Publish date: Tue, 31 May 2016, 11:29 AM

1. Introduction

Note : To fully understand what I wrote in this article, I suggest you first go through my previous articles about MACD.

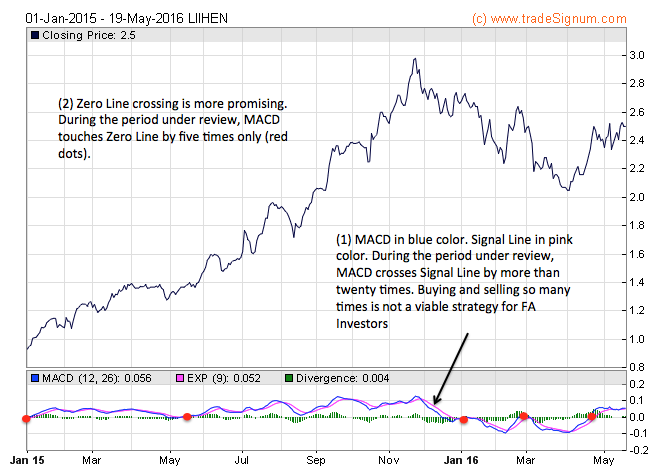

Just to recap, MACD generates transaction signals when it crosses either the Sginal Line or Zero Line.

As mentioned in my previous article, Signal Line crossing is more sensitive. It gives more advanced warning compared to Zero Line crossing. However, there will also be more false signals, especially when the stock is trading sideway.

2. Pleasant Surprises From Zero Line Crossing

To test out how MACD will fare in real life trading or investing, I tried it out with some of the stocks that I bought in 2015. The findings turned out to be quite positive.

As expected, Signal Line Crossing is not very useful as it generated too many Buy Sell signals. As shown in diagram below, MACD crossed Signal Line by more than 20 times during the period under review.

Zero Line Crossing is more promising. However, it still is too sensitive, generated 5 signals during the period.

One possible way to filter out the noises is to wait for a noticeable gap to open up between MACD and Zero Line.

By applying this method, an FA investor would have done well with furniture stocks in 2015 :-

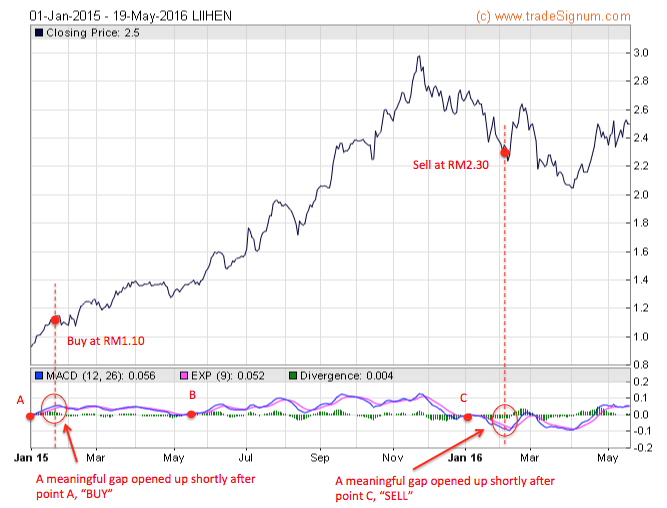

(a) Lii Hen

An investor who applied the above method would have bought Lii Hen at RM1.10 and sold at RM2.30. Even though he didn't manage to buy and sell at lowest and highest points respectively, his return is still a commendable 109%.

Please note that if he didn't allow a gap to open up, he would have sold the stock at point B at RM1.40 and missed out the rest of the rally.

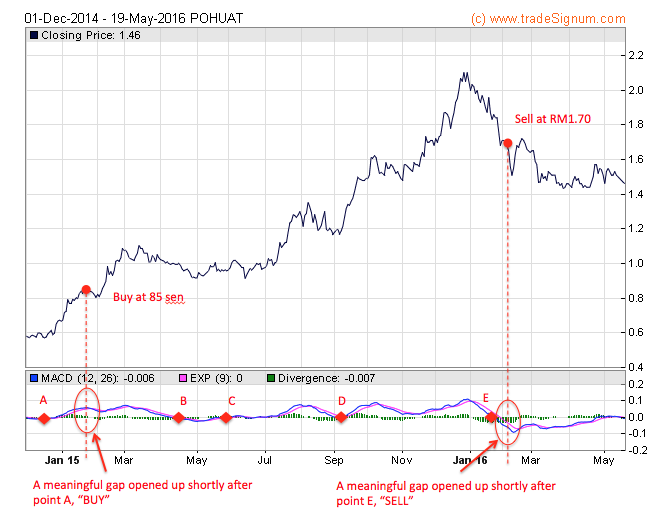

(b) Poh Huat

An investor who applied the above method would have bought Poh Huat at RM0.85 and sold at RM1.70. Even though he didn't manage to buy and sell at lowest and highest points respectively, his return is still a commendable 100%.

