Author: Icon8888 | Publish date: Wed, 27 Jul 2016, 09:36 PM

1. Introduction

CIMB used to trade as high as RM8.70 back in May 2013. It is currently trading at RM4.29 (down 51%).

The downtrend was caused by decline in profitability. In 2013, CIMB reported net profit of RM4.54 billion. In the latest financial year, its profit had declined by 40% to RM2.85 billion.

Annual Result:

The stock looked interesting as it is currently trading at Price to Book Ratio of 0.88 times. A banking group like CIMB should trade at at least 1.5 times when its earnings recovers.

(When come to banking stocks, the Market has been quite fair and rational. The higher the ROE, the higher the valuation multiples).

The purpose of this article is to try to understand what are the major factors dragging down CIMB's earning in recent years and to try to have a feel of whether it will be turning around soon.

2. Historical Profitability

Key observations :-

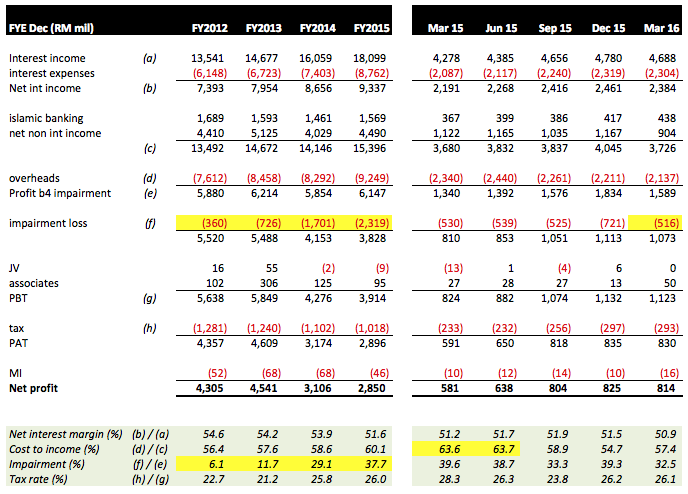

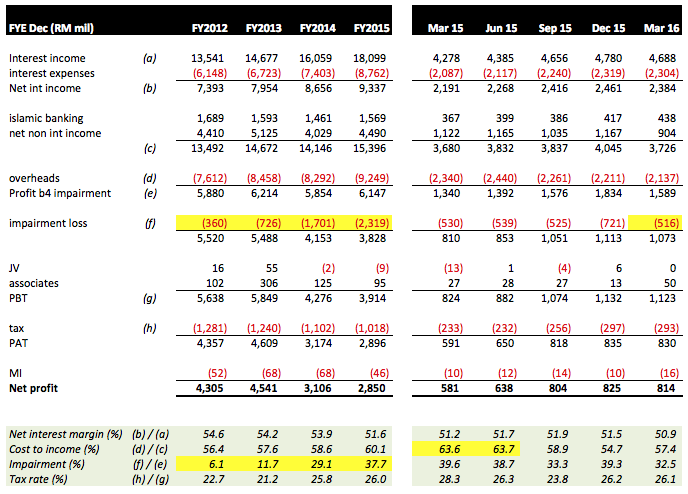

(a) Loan impairment was the main reason CIMB's performance deteriorated over the years. In FY2012 and 2013, impairment charges were 6.1% and 11.7% of profit before impairment respectively. However, in FY2014 and 2015, it increased to 29.1% and 37.7% respectively.

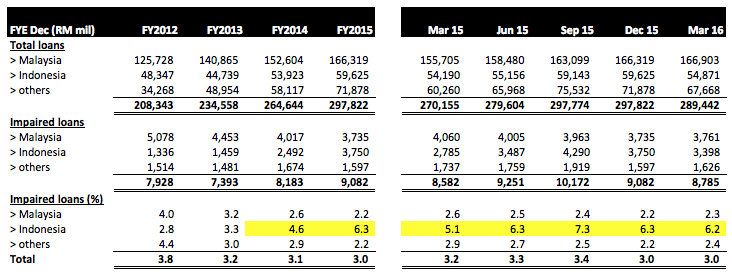

(b) Indonesia subsidiary CIMB Niaga accounted for the bulk of the bad loan spike.

