Publish date: Thu, 26 May 2016, 07:47 PM

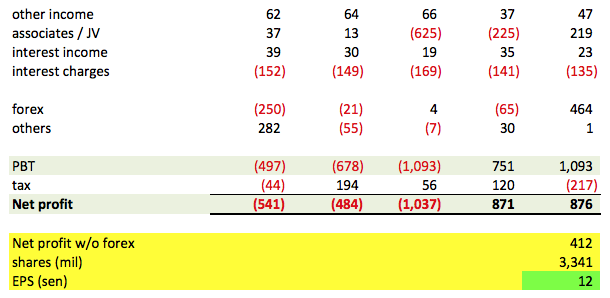

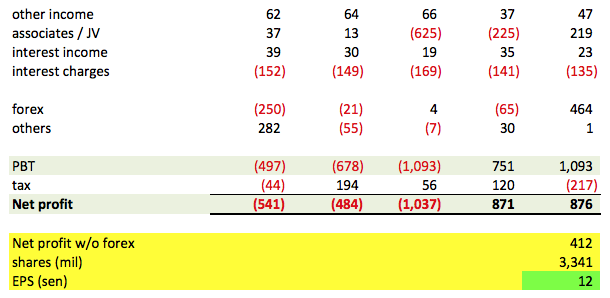

Air Asia released its March 2016 quarterly result today. I have put the latest figures in the table below, which is self explanatory.

Key observations :-

(a) Net profit came in at an astounding RM877 mil. After excluding the RM464 mil forex gain, core earnings is still a robust RM412 mil, translating into EPS of 12 sen (even after dilution pursuant to private placement)

(b) Operation wise, the latest quarter is actually not tremendously better than previous quarter.

> Total passengers carried almost the same as previous quarter;

> Load factor same as previous quarter; and

> Unit passenger revenue of RM216 is slightly lower than the previous quarter's RM226 (which is not surprising, as Q4 is usually the peak season when many people go for holidays).

(c) However, please don't let my sombre tone fools you. There is still plenty to be celebrated !!! Average fuel cost, as expected, dropped from USD75 to 56 per barrel, resulted in a whopping RM155 mil saving.

(d) Associate contribution also turned positive. From RM225 mil losses in previous quarter, it improved to RM219 mil profit, an improvement of RM444 mil.

> Thailand Air Asia performed extremly well with PBT of RM223 mil. It was achieved without forex gain.

> Indonesia Air Asia was still loss making. However, forex gain of RM41 mil turned its RM35 mil pre tax loss into a RM7 mil profit.

> Philippines Air Asia was also loss making. Similarly, forex gain of RM40 mil turned its RM33 mil pretax loss into a RM8 mil profit.

> India Air Asia almost broke even.

> Japan is making losses to the tune of RM35 mil.

Overall, I found the associates' performance acceptable. Indonesia, Phillippines, India and Japan were still making losses. But their magnitude is relatively small. It would be nice if they turn around in coming quarters. If they don't, I am ok. Their impact is not really that significant.

Concluding Remarks

Airasia's latest quarter result exceeded my wildest imagination. Based on annualised core EPS of 48 sen, the stock is currently trading at PER of 4.4 times. Barring a drastic spike in oil price (even though Air Asia has hedged most of its 2016 fuel requirement, a spike will still affect sentiment), it is not inconcievable that the stock can touch RM3.00 by year end.

If you have already sold your cars and houses, it is time to have a word with your cats, dogs, or even your girlfriend....

No comments:

Post a Comment