Publish date: Fri, 15 Jan 2016, 09:03 PM

These two days many people were very scared. RBS said 2016 is end of the world, everybody should go and hide in the cave.

http://money.cnn.com/2016/01/12/investing/markets-sell-everything-cataclysmic-year-rbs/

I read one paragraph and threw away that article.

Optimus Prime also ran around like headless chicken. He said George Soros said it is the end of the world. We should all go and hide in the cave.

http://www.bloomberg.com/news/videos/2016-01-07/is-george-soros-right-that-we-are-in-a-crisis-

I didn't even bother to read that article.

Why Icon8888 so gung ho ?

I wasn't always like that. In 2015, when the bear came, I ran around like headless chicken as well.

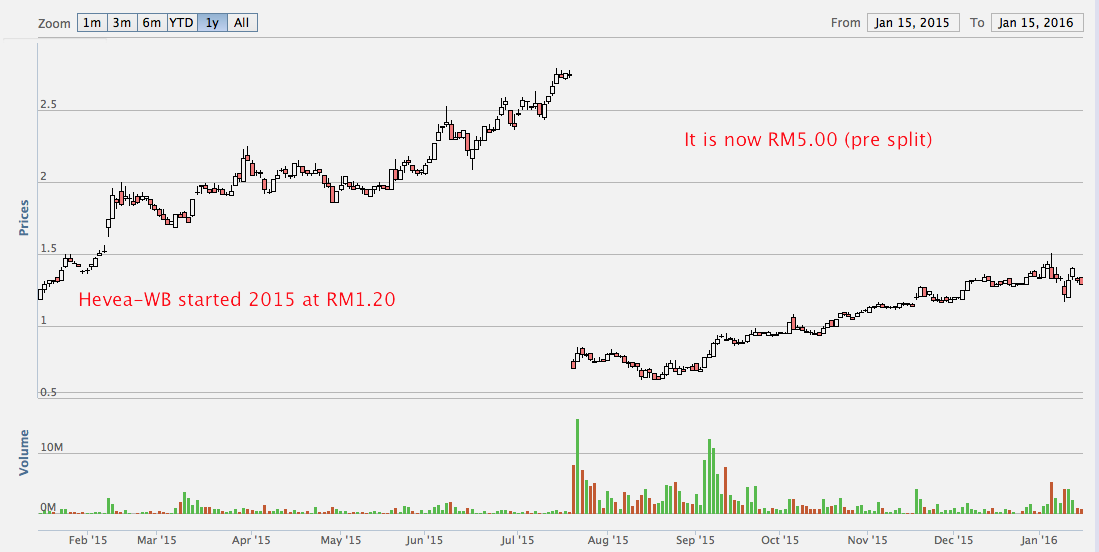

But if you look at the charts below, you will also feel that there is nothing to be afraid of.

What do all these stocks have in common ? They are all export stocks.

2015 was a horrifying year. Malaysia experienced massive currency devlaution. Many stock price plummeted.

However, this turned out to be a golden opportunity.

Have you heard of a saying "Have your cake and eat it too ?"

2015 was such a year. Financial panic caused the price of many export stocks (togther with many other stocks) to plummet. At the same time, the sinking Ringgit acts like a pump that keep pushing steroid into the P&L of export companies.

Stock price kept dropping while corporate profit kept ballooning.

When the dust settled down and calmness returned, all those export stocks experienced massive re rating. Many people laughed all the way to the bank.

As I look into 2016, I saw a high possibility of history repeating. There are three big mountains weighing down on Ringgit :-

(a) US is expected to raise rates by as many as 4 times.

http://www.bloomberg.com/news/articles/2015-12-16/fed-ends-zero-rate-era-signals-4-quarter-point-2016-increases

(b) Chinese Yuan is likely to be weak in 2016.

In 2015, China artificially propped up the Yuan to curry favor with IMF to gain political support for inclusion in Special Drawing Rights (a currency basket that grants it Reserve Currency Status).

China did that by actively selling USD to buy Yuan. As a result, even though with month after month of trade surplus, China experienced a massive outflow of US Dollars (USD500 billion), causing Dollars reserve to drop from USD3.9 trillion to USD3.4 trillion in 2015.

http://www.bloomberg.com/news/articles/2015-08-27/china-said-to-sell-treasuries-as-dollars-needed-for-yuan-support

The IMF finally approved Yuan inclusion in its December 2015 meeting. With that out of the way, China is now back in the currency market to reverse the decline in USD reserves.

They did that by printing Yuan to actively buy US Dollars. This will allow US Dollars to flow back to their treasury, addressing the anxiety associated with USD depletion. However, the end result is the devaluation of the Yuan.

This augurs well for their exporters as well. So China has every reason to keep doing that in 2016.

(c) Oil price is expected to be very weak in 2016. Many people will shrug when I say this. This is because oil price has already dropped to USD30 per barrel. With Iran returning to the oil market soon, oil price is unlikely to recover in the near term, unless a massive war broke out in the Middle East to disrupt supply.

http://www.bloomberg.com/news/articles/2015-11-19/iran-sanctions-might-be-lifted-in-january-as-atomic-gear-removed

All the above factors put together will form a big overhang against Ringgit appreciation. Just imagine you are a fund manager managing billion of Dollars of currency portfolio. Do you dare to simply bet in favour of a strong Ringgit ? Please bear in mind that every 3 months the US Fed plans to raise its interest rate. Do you want to stand in the path of the tornado, which will blow at you every 3 months ?

Concluding Remarks

The current macro environment is a once in a life time opportunity to make money from stock market. Very seldom we will have such good earnings visibility for a particular group of companies. We shoud make use of the opportunities and not let them slip through our fingers.

Don't be afraid of the coming market trubulence. The more uncertainties in the financial market, the better it is for exporters. If things work out well, 2016 could be another bountiful year, provided you pick your stocks wisely and carefully.

No comments:

Post a Comment