Publish date: Wed, 13 Jan 2016, 09:56 AM

(Dufu factory located at Bayan Lepas, Penang)

1. Background Information

Dufu is principally involved in manufacturing of components for Hard Disc Drive industry.

(Precision turning products)

(Precision machining products)

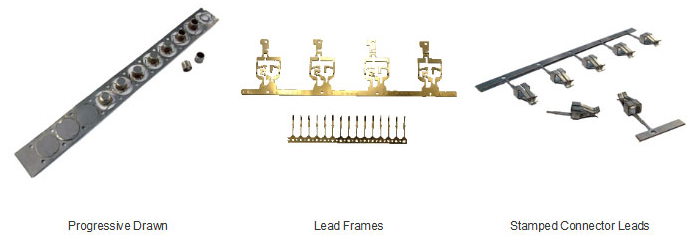

(Metal stamping products)

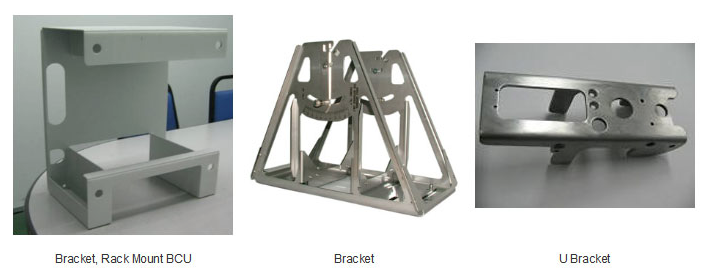

(Sheet metal fabrication)

(Tool and die fabrication)

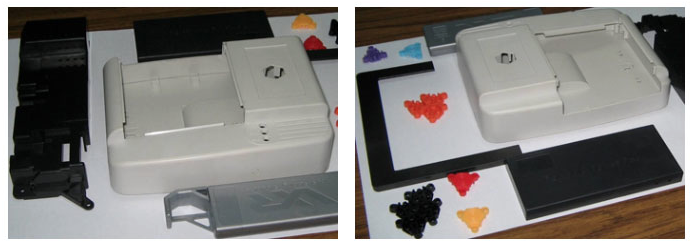

(Plastic components)

Based on 175 mil shares and price of 55 sen, market cap is RM96 mil.

The group has net assets of RM109 mil, loans of RM15 mil and cash of RM16.9 mil. As such, net cash is RM2 mil.

The group has not done well in the past few years. Same as many other manufacturing companies, Malaysia was not cost competitive compared to China and Vietnam.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| TTM | 165,450 | 6,717 | 3.83 | 13.32 | 2.00 | 4.00 | 0.6220 |

| 2014-12-31 | 135,668 | 5,939 | 3.38 | 7.85 | - | - | 0.5680 |

| 2013-12-31 | 104,195 | -5,539 | -3.78 | - | - | - | 0.5230 |

| 2012-12-31 | 114,084 | -2,194 | -1.83 | - | - | - | 0.6960 |

| 2011-12-31 | 119,296 | -4,809 | -4.00 | - | - | - | 0.7230 |

| 2010-12-31 | 128,495 | 6,825 | 5.69 | 7.21 | 1.00 | 2.44 | 0.7460 |

| 2009-12-31 | 116,642 | 11,125 | 9.27 | 4.64 | 1.00 | 2.33 | 0.7220 |

| 2008-12-31 | 121,480 | 9,798 | 8.17 | 4.04 | 1.50 | 4.55 | 0.6380 |

| 2007-12-31 | 109,509 | 12,152 | 14.14 | 4.88 | - | - | 0.7590 |

| 2006-12-31 | 90,601 | 7,861 | 12.94 | - | - | - | 1.4400 |

| 2005-12-31 | - | - | - | - | - | - | - |

However, in the recent quarters, their profitability improved. Please refer to next section for information.

2. Historical Profitability

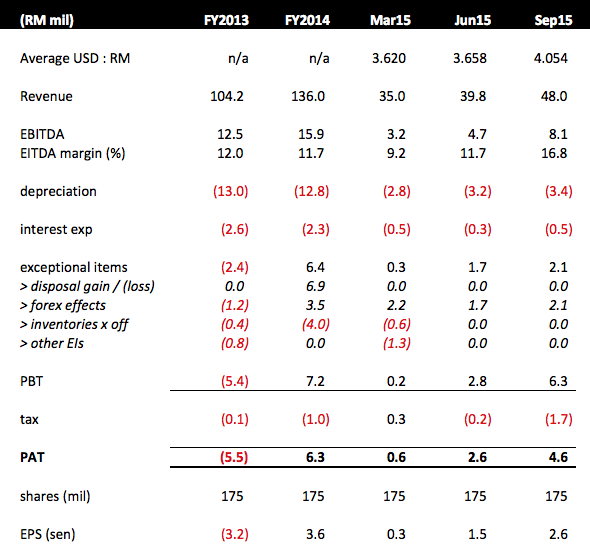

The following table sets out the group's historical profit over past two years and recent quarters :-

Key observations :-

(a) Strengthening of USD resulted in forex gain. According to latest quarterly result, more than 80% of the group's revenue was derived from overseas.

