(Icon) Netx Holdings : e-Payment Reported Huge Jump In Earning. Can It Become Malaysia's Alipay ?

Netx is listed on ACE. It has 2.34 billion shares outstanding. Based on share price of 4.5 sen, market cap is RM105 mil.

The group was traditionally involved in provision of networking consulting service. However, in mid 2017, it ventured into e-Payment (please refer to Appendix below).

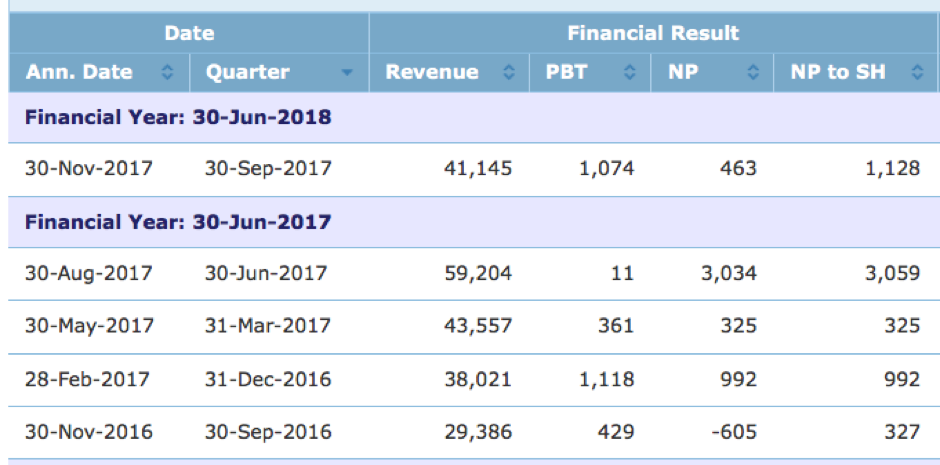

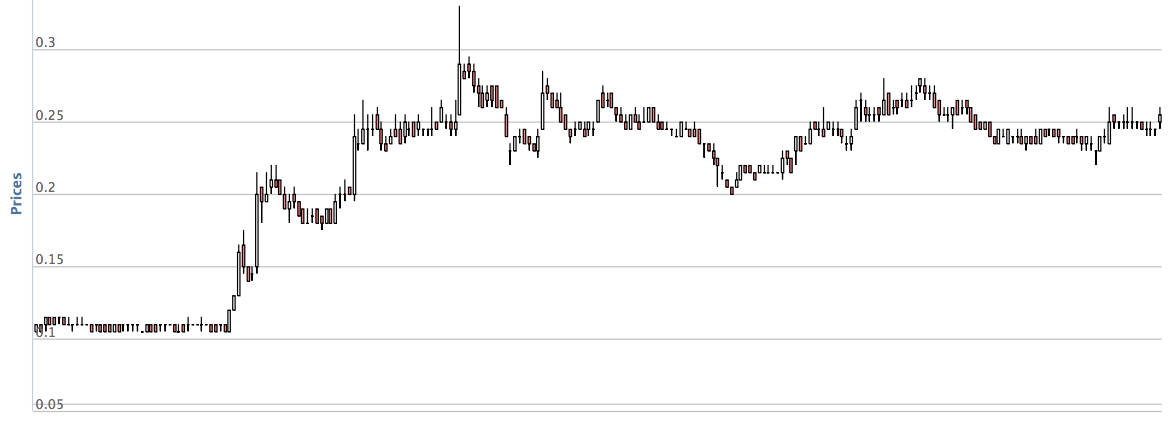

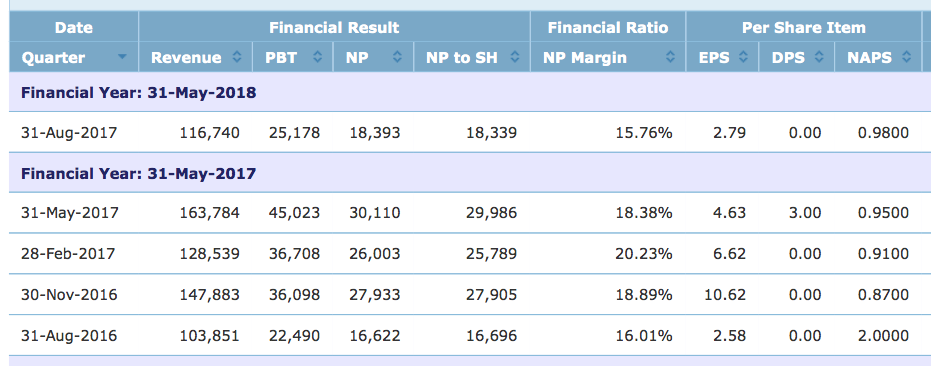

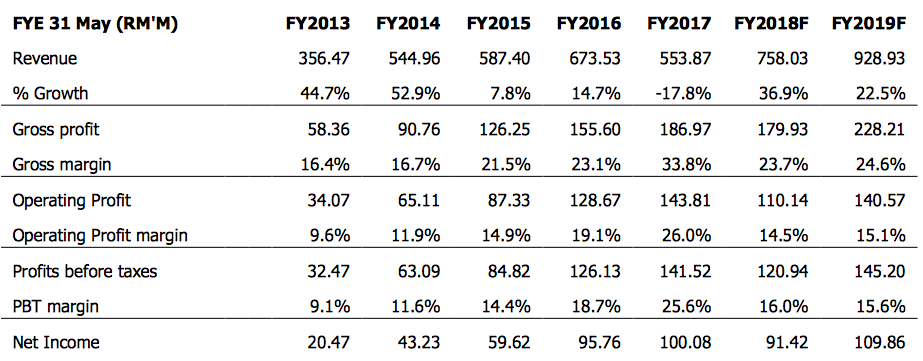

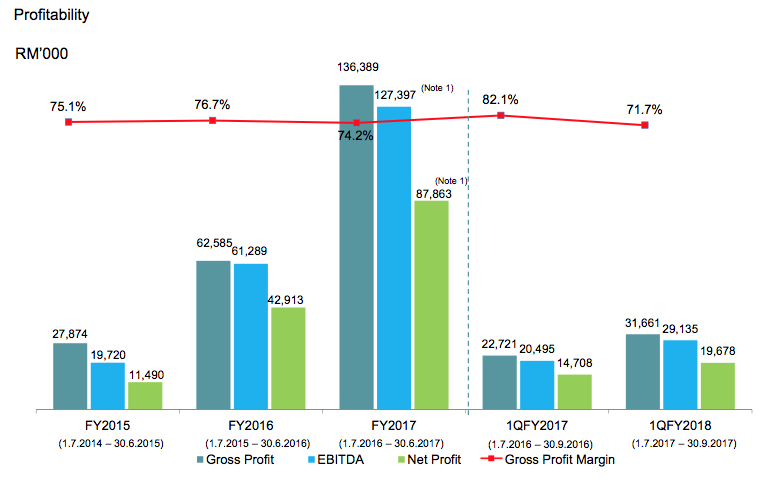

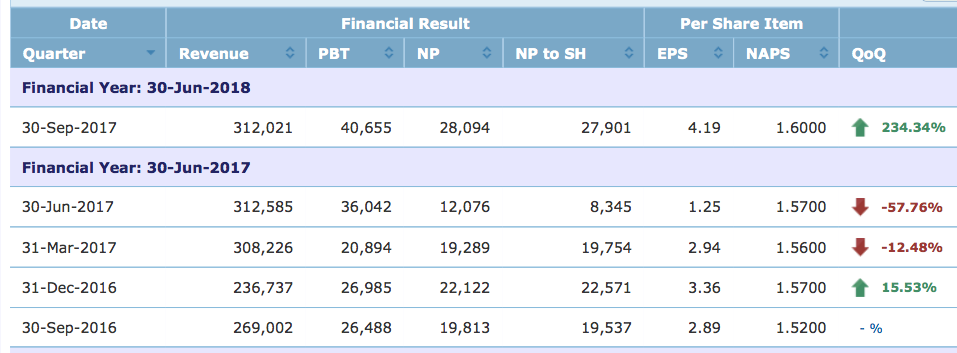

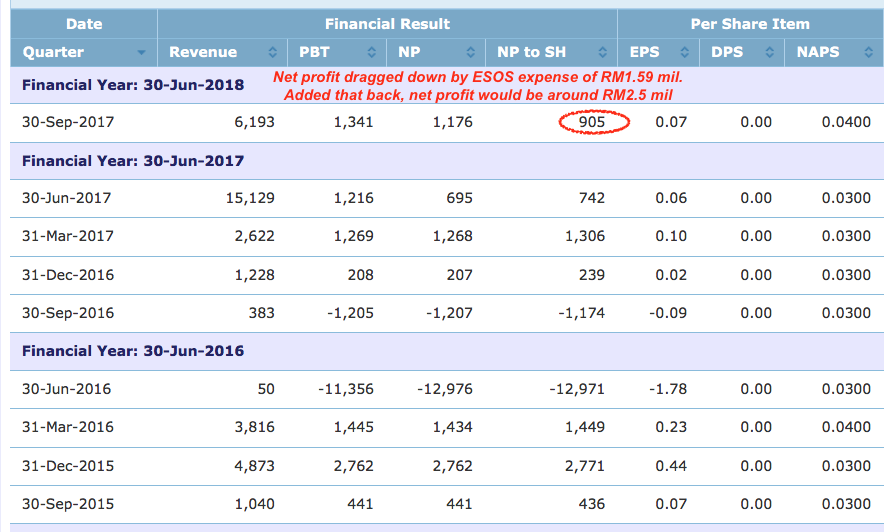

As shown below, the group has not always been profitable. However, those are things of the past.

