Publish date: Mon, 18 Jan 2016, 09:51 PM

1. Background Information Mercury was listed on the Bursa in 1991. It was principally involved in manufacturing and trading of car paint. However, in 2015, it diversified into construction business. Based on 40.2 mil shares and price of RM1.42, the company's market capitalisation is RM57 mil. The group has net assets of RM58 mil, loans of RM30 mil and cash of RM9.4 mil. As such, net gearing is 0.36 times. The group has been consistently profitable. Even in 2008, they reported net profit of RM4.6 mil. Annual Result:

Based on FY2014 net profit of RM4.8 mil, historical PER would be approximately 11.9 times. The group reported EPS of 5 sen in the latest quarter ended 30 September 2015. Quarter Result:

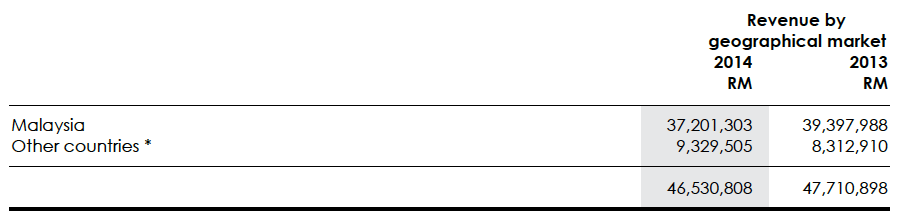

2. Car Paint Division The group exports closed to 20% of its products.  According to the Company's annual report for the financial year ended 30 June 2015, the export division benefited from the weak Ringgit :-  Low oil price benefits the Group. However, weak Ringgit will result in higher import cost.  So far, the low oil price seemed to outshine the weak Ringgit, resulting in margin expansion.  As shown in table above, the operating margin of the group's car paint division expanded from 14.3% in FY2014 to 28% in September 2015 quarter. (I am unable to explain 2015 June quarter profit margin dip. One possible reason is seasonaility. The group's 2014 June quarter was also relatively weak compared to other quarters). The company's business is resilient because it supplies to the auto refinish industry.  3. Construction Division To diversify into construction, in 2015, Mercury acquired 70% equity interest in Paramount Bounty Sdn Bhd (PBSB) for cash consideration of RM42 mil. As part and parcel of the deal, the vendors of PBSB provided a guarantee of RM6.6 mil PAT per annum for EACH of the financial year ended 31 December 2015, 2016 and 2017 respectively. Based on 70% equity interest, Mercury will be entitled to RM4.62 mil PAT per annum. The group raised RM30 mil borrowings to part fund the acquisition. Based on 6% interest rate and assume 25% tax, net interest expenses should be RM1.35 mil per annum. This should lead to earnings accretion of RM3.3 mil. Based on 40 mil shares, EPS should be enhanced by 8.2 sen. The acquisition was completed on 3 August 2015. The September 2015 quarterly result reflected 2 months contribution from PBSB. 4. Concluding Remarks (a) As mentioned above, the weak Ringgit will boost export profit margin but at the same time will result in higher import cost. But this could be offset by lower raw material cost caused by low oil price. There is not sufficient information for us to determine the exact effect. But the September 2015 quarter showed a massive expansion of paint division profit margin from 14% in FY2014 to 28%. We will just have to wait for next quarter result to see whether it is sustainable. (b) The group's car paint business is resilient as the customers are from the refinishing segment. The acquisition of construction division will result in EPS accretion of at least 8 sen per annum over next 2 years. Not all people are comfortable with growing by M&A. Neither am I. But for this particular case, I decided to close one eye and not think too much. No matter what you say, the group's earnings visibility for the next two years (until 31 December 2017) will be quite good. Two years is a long time, many things can happen. But this is the stock market, no risk no return. |

No comments:

Post a Comment