(b) As the Ringgit depreciated throughout 2015, the group's EBITDA margin expanded from 9.2% in March (average USD of 3.62) to 16.8% in September 2015 (average USD of 4.05). EBITDA margin is expected to further expand in the coming December quarter as average USD was higher than 4.20.

3. Financial Irregularity

In June 2015, tipped off by whistle blower, Dufu discovered some payment related irregularity. The amount was not huge, approximately RM3 mil plus. A special panel was set up by the company to investigate the matter. The case was settled after the then CEO tendered resignation and replaced by an acting CEO.

4. Expect Strong Dividend Ahead

On 7 December 2015, Dufu announced interim dividend of 2 sen per share. The dividend went ex on 29 December 2015.

One of the pleasant surprise from studying Dufu is the discovery of its potential to become a strong dividend play.

Over the past few years, the group has been aggressively degearing. From January 2013 until September 2015, the group has pared down borrowings by RM29.3 mil.

With the elimination of those borrowings, the group is currently in very healthy financial position. As mentioned earlier, as at September 2015, net cash is RM2 mil.

Strictly speaking, as the group's cash is sufficient to cover its existing borrowings, its surplus operating cashflow can be fully used to pay dividend.

In the first 9 months of 2015, the group generated net cashflow of RM15.3 mil after capex, but before loans repayment. For discussion sake, let's assume full year net cash flow of RM17 mil. Based on 175 mil shares, the group is in a position to pay out dividend per share up to 9.7 sen. Based on existing price of 55 sen, dividend yield works out to be 18%.

Of course, this represents the upper limit. In real life, the company is unlikely to pay out so much. But the overall concept of strong dividend payment is real, not a fantasy. The company has given shareholders a taste of things to come by paying 2 sen interim dividend in December 2015. We can expect more in subsequent quarters.

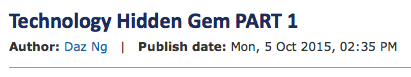

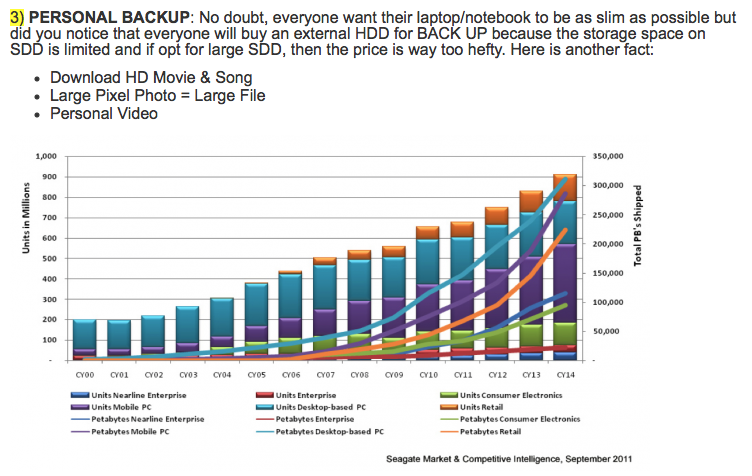

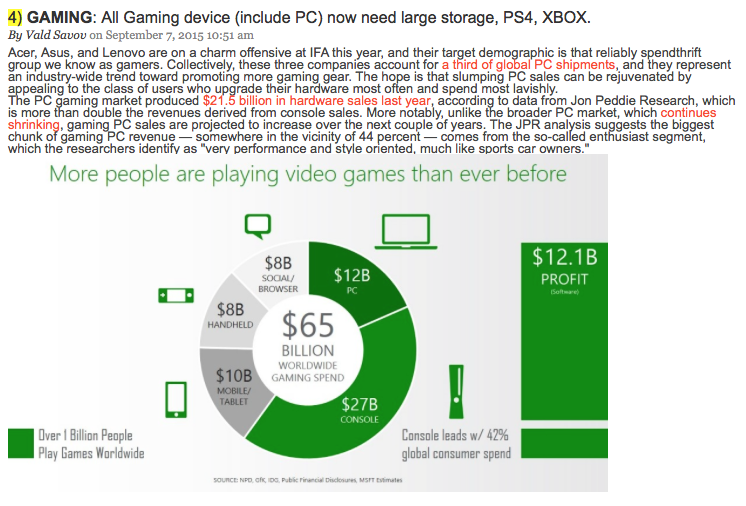

Not too long ago, the investing community had the perception that HDD is a sunset industry as Solid State Devices gain popularity. However, this notion has been dispelled decisively by one EXCELLENT article written recently by our own forum member Daz Ng bearing the following title :-

I like the article so much that I am going to cut and paste the entire section about HDD industry here for you to go through :-

No comments:

Post a Comment