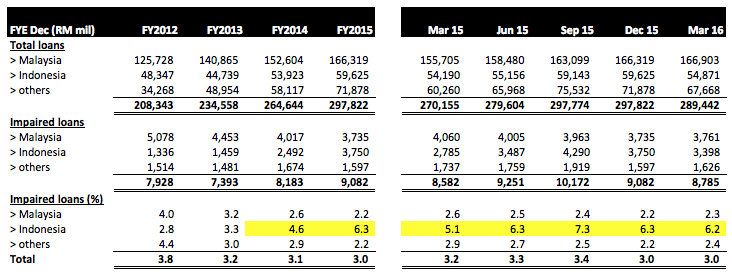

As shown in table above, in FY2012 and 2013, only about 3% of CIMB Niaga's loans were impaired. However, in FY2014 and 2015, that has increased to 4.6% and 6.3% respectively.

Compared to Indonesia, Malaysia and other regions had been managing their loan books pretty well with impairment of 2% plus in FY2014 and 2015.

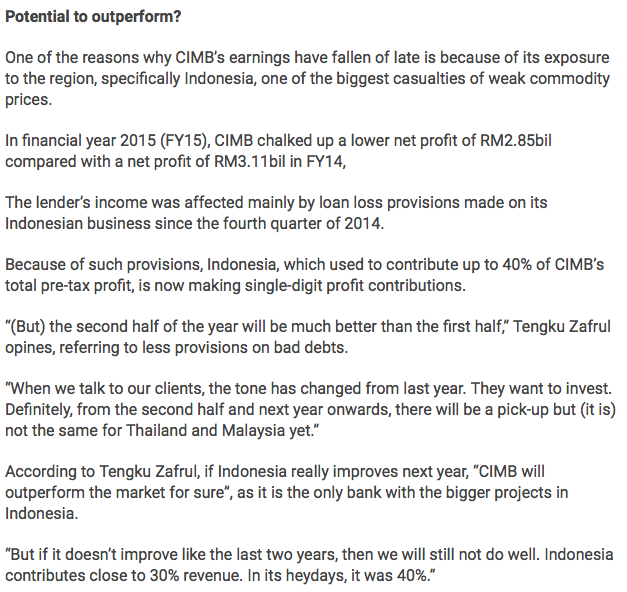

According to the company, collapse of commodity prices was the main reason for the spike in Indonesia bad loans. Indonesia relied quite heavily on commodity export. The downturn caused many borrowers to get into difficulties.

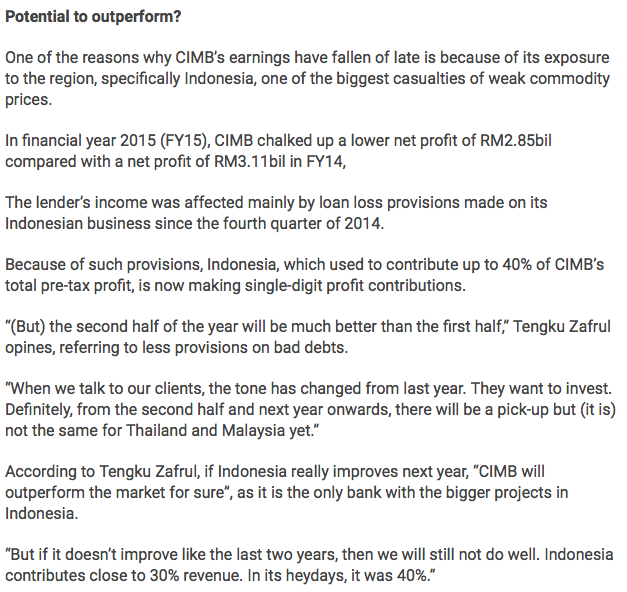

(c) In a recent interview with The Star, the CEO of CIMB expects Indonesia operation to perform better in second half of 2016.

(d) To improve performance, CIMB launched a campaign in 2015 called T18 (Target 2018) to revamp its operation. Among the measures put in place is reduction in overhead. The group's Cost to Income ratio has inched up in FY2015. The group targets to bring it down to 50% by 2018 (The group retrenched more than 3,000 employees in 2015 through a Mutual Separation Scheme).

3. Concluding Remarks

(a) By virtue of its 0.88 times PBR, I believe that CIMB is undervalued at current price of RM4.29. However, re-rating will only happen if its earnings improve.

(b) As mentioned above, the main reason the group's profitability has declined so much is because of non perfoming loans of its Indonesia subsidiary. After going through two rough years, there are signs that the Indonesian economy is gaining strength. CIMB's CEO has hinted of better performance in second half of 2016. Will that materialise ? We can only find out over time.