Please note that if he didn't allow a gap to open up, he would have undertaken additional transactions at point B, C and D. From FA investors' point of view, unnecessary transactions are not a good thing as it requires multiple entry / exit decisions, which are not easy to make.

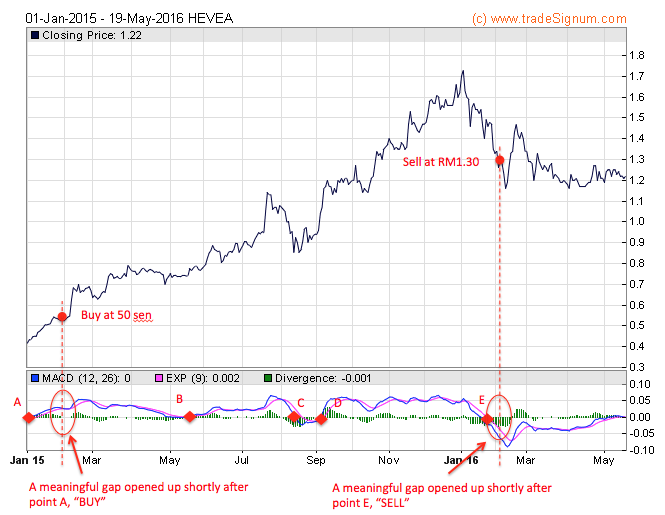

(c) Hevea

An investor who applied the above method would have bought Hevea at RM0.50 and sold at RM1.30. Even though he didn't manage to buy and sell at lowest and highest points respectively, his return is still a commendable 160%.

Please note that if he didn't allow a gap to open up, he would have undertaken additional transactions at point B, C and D. From FA investors' point of view, unnecessary transactions are not a good thing as it requires multiple entry / exit decisions, which are not easy to make.

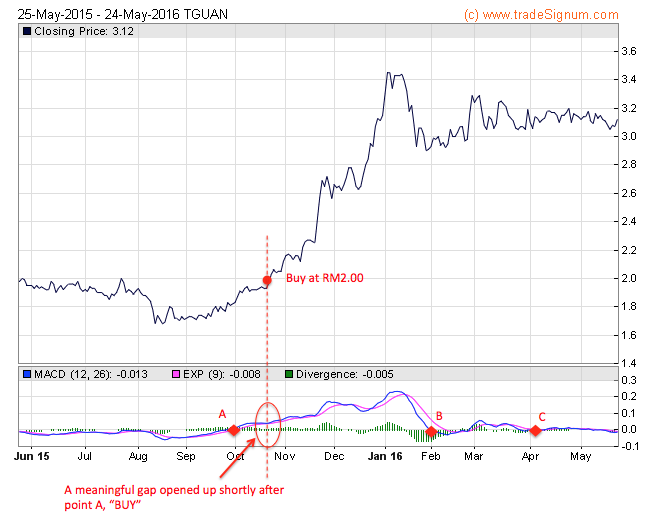

(d) Thong Guan

An investor who applied the above method would have bought Thong Guan at RM2.00 at point A. Since his entry, MACD did not touch the Zero Line again until February and April 2016 at point B and C respectively. However, since no meaningful gap opens up at B and C, technically there is no Sell signal yet.

In other words, MACD is telling the Investor to hold on to Thong Guan. On hind sight, this is a correct signal as Thong Guan share price remains stable and did not decline drastically after Point B and C.

