Capital, Earnings Yield, etc. In order to do that, inevitably you need to look back to the past.

Not only that. If I am not wrong, KC is usually not very comfortable trying to make prediction about the future. If you do a search of "KCChong + statistical significance + future" in i3, the following will show up (not exhaustive) :-

Before I proceed further, let me clarify that the above examples should not be contrued as stating that KC ignores the future when come to picking stocks. All we can say is that compared to Stockmanmy, KC does let the past plays a more important role.

So, Stockmanmy vs. KCChong, future vs. past. Who is right ? Who is wrong ?

2. Picking Stocks Based On The Future

I believe many people would have noticed that I am friendly towards KC. However, that is not relevant for this article. I am writing this article to discuss facts and truth, not to play politics.

With that in mind, I hereby declare that I am actually in similar school as Stockmanmy.

This is actually not surprising. Forum members who have been following my articles would have noticed that I rely heavily on future earnings to guide my investment decision.

My thought process and the way I operate is actually very similar to what Stockmanmy eloborated in his article. To deny that is simply lying.

Not only that, I have gone one step further to narrow down the timeframe for earnings forecast to the immediate next 12 months, as proposed by Uncle Koon in his now famous "Buy stocks that next year profit will be higher than this year".

The strategy has served me well. I achieved good return in 2015. In 2016, after an initial dip, my portfolio has rebounced and is doing reasonably well.

3. Picking Stocks Based On The Past

In the above section, I mentioned that the future is important for successful stock picking. How about the past ? Is referring to the past equivalent to "driving by looking at rearview window" as mentioned by forum member Fortunecheat ?

Is the past still relevant ? If the answer is Yes, how relevant ? And in what way it is relevant ?

To answer the above questions, I would like to refer you to the wisdom of one very famous investment Guru, Joel Greenblatt.

Joel Greenblatt is a very successful investor. Through his firm Gotham Capital, Greenblatt presided over an impressive annualised return of 40% during the period from 1985 to 2006.

How did he do it ? Greenblatt's investment strategy is explained in his book "The Little Book That Beats The Market". You can download it by clicking on the following link :

http://www.poslovni.hr/media/PostAttachments/1203672/Joel%20Greenblatt%20-%20The%20Little%20Book%20That%20Beats%20the%20Market.pdf

Bascially, Greenblatt picked stocks that fulfilled A COMBINATION OF the following :-

(a) High earnings yield (EY); and

(b) High Return On Invested Capital (ROIC).

whereby EY = EBIT / Enterprise Value; and

ROIC = EBIT / (Net fixed assets + working capital).

The above formulars looked very complicated. However, there are equivalents that can help you to immediately understand them.

EY is actually the cousin of our well know PE Ratio (in reverse, namely 1/PER).

ROIC is the cousin of our well known Return on Equity (ROE).

Basically, Greenblatt picks stocks that have a combination of Low PER and High ROE.

However, the above criterias is not important for this article (actually, what Greenblatt proposed is nothing groundbreaking. Most investors nowadays know that low PER and high ROE is good). What is important for this article is that Greenblatt relies heavily on the pastwhen come to calculating EY and ROIC.

I did not cook this up. Greenblatt explicitly mentioned this in Chapter Eleven of the Book.

I have cut and paste quite a lot of information up there. What is the key lesson learned ?

4. Fallen Angels

What I am trying to highlight is not that you should use EY and ROIC to pick stokcs. They are useful tools, but not the purpose of this article.

I am also not trying to convince you that you should rely on past earnings to forecast future profit. Forecasting of profit is best done based on assumptions of the future, not the past. The past is over, many things that was previously there might have changed beyond recognition. It is risky to drive by looking at rearview window, just like what forum member Fortunecheat mentioned (actually Peter Lynch was the one that said it).

What I am trying to highlight is that while making fast money in the market based on Earnings Growth method, please don't forget to also pay attention to beaten down stocks that used to do well in the past but are now suffering due to unfavorable economic conditions.

One good example is MBM Resources. It used to generate EPS ranging from 40 sen to 50 sen. However, due to difficulty of securing car financing, weak consumer sentiment, weak Ringgit, etc, the group's EPS declined to approximately 20 sen. Its share price also declined from as high as RM4.00 to the current RM2.02 (down by 50%).

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY |

|---|---|---|---|---|---|---|

| TTM | 1,598,858 | 63,653 | 16.30 | 12.40 | 17.00 | 8.42 |

| 2015-12-31 | 1,816,663 | 80,398 | 20.58 | 11.67 | 7.00 | 2.92 |

| 2014-12-31 | 1,774,144 | 112,222 | 28.72 | 10.10 | 8.00 | 2.76 |

| 2013-12-31 | 1,959,689 | 138,480 | 35.45 | 9.06 | 6.00 | 1.87 |

| 2012-12-31 | 2,267,658 | 136,442 | 38.34 | 8.38 | 9.00 | 2.80 |

| 2011-12-31 | 1,705,573 | 121,237 | 42.60 | 5.76 | 6.00 | 2.45 |

| 2010-12-31 | 1,528,494 | 142,136 | 58.64 | 4.39 | 10.00 | 3.89 |

Companies like these are called "Fallen Angels". Their performance weakened substantially recently due to unfavorable market condition, but the business infrastructure (manufacturing capacity, distribution network, brand, etc) is very much intact. It is a matter of time (according to academic study, usually 5 years is the max) the operating environment will revert to the norm. When that happens, the stock will regain its mojo and deliver above average return to investors.

Please note that this is not the same as making a forecast of an untested company. I am not suggesting that we should forecast that for example, Asia Poly can make 10 sen EPS next year just because it reported 9 sen EPS in previous year. A Fallen Angel must be a company that has a strong track record in the past and has likelihood to recover when things normalised. Joel Greenblatt proved that for that kind of companies, if you invest BASED ON PAST DATA and with a bit of patience, it is possible to generate fantastic return over an extended period of time.

5. Concludng Remarks

(a) Based on real life experience, I advocate buying stocks based on future earnings. It is proven that most investors in Bursa love strong corporate profit. Stocks that display this characteristic will attract massive following and immediate outperformance.

(b) However, do not dismiss the useful role that historical earnings can play. It can be useful for picking Fallen Angels that have potential to shine again once things normalised. Those stocks usually trade at depressed valuation and hence offer good bargain. With some patience, they can generate impressive return at later stage.

(c) There is no need to dispute which method is more superior. One can give you fast money, the other gives you opportunity to bottom fish.

(d) In real life, I suggest putting the bulk of your money (let's say, 70%) in stocks that have strong earnings visibility while also nibble on beaten down stocks that have PROVEN HISTORICAL PERFORMANCE (let's say, 30% of your portoflio).

For beaten down stocks, you can build up your position more aggressively when there is indication of genuine turning around (be it based on FA or TA). By doing so, you can gain exposure at trough valuation while avoiding huge amout of capital being tied down in slow moving stocks.

There's shocking news in the sports betting world.

ReplyDeleteIt has been said that any bettor needs to see this,

Watch this or stop betting on sports...

Sports Cash System - Advanced Sports Betting Software.