(c) The reason I invest in CIMB is because I believe it has limited downside. I do not have high expectation for this stock. If it can deliver 20% return for me by end of 2016 (Target Price of RM5.20), I will be very happy.

CIMB used to trade as high as RM8.70 back in May 2013. It is currently trading at RM4.29 (down 51%).

The downtrend was caused by decline in profitability. In 2013, CIMB reported net profit of RM4.54 billion. In the latest financial year, its profit had declined by 40% to RM2.85 billion.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| 2015-12-31 | 15,395,790 | 2,849,509 | 33.62 | 13.51 | 14.00 | 3.08 | 4.8100 | 6.99 |

| 2014-12-31 | 14,145,924 | 3,106,808 | 37.48 | 14.84 | 15.00 | 2.70 | 4.4400 | 8.44 |

| 2013-12-31 | 14,671,835 | 4,540,403 | 59.97 | 12.71 | 23.82 | 3.13 | 3.9200 | 15.30 |

| 2012-12-31 | 13,494,825 | 4,344,776 | 58.45 | 13.06 | 23.38 | 3.06 | 3.8100 | 15.34 |

The stock looked interesting as it is currently trading at Price to Book Ratio of 0.88 times. A banking group like CIMB should trade at at least 1.5 times when its earnings recovers.

(When come to banking stocks, the Market has been quite fair and rational. The higher the ROE, the higher the valuation multiples).

The purpose of this article is to try to understand what are the major factors dragging down CIMB's earning in recent years and to try to have a feel of whether it will be turning around soon.

2. Historical Profitability

Key observations :-

(a) Loan impairment was the main reason CIMB's performance deteriorated over the years. In FY2012 and 2013, impairment charges were 6.1% and 11.7% of profit before impairment respectively. However, in FY2014 and 2015, it increased to 29.1% and 37.7% respectively.

(b) Indonesia subsidiary CIMB Niaga accounted for the bulk of the bad loan spike.

As shown in table above, in FY2012 and 2013, only about 3% of CIMB Niaga's loans were impaired. However, in FY2014 and 2015, that has increased to 4.6% and 6.3% respectively.

Compared to Indonesia, Malaysia and other regions had been managing their loan books pretty well with impairment of 2% plus in FY2014 and 2015.

According to the company, collapse of commodity prices was the main reason for the spike in Indonesia bad loans. Indonesia relied quite heavily on commodity export. The downturn caused many borrowers to get into difficulties.

(c) In a recent interview with The Star, the CEO of CIMB expects Indonesia operation to perform better in second half of 2016.

(d) To improve performance, CIMB launched a campaign in 2015 called T18 (Target 2018) to revamp its operation. Among the measures put in place is reduction in overhead. The group's Cost to Income ratio has inched up in FY2015. The group targets to bring it down to 50% by 2018 (The group retrenched more than 3,000 employees in 2015 through a Mutual Separation Scheme).

3. Concluding Remarks

(a) By virtue of its 0.88 times PBR, I believe that CIMB is undervalued at current price of RM4.29. However, re-rating will only happen if its earnings improve.

(b) As mentioned above, the main reason the group's profitability has declined so much is because of non perfoming loans of its Indonesia subsidiary. After going through two rough years, there are signs that the Indonesian economy is gaining strength. CIMB's CEO has hinted of better performance in second half of 2016. Will that materialise ? We can only find out over time.

(c) The reason I invest in CIMB is because I believe it has limited downside. I do not have high expectation for this stock. If it can deliver 20% return for me by end of 2016 (Target Price of RM5.20), I will be very happy.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

BORROWERS APPLICATION DETAILS

1. Name Of Applicant in Full:……..

2. Telephone Numbers:……….

3. Address and Location:…….

4. Amount in request………..

5. Repayment Period:………..

6. Purpose Of Loan………….

7. country…………………

8. phone…………………..

9. occupation………………

10.age/sex…………………

11.Monthly Income…………..

12.Email……………..

Regards.

Managements

Email Kindly Contact: urgentloan22@gmail.com

Are you in need of a loan? Do you want to pay off your bills? Do you want to be financially stable? All you have to do is to contact us for more information on how to get started and get the loan you desire. This offer is open to all that will be able to repay back in due time. Note-that repayment time frame is negotiable and at interest rate of 3% just email us creditloan11@gmail.com

ReplyDelete