Author: Icon8888 | Publish date: Tue, 16 Feb 2016, 02:27 PM

Executive Summary

(a) Yesterday, Tek Seng released its December 2015 quarterly results. Compared to preceding quarter, net profit increased by 100% from RM5 mil to RM10 mil. The substantial jump in earnings was due to higher sales of solar cells and panels by 51% owned subsidiary TS Solartech Sdn Bhd (TSSB).

(b) Going forward, the positive momentum is expected to continue. TSSB targets to complete 200% capacity expansion by Q3 of 2016 to cater for anticipated strong demand.

(c) Based on latest share price of RM1.20 and annualised EPS of 17.2 sen, the stock is currently trading at prospective PER of 7 times. PER will drop further if the group's coming 2016 capex is successfully executed and EPS climbs to new height.

1. Background Information

Tek Seng was originally involved in manufacturing of PVC sheets, car mats and other related products.

(PVC flooring)

(Car mat)

In 2011, the group diversified into solar cells manufacturing by acquiring 60% equity interest in TSSB. In Q4 of FY2012, TSSB commissioned its first production line. Its factory is located in Penang.

In 2012, the group increased its shareholding in TSSB to 86%.

In 2014, TSSB issued the following instruments to Taiwan listed Solartech Energy Corp :-

(a) 3.17 mil new ordinary shares for cash consideration of RM13.2 mil; and

(b) RM87 mil Redeemable Preference Shares (RPS) for 2 units of solar cell turnkey lines.

Pursuant to the issuance of new ordinary shares, Tek Seng and Solartech Energy Corp owned 68% and 21% equity interest in TSSB respectively.

In 2015, Tek Seng and Solartech Energy Corp agreed to amend the terms of the RPS to make them convertible into new ordinary shares in TSSB.

Pursuant to the conversion, Tek Seng's equity interest in TSSB was diluted to the existing 51%.

Based on 240 mil shares and RM1.20, Tek Seng's market cap is RM288 mil.

With net assets of RM175 mil, loans of RM105 mil and cash of RM18 mil, net gearing is approximately 0.5 times.

2. Dramatic Improvement In Earnings

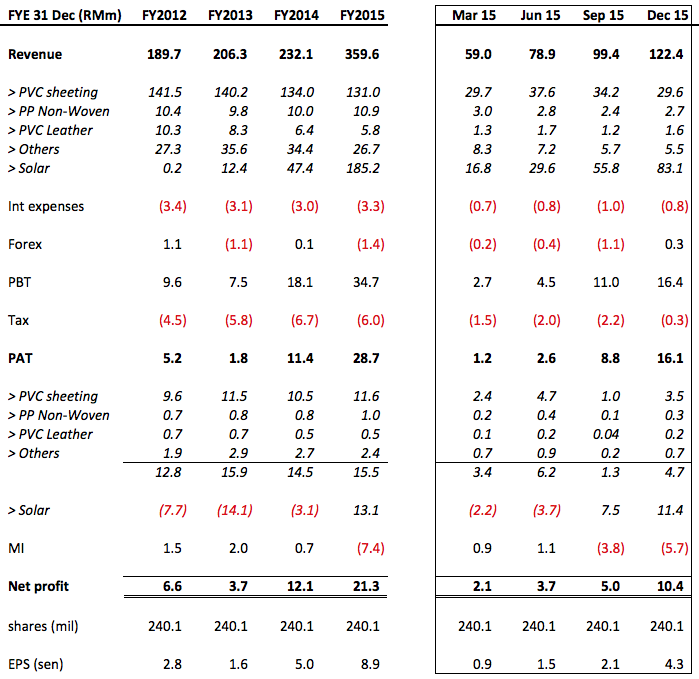

Yesterday, Tek Seng announced a sterling set of results, driven by strong performance of its solar division. Please refer to table below for further details.

Key observations :-

(a) Over the past few years, non solar divisions (PVC related products) generated consistent PAT ranging from RM13 mil to RM16 mil per annum.

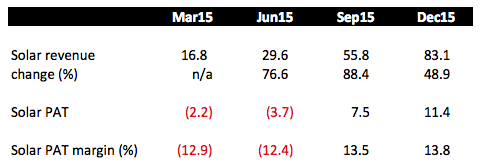

(b) Solar division commenced operation in FY2012. It has been in the red until September 2015 quarter when it decisively turned around and reported PAT of RM7.5 mil.

In December 2015 quarter, PAT further increased to RM11.4 mil, driven by higher sales. PAT margin remained stable at approximately 13.5%.

3. Capacity Expansion

According to an article in The Star dated 15 February 2016, TSSB will increase its capacity by 200% by Q3 of 2016.

http://www.thestar.com.my/business/business-news/2016/02/15/tek-seng-set-to-triple-production-capacity/

No comments:

Post a Comment