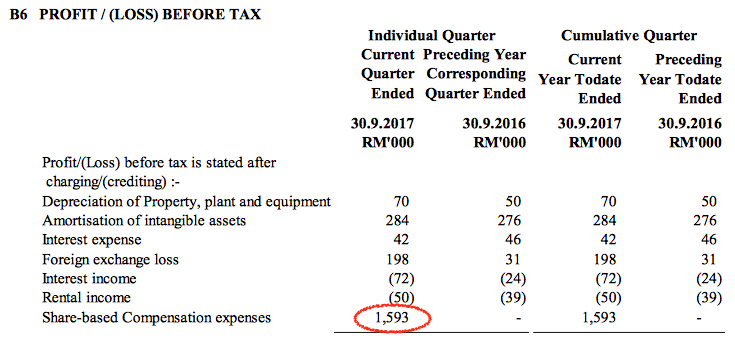

In the latest quarter, due to contribution from its new e-Payment business, the group has actually done quite well. Officially, the net profit was RM0.95 mil. However, there was ESOS expense of RM1.59 mil. In this regard, net profit for the quarter was actually as high as RM2.5 mil.

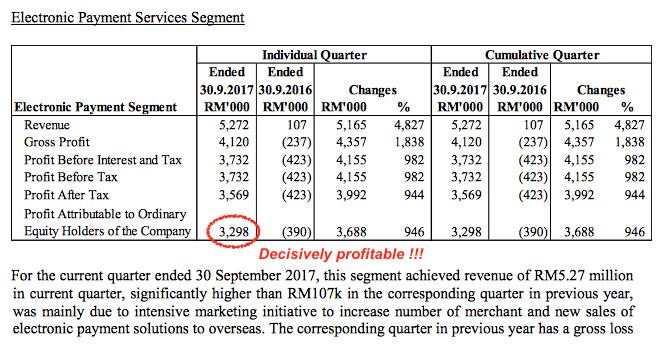

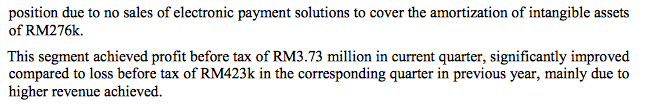

The following is extracted from the September 2017 quarterly report, explaining how e-Payment division has generated more than RM3 mil net profit :-

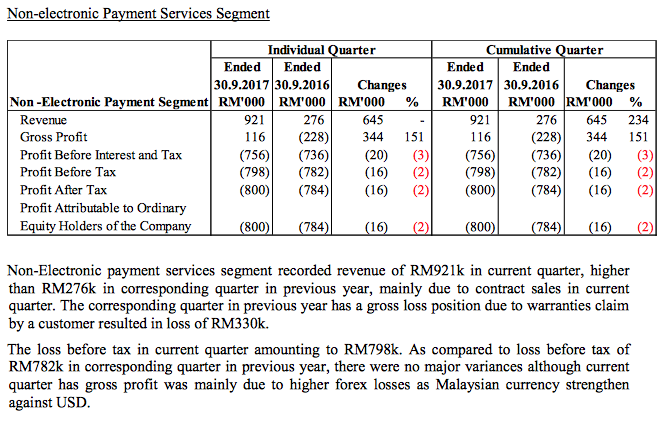

On the other hand, the traditional networking business has chalked up small losses, mostly due to strengthening of Ringgit :

On 1 August 2017, the company sought shareholders' approval to issue 500 mil new shares to MacQuarie at around 45 sen. The shares issuance was completed on 22 January 2018. As a result, share cap has increased to the existing RM2.3 billion shares. Approximately RM20 mil of the proceeds raised will be used for capex for e-Payment while the rest of RM2 mil was for working capital.

Concluding Remarks

For those who have been following my articles, they would know that I pick stocks based on forward earnings. In Netx's case, I notice that the market cap is approximately RM105 mil. So I ask myself whether it is possible to generate RM10 mil in the coming financial year ? This will lead to prospective PER of 10 times, a valuation that I am comfortable with for ACE counters.

As mentioned above, Netx's latest quarterly net profit was RM2.5 mil. If annualised, full year profit works out to be RM10 mil. If things continue to work out well, it is likely that the stock will trade at PER of at least 15 times (ACE market norm). That would give it market cap of RM150 mil. Based on 2.34 billion shares, target price of 6.5 sen (vs. 4.5 sen now). Purely based on this potential, I decided to take a small position for fun.

Of course, whatever I wrote in the paragraph above was purely my expectation (and a little bit of fantasy). Whether it is achievable will depend on a lot of factors. Nobody has the answer, only time can tell whether I am right or wrong.

I also take comfort of the 500 mil shares issuance to Macquarie Bank at around 4.5 sen. Macquarie is no newbie to the financial scene. To fork out RM22 mil to invest in Netx, they must have felt that something is right about the group. I am happy to ride with them.

|