3. Does Not Always Work

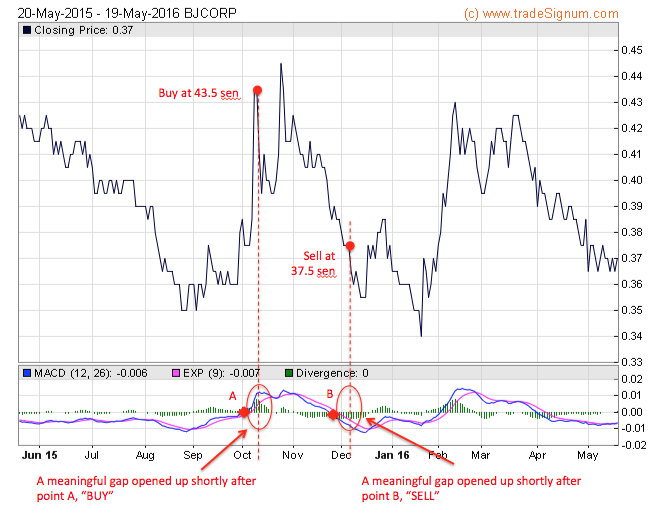

Wow, it seemed that the method has a 100% success rate !!! Have we found the magic formula that can turn us into Stock Gods ? Not really. Let's look at Berjaya Corp's case, which obviously doesn't work.

An investor who applied the above method would have bought BJCorp at RM0.435 and sold at RM0.375, incurring a loss of 14%.

Why did the method not work this time ?

4. Strong Trend Required

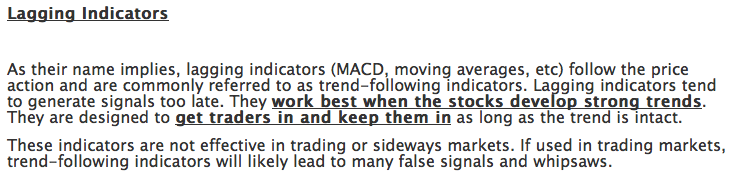

In my ealier article called "What You Should Know About Technical Indicators", I mentioned that MACD works best when there is a strong trend for the stock :-

It is not difficult to prove that MACD is a Lagging Indicator. If you look at Lii Hen's case, the stock peaked at RM3.00 around end Novemer 2015 while MACD only crossed Zero Line in early January 2016 at RM2.70. The same pattern happens to Poh Huat, Hevea and Thong Guan as well.

Because of its inefficiency, MACD only works for stocks that register huge gain (pursuant to a strong trend). MACD is a bit slow prompting you to buy and it is also a bit slow prompting you to sell. As such, certain gain has to be sacrificed. For that to work, there must be sufficient fat between buy and sell.

5. Spotting A Trend Is Easier Said Than Done

In the above section, we establish that MACD only works well for stocks that develope strong trend. But how do you know that a particular stock WILL develope a strong trend ?

If you ask the above question to a TA analyst, he will draw lines all over the Chart to show you how the trend looked like. I have a healthy respect for Technical Analysis, but most of the time I found all these so called Trend detection are 20 / 20 Hindsight. It is easy to describe a trend AFTER it has happened. But detecting a Trend AT ITS INFANCY is a different thing. Sometime you are right, sometime you are wrong.

If that is the case, how do you detect a trend ?

I suggest we fall back on Fundamental Analysis.

For example : By mid 2015, there are indications that Ringgit is about to weaken substantially. There is a possibility of an Export Trend. Zoom in on export stocks and study their MACDs (in this case, Zero Line Crossing).

Another example : Due to a multitude of positive factors, Air Asia is expected to do well in the next 6 to 12 months. I think it is safe for us to say that Air Asia is in an Upward Trend.

Of course, FA is only my suggestion. If you truly feel that your TA methods are reliable enough to allow you to detect Trend at infancy, by all means stick to those methods.

6. Concluding Remarks

(a) My study showed that MACD Zero Line Crossing could be a useful TA tool for FA Investors to buy into a stock, hold it for certain period of time, and exit when Sell signal emerges.

(b) However, MACD is relatively slow in generating Buy or Sell signals. It only prompt you to buy after the stock has gone up by quite a fair bit (as it needs that to confirm the Buy momentum), and the same is true for selling.

(c) Because of the above, MACD Zero Line Crossing only works well for stocks that pose strong gain. In other words, stocks that develope a strong trend. It is not suitable for short term trading that give you let's say, 5% or 10% gain for each trade.

(d) To detect whether a stock will be forming a trend (and hence is suitable for using MACD Zero Line Crossing to guide future Buy Sell decisions), I suggest we rely on Fundamental Analysis to provide guidance. Of course you can use other methods, if you think they work well.

(e) Last but not least, let me highlight one very important point, just in case you didn't notice - The method I propose in this article requires you to identify the stocks that you want to buy (through FA ?). MACD is not supposed to identify the stocks for you. MACD's role is to provide you guidance on entry and exit points.

No comments:

Post a Comment