Capex Bearing Fruits. Growing Like A 16 Year Old

Author: Icon8888 | Publish date: Wed, 30 Dec 2015, 06:37 AM

1. Principal Business Activties

JHM is listed on the ACE market. It is principally involved in design and manufacturing of the following microelectronic components ("MEC") :-

(a) components related to High Brightness Light Emitting Diode;

(b) fine pitch connector pins; and

(c) others.

JHM's strength is in its design and development capabilities for complex MEC. The Group would normally be involved from the conceptual phase to the designing and ultimately commissioning of the components for mass production at optimal cost efficiency.

The cutting edge capabilities in designing have enabled the Group to not only penetrate multinational corporations (“MNCs”) but also allowed the Group to enlarge its customer base to cover larger market applications. MEC are catered to a wide base of industries such as electronic, telecommunication, semiconductor and automobile.

The company's head office is in Penang while its factory is located in Sungai Petani.

2. Background Financials

Based on 123 mil shares and price of 46 sen, JHM has market cap of RM57 mil.

The group has reasonably strong balance sheets. Based on net assets of RM34 mil, cash of RM3 mil and borrowings of RM14 mil, net gearing is approximately 0.32 times.

The group's past few quarter P&Ls are as set out below :-

Note : the company stopped providing segmental breakdown for revenue and EBITDA in its latest quarterly report

Key observations :-

(a) Since the beginning of FY2015, both the Group's revenue and profitability improved substantially. EBITDA margin expanded from the previous average of approximately 3.8% to 12%.

The dramatic turnaround was mostly due to its capex programme in 2014. The following was what the company said in its FY2014 annual report :

(b) In the latest quarter ended September 2015, the group incurred forex loss of RM1.66 mil. This is not surprising as according to FY2014 annual report, the group has net exposure to USD liabilities :-

The company did not provide details of USD liabilities in its quarterly reports. However, the Ringgit depreciated by closed to 15% in Q3 vs. the USD. So the impact was quite severe.

(c) The group reported net profit of RM1.3 mil in the latest quarter. However, if you add back the RM1.66 mil forex loss, and after making relevant tax adjustment (assume 25%), adjusted net profit for the quarter should be approximately RM2.5 mil.

As the Ringgit has not changed much in Q4 of 2015 (October to December), the coming quarter should not have any major forex losses. As a result, I believe RM2.5 mil is a good estimate of the coming Q4 earnings.

If that is the case, FY2015 net profit could potentially be RM7.1 mil (being RM1.8 mil, RM1.5 mil, RM1.3 mil and RM2.5 mil for Q1, 2, 3 and 4 respectively).

Based on market cap of RM57 mil, I would argue that prospective PER is approximately 8 times.

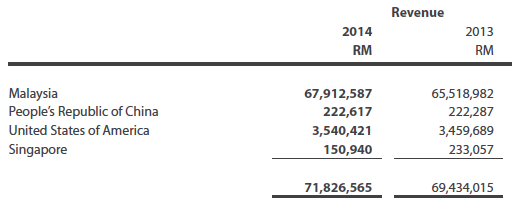

(d) The group derived the bulk of its revenue from Malaysia :-

3. Concluding Remarks

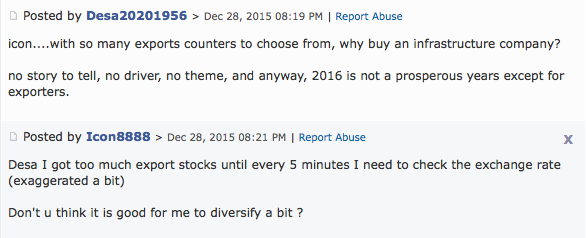

This counter is not an export play, which is all the rage now.

But this is exactly what I want. A forum member asked me recently why I bother to write about Mudajaya ? And the following is my answer :-

I found this little company simple and nice. It seemed that its recent capex has put it on stronger footing, allowing it to grow its revenue and profitability at an impressive rate.

With the recent devaluation of Ringgit, Malaysia's manufacturing industry is experiencing a renaissance of sort. Even though the group currently does not directly benefit from export market, spill overs from other exporting companies could potentially benefit it. As a small size ACE company, there is room for further growth.

Balance sheet strength is reasonable. Prospective PER is also not demanding.

For me, the stock is a BUY at this price.

No comments:

Post a Comment