Upward Revision of Target Price From RM3.58 to RM3.96

Author: Icon8888 | Publish date: Wed, 30 Dec 2015, 04:10 PM

I last wrote about Thong Guan when it was trading at RM2.25 (19 November 2015). The stock has since gone up by 39% to RM3.13.

In that article, I set a Target Price of RM3.58.

Now that share price is inching towards that level, is it time to take profit ?

Just hold on to your horses.....

Consistent with practice by many analysts, Icon8888 decides to revise upward Target Price to better reflect investors sentiment toward this stock. The decision to set a higher Target Price also took into consideration the super profit announced by Scientex recently. Both Thong Guan and Scientex are in more less the same industry.

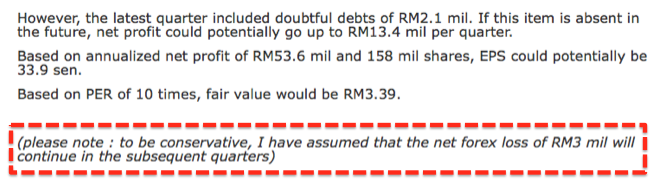

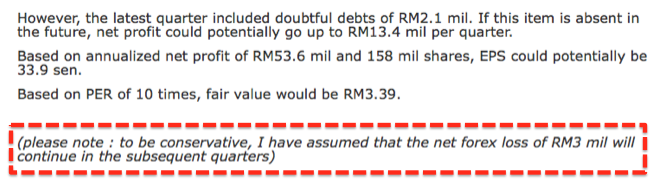

Revising upward the Target Price is not difficult. This is because in my previous article, I have deliberately understated the prospective earnings (just to be conservative) by ignoring the adverse impact of forex losses on Thong Guan's September 2015 results :-

We are now approaching end December. During Q4, Ringgit actually strengthened slightly by approximately 3% from 4.4265 to 4.2958.

As Thong Guan has net exposure to USD liabilities, weakening of Ringgit will result in forex loss, while the opposite will result in forex gain.

To be conservative, I did not assume any forex gain in coming quarter. I will still assume forex losses. However, the amount will be only half of those in the September 2015 quarter.

By making that adjustment, prospective earnings has gone up from the previous RM56.6 mil to RM62.6 mil. EPS also increased from 35.8 sen to 39.6 sen.

(latest financial model)

(previous financial model)

Accordingly, based on 10 times PER (unchanged), Target Price has been revised upwards toRM3.96.

Concluding Remarks

The decision to revise upward the Target Price is not purely based on mathematics. Among all the export counters, I have the most bullish expectation for Thong Guan. The fortune of companies like Lii Hen and Poh Huat are to a large extent dependent upon the weak Ringgit.

However, Thong Guan is in a different league. Its recent capex program has boosted its technological competitivenss tremendously (please refer to my previous articles). Even with Ringgit strengthening to RM3.90, I am confident that it still can outperform many other companies to deliver super strong profit.

Unlike other export counters, Thong Guan's re-rating will be a multi year theme. I believe there is still plenty of upside, especially if it evolves into a dividend play, as per Part 4 of my articles :-

Thanks for reading. I would like to wish everybody a happy, safe and prosperous 2016.

In that article, I set a Target Price of RM3.58.

Now that share price is inching towards that level, is it time to take profit ?

Just hold on to your horses.....

Consistent with practice by many analysts, Icon8888 decides to revise upward Target Price to better reflect investors sentiment toward this stock. The decision to set a higher Target Price also took into consideration the super profit announced by Scientex recently. Both Thong Guan and Scientex are in more less the same industry.

Revising upward the Target Price is not difficult. This is because in my previous article, I have deliberately understated the prospective earnings (just to be conservative) by ignoring the adverse impact of forex losses on Thong Guan's September 2015 results :-

We are now approaching end December. During Q4, Ringgit actually strengthened slightly by approximately 3% from 4.4265 to 4.2958.

As Thong Guan has net exposure to USD liabilities, weakening of Ringgit will result in forex loss, while the opposite will result in forex gain.

To be conservative, I did not assume any forex gain in coming quarter. I will still assume forex losses. However, the amount will be only half of those in the September 2015 quarter.

By making that adjustment, prospective earnings has gone up from the previous RM56.6 mil to RM62.6 mil. EPS also increased from 35.8 sen to 39.6 sen.

(latest financial model)

(previous financial model)

Accordingly, based on 10 times PER (unchanged), Target Price has been revised upwards toRM3.96.

Concluding Remarks

The decision to revise upward the Target Price is not purely based on mathematics. Among all the export counters, I have the most bullish expectation for Thong Guan. The fortune of companies like Lii Hen and Poh Huat are to a large extent dependent upon the weak Ringgit.

However, Thong Guan is in a different league. Its recent capex program has boosted its technological competitivenss tremendously (please refer to my previous articles). Even with Ringgit strengthening to RM3.90, I am confident that it still can outperform many other companies to deliver super strong profit.

Unlike other export counters, Thong Guan's re-rating will be a multi year theme. I believe there is still plenty of upside, especially if it evolves into a dividend play, as per Part 4 of my articles :-

Thanks for reading. I would like to wish everybody a happy, safe and prosperous 2016.

Thanks for very detailed explanation

ReplyDelete-Zeff-